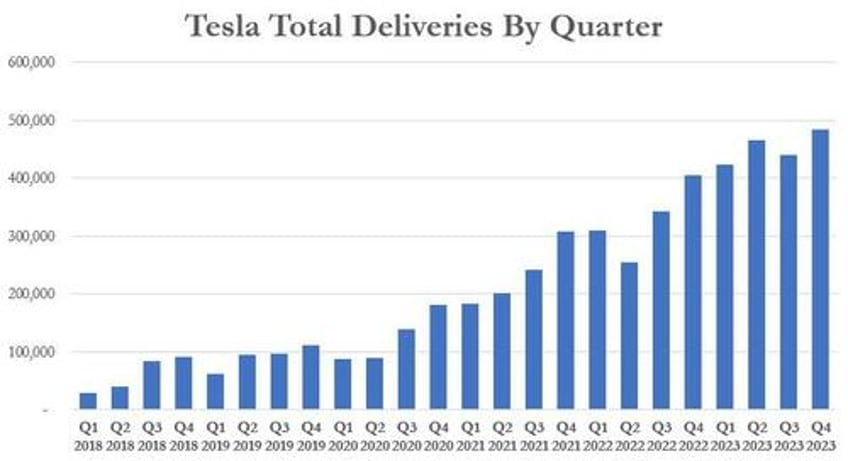

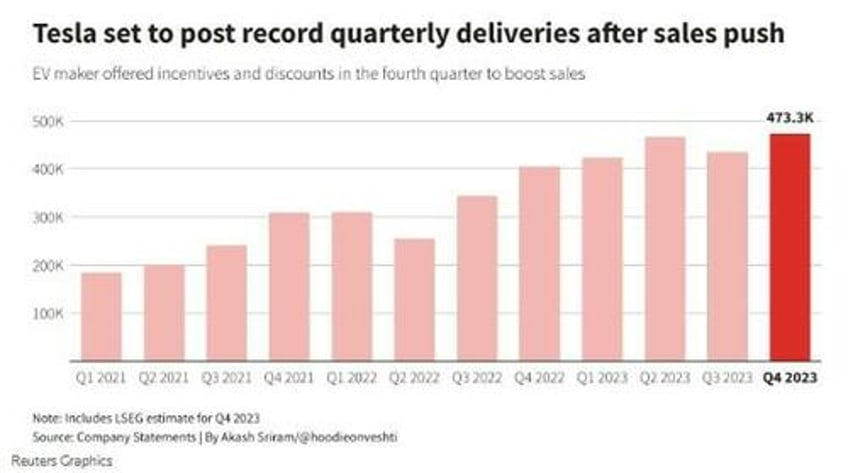

For Q4, Tesla announced this morning it had "produced approximately 495,000 vehicles and delivered over 484,000 vehicles", putting up numbers in line with recently adjusted estimates for the quarter. Production beat estimates of about 482,336, per Bloomberg's estimates.

The company noted that its full year vehicle delivery number was up 38% to 1.81 million, slightly less than recently revised expectations for the year. Nonetheless, total deliveries mark a record quarter for the EV manufacturer. The company manufactured approximately 1.85 million vehicles for the period.

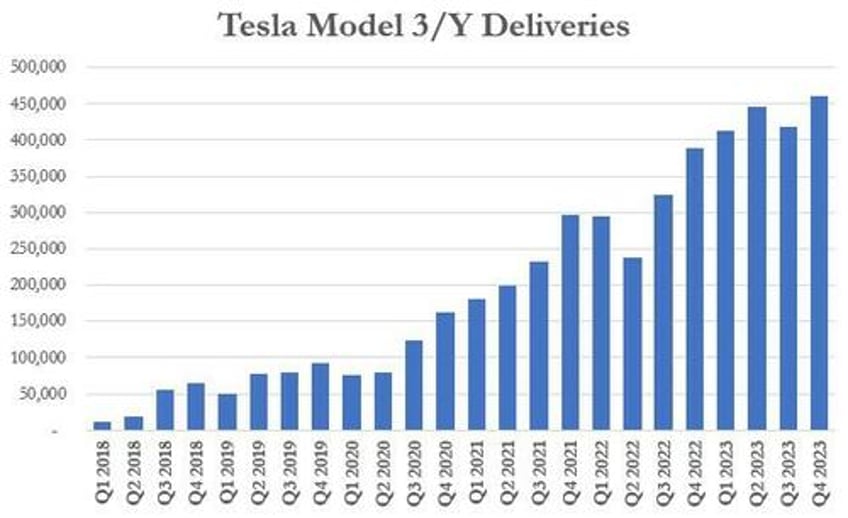

The company delivered 461,538 Model 3/Ys and 22,969 in "other models", which includes Model S, Model X and the new Cybertruck.

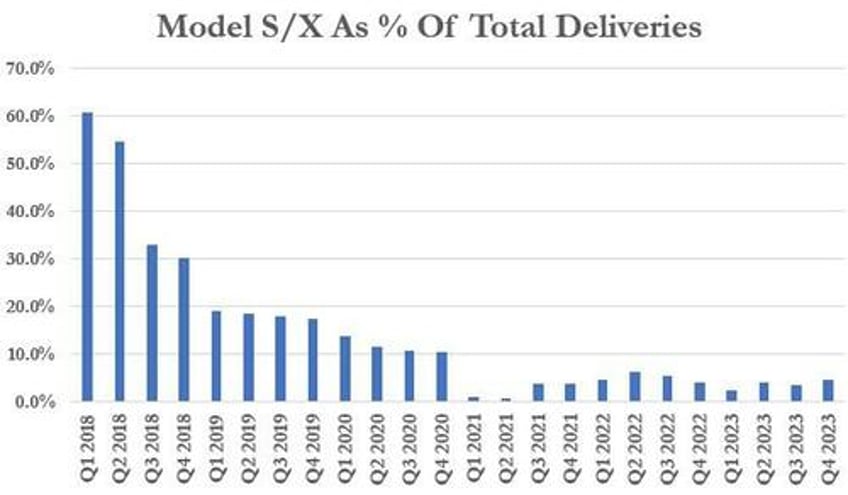

For now, the company's Model 3 and Model Y sales continue to drive its deliveries, with Model S, Model X and Cybertruck deliveries accounting for still only about 5% of the company's total deliveries for the quarter.

As we noted days ago, analysts were expecting record deliveries but a miss on the company's 2 million mark for the year.

Analysts had predicted the company would deliver 1.82 million vehicles in 2023, up 37% from the year prior. Estimates were for about 473,000 vehicles delivered in the fourth quarter.

Daiwa Capital Markets analyst Jairam Nathan revised Tesla's 2024 delivery forecast down to 2.04 million from 2.14 million, anticipating a 4% drop in average revenue per vehicle compared to 2023.

Garrett Nelson, senior analyst at CFRA Research, told Reuters last week: "The fourth quarter is typically the strongest of the year in terms of deliveries for Tesla, we're expecting that to be the case again this year."

The company is grappling with a decline in sales and has been using aggressive price cuts to move metal worldwide throughout the course of the year. This strategy was particularly emphasized in China, where Tesla has seen a reduction in its market share, challenged by domestic competitors such as BYD.

We have written extensively about how China's EV market is becoming saturated and increasingly competitive.

Tesla, intensifying its year-end sales with increased discounts, aims for a 50% average annual growth over several years. However, in 2024, the EV leader faces challenges such as the loss of federal tax credits in the U.S. and Germany's cessation of its EV subsidy program.