By Jessica Menton, Bloomberg Earnings Watch reporter and analyst

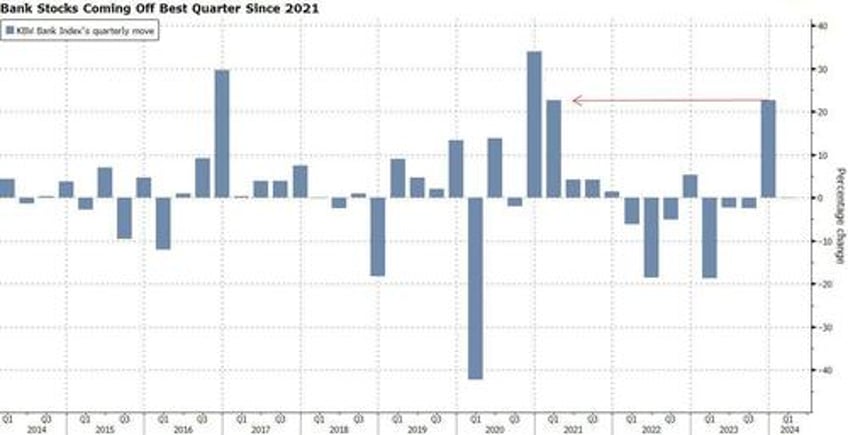

Fresh off their best quarter since 2021, banks stocks are set for a high-stakes earnings showdown as Wall Street’s most influential executives give investors their latest take on the US economy.

JPMorgan Chase & Co., Bank of America Corp., Citigroup Inc. and Wells Fargo & Co. kick off the reporting cycle for Corporate America on Friday, after a gauge of US bank stocks gained 23% last quarter, trouncing the broader market.

Bank shares were under pressure for much of 2023, and then surged starting in late October as confidence built that the Federal Reserve would end its rate-hike campaign without triggering a recession. Now the focus is on the timing of policy easing, and investors will scrutinize what that means for all corners of the lenders’ business, from the health of their loan portfolios to the outlook for deposit rates.

“Banks are obviously not as cheap as they were, but at the same time I don’t think people believe the valuations of banks are stretched,” said Richard Ramsden, an analyst at Goldman Sachs Group Inc.

If the banks are more upbeat than expected around net interest income, loan growth, capital markets and deposit pricing, “all of that is obviously going to feed through into greater earnings and probably further relative outperformance from some of the banks,” Ramsden said.

On Tuesday, attention turns to earnings from Morgan Stanley and Goldman Sachs. That day also brings the first results from the regional lenders, with PNC Financial Services Group reporting, making it a bellwether for regional lenders.

The big banks are generally expected to report downbeat results for the fourth quarter amid higher funding costs. Net interest income for the sector looks set to drop, while elevated expenses and weak trading revenue are also likely to weigh on earnings, Goldman’s Ramsden said in a report. Loan growth will probably be modest, he said.

The companies are also expected to detail payments to the FDIC resulting from the regional bank failures that roiled financial markets early last year. Citigroup said Wednesday that it expects to incur a $1.7 billion cost to replenish the FDIC fund. Meanwhile, Bank of America said it would take a $1.6 billion charge tied to the Libor transition.

The tide turned for bank shares last quarter as the prospect of Fed rate cuts in 2024 eased concern over areas such as net interest margins.

There’s plenty of reason for caution. The inflation rate remains well above the Fed’s target, and markets are betting on a more aggressive path of rate cuts than the Fed is signaling. JPMorgan Chief Executive Officer Jamie Dimon this week said he remains skeptical that the Fed’s hikes will succeed in taming inflation without eventually slamming the breaks on the economy.

Some analysts are advising investors to temper their enthusiasm.

At BMO Capital Markets, James Fotheringham downgraded a handful of US banks and specialty-finance firms on the back of the rally, warning they appear vulnerable to an “impending” credit cycle. UBS Group AG analysts, meanwhile, flagged the risk of “wild swings in sentiment.”

“January earnings season may present a speed bump to the sector’s recent momentum,” UBS’s Erika Najarian wrote in a note this week. Still, looking more broadly, over the past month financial companies are the only sector where the majority of analyst earnings revisions were upwards, according to Citigroup data.