With everyone's attention turning to Mag7 heavyweight Tesla after hours (full preview here), focus will be on whether outlook is reduced after weaker Q1 sales; other key focus points will be i) robotaxi launch, ii) FSD adoptions in China and Europe and iii) updates on lower priced vehicles/new launches. TSLA stock is down -53% from it’s December highs (-40% YTD) and given all the negative press of late (including ‘code red’ headlines yesterday) leave Goldman thinking that positioning and expectations are very low at this point.

To that point, Gene Munster, managing partner at Deepwater Securities, thinks Tesla’s investment case has little to do with how the company performs this year. Rather, investors are looking to 2026 and beyond and Tesla’s autonomy opportunity. “I expect $TSLA to be ugly tonight (11-12% auto gross margins ex credits, down from 13.6% in December) — and it probably doesn’t matter,” Munster said in a post on X ahead of the results.

Also as widely documented recently, amid backlash against Musk, some Tesla owners are opting to trade their vehicles in. While used vehicles are increasing in price by about 1% on average, Tesla models are seeing price drops of about 10%, according to iSeeCars.com, which may be a discussion point on the earnings call.

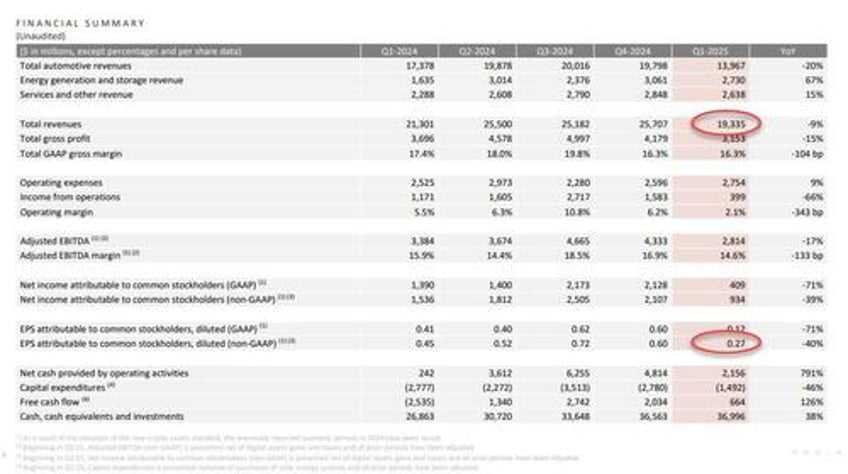

So with that in mind, Tesla shares close the day up 4.6%, with straddles pricing in a +/-10% move after earnings. Here is what the company just reported for Q1 moments ago. As Munster predicted, it was ugly.

- Revenues $19.34BN, big miss to estimates of $21.37BN

- EPS 27c, missing estimates of 43c

- Gross margin 16.3% (down from 17.4% y/y), and beating estimates of 16.1%

- Automotive gross margin ex reg credits 12.5%, beating estimates of 11.9%

- Operating income $399 million, -66% y/y, missing estimates of $1.13 billion

- Free cash flow $664 million (vs. negative $2.53 billion y/y) missing estimate $1.08 billion

- Capital expenditure $1.49 billion (down -46% y/y), missing estimates of $2.49 billion

And visually:

Commentary and context from the investor letter (more below)

- Will Revisit Our 2025 Guidance in Our Q2 Update

- Leaves Out Return to Growth Forecast From Earnings Report

- Rate of Growth Will Depend on A Variety of Factors

- Tariff Landscape to Have A Larger Impact on Energy Unit

- Says Difficult to Measure Impacts of Global Trade Policy

- Actions to Stabilize in Medium to Long-Term

- Sufficient Liquidity to Fund Our Product Roadmap

- Plans for New Vehicles on Track for Start Prod in 1H '25

- Uncertainty Could Impact Demand in Near Term

- Sees More Affordable Models Lead to Less Cost Reduction

- Despite Tariffs, Sees Increasing Need for Energy Storage

- Tariffs to Impact Energy More Than Automotive

The company's Q1 investor letter was far more downbeat than investors had come to expect. Here is what Musk had to say about the company's highlights:

Uncertainty in the automotive and energy markets continues to increase as rapidly evolving trade policy adversely impacts the global supply chain and cost structure of Tesla and our peers. This dynamic, along with changing political sentiment, could have a meaningful impact on demand for our products in the near-term. We remain committed to expanding our business model to include delivering autonomous robots across multiple form factors and use cases – powered by our real-world AI expertise – to our customers and for use in our factories, as we navigate these headwinds.

The warnings continued, with an emphasis on the company's energy business:

AI is a major pillar of growth for Tesla and the broader economy and key to our pursuit of sustainable abundance. Furthermore, AI infrastructure is driving rapid load growth, which, along with traditional utility customer applications, is creating an outsized opportunity for our Energy storage products to stabilize the grid, shift energy when it is needed most and provide additional power capacity. While the current tariff landscape will have a relatively larger impact on our Energy business compared to automotive, we are taking actions to stabilize the business in the medium to long-term and focus on maintaining its health.

As Bloomberg expands on the bolded text, that must be because Tesla’s Megapack product, the massive batteries that store energy, uses LFP cells, which are largely imported from China.

But most troubling was the following segment, announcing that the company will only discuss 2025 guidance in the Q2 update next quarter:

It is difficult to measure the impacts of shifting global trade policy on the automotive and energy supply chains, our cost structure and demand for durable goods and related services. While we are making prudent investments that will set up both our vehicle and energy businesses for growth, the rate of growth this year will depend on a variety of factors, including the rate of acceleration of our autonomy efforts, production ramp at our factories and the broader macroeconomic environment. We will revisit our 2025 guidance in our Q2 update.

And then there was this ominous headline from Bloomberg:

- *TESLA LEAVES OUT RETURN TO GROWTH FORECAST FROM EARNINGS REPORT

Investors will certainly be interested in seeing what Elon has to say about his close relationship with Donald Trump; here Bloomberg notes that the deck doesn’t mention Musk. But it does acknowledge “changing political sentiment” which “could have a meaningful impact on demand for our products in the near-term." It will be interesting if that’s the case in more than one region. There were many concerned that the Chinese consumer would champion domestic names due to Musk’s association with the Trump administration and its tariff policy.

While this barrage of warnings and negative news would have been enough to send the stock plunging after hours, the following section from the earnings report is what some are clinging to to explain why the stock is modestly higher after hours:

Plans for new vehicles, including more affordable models, remain on track for start of production in the first half of 2025. These vehicles will utilize aspects of the next generation platform as well as aspects of our current platforms and will be produced on the same manufacturing lines as our current vehicle lineup.

Tesla elaborates that "this approach will result in achieving less cost reduction than previously expected but enables us to prudently grow our vehicle volumes in a more capex efficient manner during uncertain times. This should help us fully utilize our current expected maximum capacity of close to three million vehicles, enabling more than 60% growth over 2024 production before investing in new manufacturing lines."

As for the company's Robotaxi product, the Cybercab, Tesla said it is scheduled for volume production starting in 2026.

One wonders how long the initial upside momentum in the stock price will persist once investors dig into this latest attempt to manage expectations.

For now, it is working and after swinging after hours, TSLA stock has tabilize modestly in the green, trading just around $238. Dave Mazza, CEO at Roundhill Financial, had this to say post results: “A lot of negative seems to be priced in if the Tesla numbers were that bad and the stock isn’t tanking.”

Full investor presentation below (full pdf here):