Markets this year - and newsflow in general - seem to be rolling from one mega theme to another at breakneck speed. As DB's Jim Reid described it, by mid-January, the UK was in the crosshairs of investors as global yields spiked. A week later, Deep Seek created temporary panic in the tech sector. Then yesterday saw another huge market swing, especially in Mexican and Canadian assets, as the “shock” weekend tariffs were delayed by a month.

Sure, trade will remain the short-term focus, but don’t forget about tech. Alphabet reported tonight and tumbled more than 8% after it missed on revenue and cloud, with Amazon now on deck for Thursday. Note that yesterday Nvidia fell below last Monday’s levels when they fell -16.97% in a day, thus wiping out the subsequent bounce. It’s now down -22% from its all-time high in early January and at levels it first hit in June last year, pointing to a loss of momentum. So keep an eye on tech as the trade war heats up.

That said, the trade topic continues to be front and center and US tariffs of 10% on all Chinese goods went into effect this morning, which were met in turn with retaliation from China. They imposed 10-15% tariffs on a combination of energy, agricultural goods, and auto vehicles from the US, a response which was largely viewed by the market as tame even if this is just the first exchange in the latest trade war.

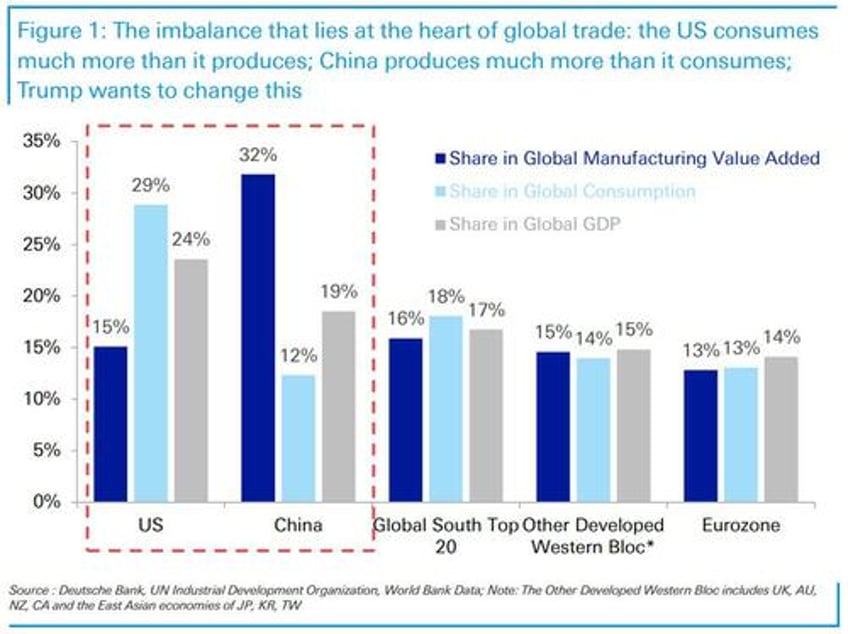

Indeed, while markets may be inclined to read across from negotiating successes the US had with Mexico and Canada, a lot is different in the US-China trade relationship according to Reid, where a much more existential imbalance lies behind US trade angst with China, which the Trump administration now seems keen to correct.

In a report published this morning by Deutsche Bank's Thematic Research team (available to pro subs in the usual place), the authors look at the heart of the imbalance that’s motivating the US-China trade war and explains why this will be a fundamentally different fight.

While the US accounts for 29% of global consumption, it produces only 15% of the world's goods. Meanwhile, China accounts for 32% of global manufacturing but just 12% of consumption. Simplifying it, this imbalance shows up in a USD1 trillion Chinese trade surplus and a nearly equivalent US deficit.

China's economic development in recent years, instead of moving it towards a consumer-oriented economy, has moved in the direction of a more advanced manufacturing economy. This is now causing consternation in the West, with China making strides in many high-value added capital goods. While the US is still the second-largest goods producer, it has less than half of China's global share, with many US allies also seeing significant drops in their manufacturing share over the past 30 years. This may now have gone too far. Access to cheaper goods is no longer a good “trade” for the US given the loss of economic security over production supply chains and technologies to a competing power.

Trump's exhortations to "MAKE YOUR PRODUCT IN THE USA AND THERE ARE NO TARIFFS" suggests that bringing production back to the US is a key goal of trade policy.

As Reid concludes, the US-China trade war is likely to be fundamentally more enduring than the US’s disputes with its neighbors, something which the market is clearly not ready for...

Much more in the full DB presentation available to pro subscribers.