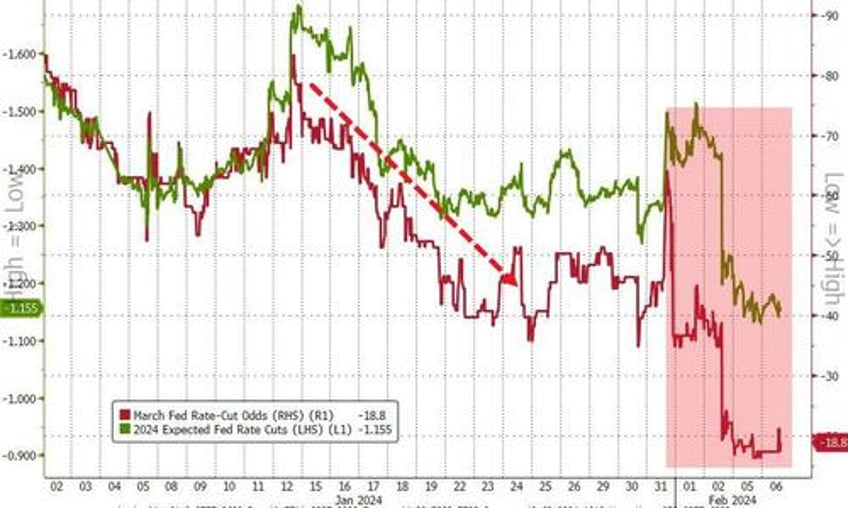

Market participants started the year with aggressive expectations of rapid and large rate cuts. However, after the latest inflation, growth, and job figures, the probability of a rate cut in March has fallen from 80 to 19%.

Unfortunately for many, headline figures will support a hawkish Federal Reserve, and the latest comments from Jerome Powell suggest rate cuts may not come as fast as bond investors would like.

For the Federal Reserve, the headline macro figures show a strong economy, solid job creation, a low unemployment rate, stronger GDP growth, and persistent inflation. The real economy shows a weaker picture.

The latest job report is not as strong as it looks. According to the Bureau of Labor Statistics, the labor force participation rate, at 62.5 percent, was unchanged in January, and the employment-population ratio, at 60.2 percent, was also little changed. These two measures showed little or no change over the year and remain below the pre-pandemic level. Furthermore, government jobs added 35,000 in the month and ran at +50,000 per month in the past year.

At 3.7%, the unemployment rate looks good, and monthly job creation of more than 225,000 seems enough for the Federal Reserve to keep rates unchanged, but we must also question the strength of the job market when the two measures mentioned before remain below the pre-pandemic level and real wage growth has been negative in the past two years.

Due to the massive debt accumulation that has inflated GDP growth, a $2 trillion increase in public debt and record-high credit card debt holding consumption have obscured a $1.5 trillion increase in gross domestic product.

However, the Federal Reserve will not consider these details. For the central bank, GDP growth is positive even when debt is the primary driver, and job creation is beneficial even when real wages remain in the negative growth range and major ratios are below pre-pandemic levels.

The United States two-year bond yield stands at 4.36% and the 10-year at 4.06%. The massive inflow into bonds of the past year needs lower sovereign bond yields and rate cuts to avoid significant losses, and this bet may show dangerous cracks. Additionally, regional banks’ problems surface again. The unrealized losses from sovereign bond holdings reached a new high in the fourth quarter, and the regional bank index is down on the year despite a strong market. Are there signs of trouble ahead? Probably.

The entire bullish market sentiment is predicated on massive rate cuts with no economic impact. The reality is that the economy is weaker than it seems, and rate cuts may be further away than what many market participants need.

The longer it takes for the Federal Reserve to cut rates, the more difficult it will be to implement any of them, because 2024 is an election year, and I fear that if the Fed does not cut before the campaign, it will not be able to interfere in the election process with unjustified rate cuts that may be seen as a benefit to the incumbent.

The US economy is much weaker than it appears, and the headline strength is a result of high public debt, which will ultimately lead to worse economic growth in the future.

Rate hikes are currently affecting only small and medium enterprises and families, who do not see the headline optimistic economic view.

The Federal Reserve is caught in a difficult situation.

Pleasing a hyped market and risking a higher inflation figure, or...

...being prudent with rate hikes that may accelerate the deterioration of the real economy.

Either way, small businesses and families will be the most affected, as they suffer inflation and rate hikes while the government deficit is likely to soar yet again.