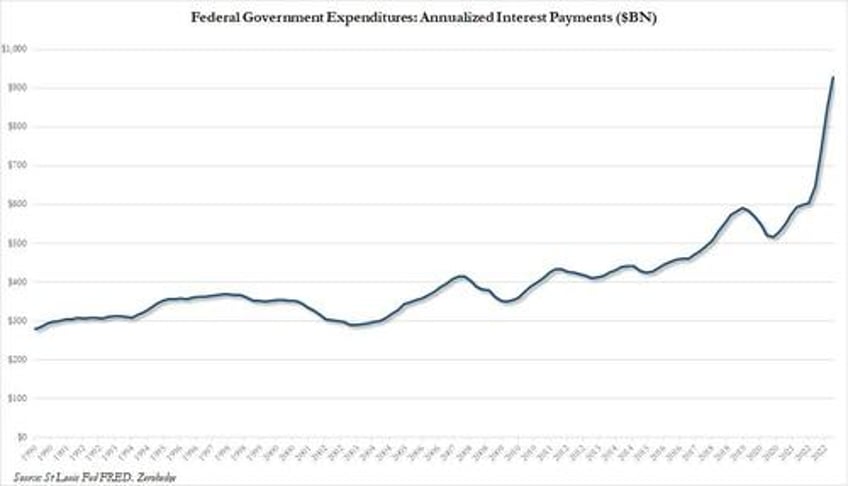

Back in July, we showed that as interest rates inexorably keep rising ever higher as the Fed's crusade to tame inflation (which the same Fed unleashed three years ago) reaches a crescendo, arguably the most significant consequence of this relentless creep higher in rates is that the annual payment on US Federal debt is about to hit $1 trillion, surpassing how much the US pays every year on defense!

Yet while the motley composition of US federal debt - which ranges from a few days for T-Bills to 30 Years for Bonds - means that the impact of higher rates is relatively quick to pass through to actual interest payment cash outflows, other debt portfolios have far better insulation from the most aggressive Fed tightening cycle since Volcker, which while superficially beneficial to the issuer, could have profoundly adverse impacts for the broader economy as the Fed is forced to keep rates far higher for much longer, which crushes ordinary retail borrowers who, unlike most corporations, didn't have the ability to issue debt maturing many years from now back in 2020 and 2021 when rates hit record lows.