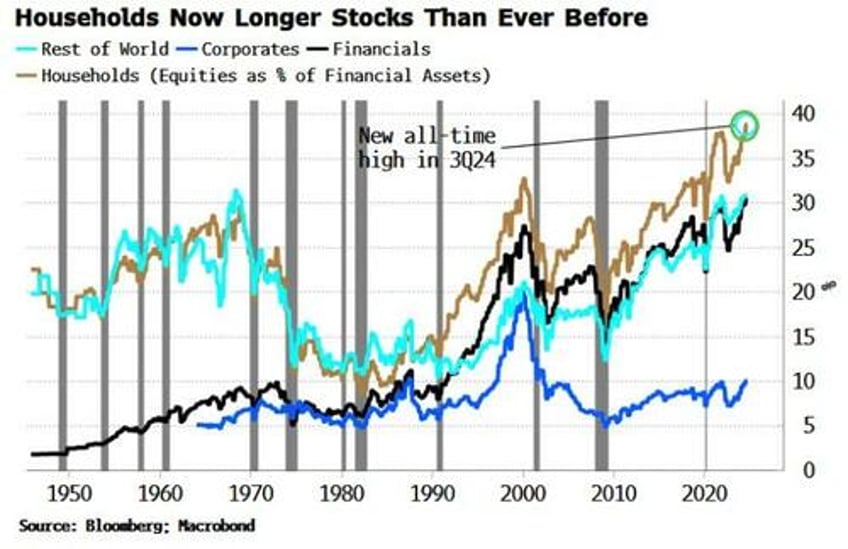

The latest Federal Flow of Funds data for the third quarter was released Thursday and shows that US households are now as long equities as they ever have been, with data going back to the 1940s.

This is another indication of the zeal for US stocks, and points to poor long-term returns.

The household sector’s stock ownership is now at 39% of financial assets, exceeding the high reached in 2021.

US households are the largest owners of stocks, owning 44% of the outstanding supply.

It’s not just households though, the cross-sector (households, corporates, financials and foreigners) ownership of equities also hit an all-time high compared to financial assets held.

When everybody is already long, it’s harder for prices to keep appreciating indefinitely.