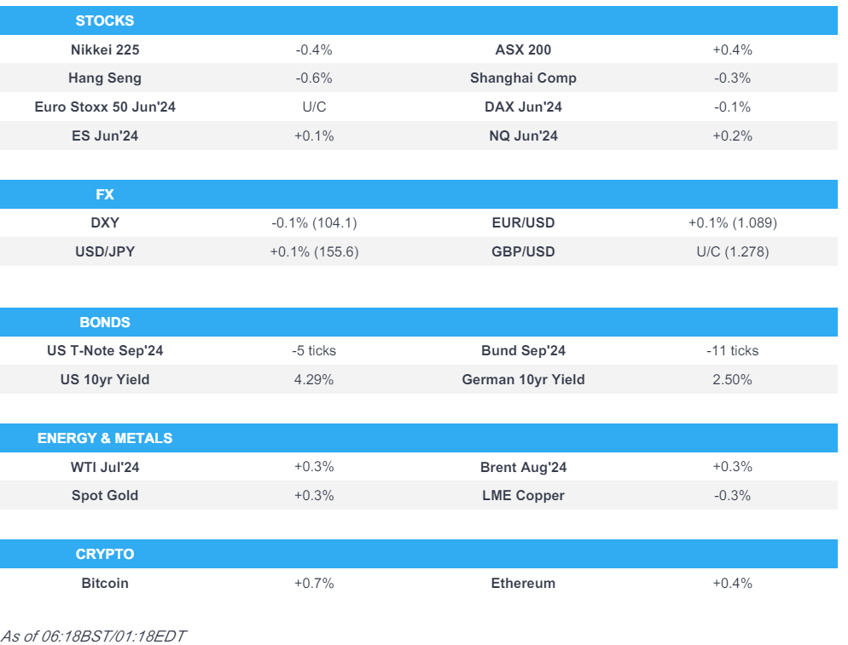

- APAC stocks traded mixed in cautious and tentative trade and macro newsflow on the quieter side ahead of the US jobs report

- European equity futures are indicative of a flat open with the Euro Stoxx 50 future unchanged after cash closed +0.7% on Thursday

- DXY traded flat in a narrow range, EUR & GBP contained; USD/JPY inched higher

- Fixed income rangebound but with a softer bias, little reaction to the latest BoJ Rinban announcement

- Commodities rangebound but with a firmer bias, relatively unreactive to Chinese trade and geopols

- Highlights include German Industrial Output, UK Halifax House Prices, EZ GDP (R), US NFP, Canadian Employment, US Wholesale Sales, ECB’s Schnabel; Lagarde; Fed's Cook.

- Click here for the Newsquawk Week Ahead.

- Click here for the Newsquawk NFP Preview.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were choppy and closed mixed as Wall Street looks to Friday’s Non-Farm payrolls report ahead of the US CPI and FOMC next Wednesday.

- SPX flat at 5,353, NDX flat at 19,021, DJI +0.20% at 38,886, RUT -0.70% at 2,049.

- Click here for a detailed summary.

NOTABLE HEADLINES

- A federal judge in San Francisco dismissed a proposed class action against Google (GOOG), which had alleged the company misused personal and copyrighted data to train its AI systems, including its Bard chatbot, according to Reuters.

- US 30yr fixed rate mortgages at 6.99% in June 6th week (prev. 7.03% W/W), via Freddie Mac.

APAC TRADE

EQUITIES

- APAC stocks traded mixed in cautious and tentative trade and macro newsflow on the quieter side ahead of the US jobs report.

- ASX 200 was kept afloat by gains in gold miners, alongside Resources and Materials names. while Real Estate and Healthcare lagged.

- Nikkei 225 was subdued following softer-than-expected household spending data. On an index level, gains in Pharma and Mining failed to counter the downside from Banking and Autos, with the latter continuing to feel the woes from its domestic safety scandal.

- Hang Seng and Shanghai Comp both dipped into the red after opening modestly firmer, whilst CATL shares tumbled some 7% after US lawmakers said Chinese EV battery manufacturers rely on forced labour and should be blocked from importing goods into the US. No reaction was seen on the Chinese trade data.

- US equity futures traded a modest upward tilt in the run-up to the US jobs report, where analysts expect the rate of monthly payroll additions to tick up slightly in May, although remained beneath recent trend rates, whilst wage growth is seen accelerating slightly on a monthly basis, but is likely to be unchanged on an annualised basis.

- European equity futures are indicative of a flat open with the Euro Stoxx 50 future unchanged after cash closed +0.7% on Thursday.

FX

- DXY traded flat intraday within a narrow 104.05-104.16 range as the Dollar gears up for the US jobs report. In terms of nearby levels, the 100 and 200 DMAs reside at 104.43 and 104.40 respectively while yesterday's range was 104.04-37.

- EUR/USD saw little action in APAC hours in the aftermath of the ECB's confab and ahead of tier 1 US data. EUR/USD holds within a 1.0888-97 range.

- GBP/USD was similarly uneventful awaiting the next catalyst with Cable within a 1.2784-94 parameter whilst EUR/GBP just about held above 0.8500.

- USD/JPY was initially modestly firmer as US yields inched higher, whilst BoJ maintained its bond-buying sizes in its latest rinban operations. No notable action was seen to the commentary from Japanese Finance Minister Suzuki.

- Antipodeans saw little action amid a lack of notable catalysts and with the Chinese yuan fixing stable overnight. No reaction was seen on the Chinese trade data.

- PBoC sets USD/CNY mid-point at 7.1106 vs exp. 7.2430 (prev. 7.1108)

FIXED INCOME

- 10-year UST futures traded within recent ranges but with a modestly softer APAC bias following the prior day's choppiness which ultimately saw futures little changed heading into the close.

- Bund futures were modestly subdued on either side of 131.00 in a 130.88-131.05 APAC parameter vs yesterday's 130.66-131.51 range.

- 10-year JGB futures were softer on either side of 144 with little reaction seen to the BoJ Rinban announcement (which maintained bond purchase amounts) and the softer-than-expected Household Spending data. Meanwhile. Bloomberg reported that the Japanese government likely financed most of its recent currency market intervention by selling Treasuries and other securities.

COMMODITIES

- Crude futures tilted modestly higher but within recent ranges amid a lack of catalysts and with geopolitics also quiet in APAC hours, although there were reports Hamas is said to be looking to reject the Israeli ceasefire proposal.

- Spot gold also edged higher in late APAC trade to top yesterday's USD 2,378.36/oz high and inch above the 23rd May high at USD 2,383.69/oz.

- Copper futures saw a modestly softer bias with 3M LME copper briefly dipping under USD 10,000/t, whilst no reaction was seen to the Chinese trade data.

- Chinese May iron ore imports 102.03mln tons (vs 101.82mln tons in April) Jan-May iron ore imports +7% Y/Y.

- Chinese May crude oil imports 46.97mln metric tons (vs 44.72mln tons in April); Jan-May crude oil imports -0.4% Y/Y.

- SPDR Gold Trust GLD reports holdings up 0.4% to 837.10 tonnes by June 6th.

- Chile's state-run Codelco is said to be looking for partners on a major new lithium project slated to begin production in 2030, according to documents cited by Reuters.

- Goldman Sachs said, "Even assuming comfortable European end-October 2024 storage, we still see winter global gas price risks skewed to the upside, led by TTF."

- Natural gas flow has restarted from the UK to Norway via Langeled pipeline, according to UK national gas data.

CRYPTO

- Bitcoin recovered to levels closer to USD 71,000 after dipping to a low near USD 70,000 earlier in the APAC session.

- Kraken is reportedly said to be in talks for a pre-IPO funding raising round, according to Bloomberg.

NOTABLE ASIA-PAC HEADLINES

- Japanese Foreign Reserves USD 1.2316tln at end-May (vs USD 1.2790tln at end-April), according to MOF. *"Japan’s holdings of foreign securities dropped sharply in May, indicating that the government likely financed most of its recent record currency market intervention by selling Treasuries and other foreign securities and still has ample firepower to step into markets again." - via Bloomberg.*

- Japanese Finance Minister Suzuki said the drop in Japan's foreign reserves as of end-May partially reflects FX intervention; and will take action against excessive forex moves. Forex intervention was conducted to address excessive moves. Forex intervention should be done in a restrained manner. Not taking into account the limit to reserves for forex intervention.

- BoJ offered to buy JPY 150bln in up to 1yr JGBs, JPY 375bln in 1-3yr JGBs, JPY 425bln in 5-10yr JGBs and JPY 150bln in 10yr-25yr JGBs; all unchanged.

- PBoC injected CNY 2bln via 7-day reverse repos with the rate at 1.80%.

- RBI maintained its Repo Rate at 6.50% as expected and maintained its policy stance as expected. FY25 real GDP growth was upgraded to 7.2% vs 7% previously. RBI Chief said risks to growth and inflation are evenly balanced and the RBI will remain resolute in commitment to aligning inflation to target.

DATA RECAP

- Chinese Trade Balance USD (May) 82.62B vs. Exp. 73.0B (Prev. 72.35B)

- Chinese Imports YY (May) 1.8% vs. Exp. 4.2% (Prev. 8.4%); Exports YY (May) 7.6% vs. Exp. 6.0% (Prev. 1.5%)

- Chinese May trade surplus with the US at USD 30.8bln (vs USD 27.24bln in April), according to customs data

- New Zealand Manufacturing Sales (Q1) -0.4% (Prev. -0.6%)

- Japanese All Household Spending MM* (Apr) -1.2% vs. Exp. 0.2% (Prev. 1.2%)

- Japanese All Household Spending YY* (Apr) 0.5% vs. Exp. 0.6% (Prev. -1.2%)

GEOPOLITICAL

MIDDLE EAST

- Hamas reportedly said that it will reject the Israeli ceasefire proposal, arguing that the proposal does not ensure a permanent end to hostilities. Hamas will continue to reject proposals until it secures a “permanent ceasefire”, via Critical Threat on X

- Qatari Foreign Ministry spokesperson said Hamas has not yet handed to mediators its response to the latest ceasefire proposal and is still studying the proposal, according to Reuters.

- Israel's Gantz's State Camp party met to discuss leaving Netanyahu's coalition; Gantz is expected to announce he will leave the government unless there is a surprise, according to Israel Broadcasting Corp. The US administration asked Gantz to reconsider his expected withdrawal from the emergency government.

- Israeli PM Netanhayu is to address US Congress on July 24th, according to Punchbowl's Sherman. However, Times of Israel sources suggested July 27th.

- US military said it destroyed eight Houthi drones and two Houthi uncrewed surface vessels in the Red Sea, according to Reuters.

OTHERS

- China, Russia and Iran called on the West to take the necessary steps to revive the Iranian nuclear agreement, and "we are ready for that", according to a statement cited by Al Jazeera.

- Philippine Coast Guard reports that the Chinese Coast Guard intentionally rammed a Philippine Navy rubber boat transporting sick personnel, according to Reuters.

EU/UK

ECB SOURCES

- Some ECB hawks reportedly argued that committing to the June rate cut too early was a mistake, a few hawks said they might have supported holding rates if there had not been a commitment, according to Reuters citing sources. "The sources, all with direct knowledge of the discussion, said that around a half dozen conservatives noted that this recent run of data may not be consistent with a rate cut, so the move was more a judgment." "A smaller number even said that their final decision might have been different without the pre-commitment." "But other than Holzmann, all agreed that backing out of the commitment would be a mistake and deeply divisive."

- ECB governors see a further interest-rate cut in July as unlikely after some stronger-than-expected economic data, with the focus now on their September meeting, according to sources via Reuters. "One source said a rate cut would be warranted in September if the ECB's inflation forecast for the last quarter of 2025 remained where it has been for some time, that is at 1.9%-2.0%."

NOTABLE HEADLINES

- EU Election exit poll reveals nationalist Wilders PVV party and Labour/Green combination seen tied for first place in the Netherlands.

- Credit Suisse AT1 bondholders have filed a suit against Switzerland in New York, according to a statement.

EMERGING MARKETS

- Mexican assets tumble on reports that the Morena leader in Congress has confirmed the 18 constitutional reforms proposed by AMLO will be voted on in September under the new configuration of Congress.

- South African ANC Leader Ramaphosa said they have agreed that they will invite parties to form a government of national unity, according to Reuters.