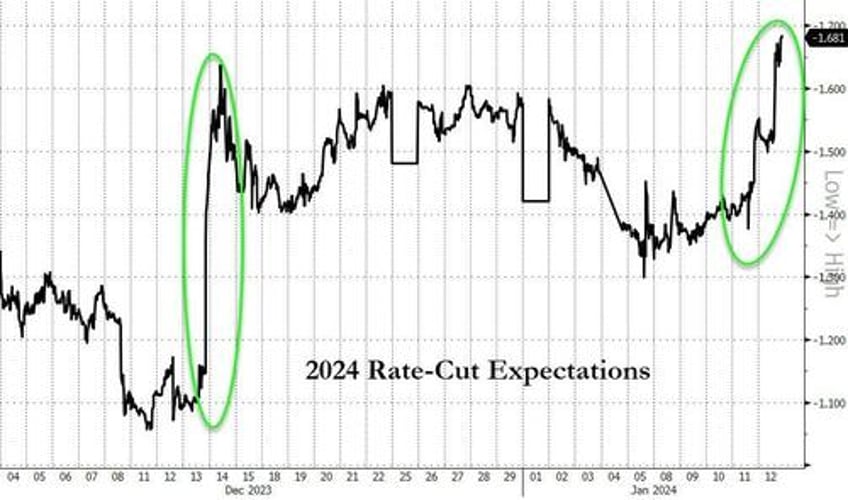

Something remarkable is taking place one day after the CPI came in hotter than expected, and in the same week that a barrage of Fed speakers pushed back against market expectations of a March rate cut: the market has gone all-in on complete Fed capitulation, and as of today, markets were pricing in a whopping 168 bps easing - almost 7 rate cuts - by year end.

Just as remarkable, the odds of a March rate cut are now over 80% (briefly hitting 90% earlier) today...