The inflation of the past three years has been devastating for households and businesses running on small margins. It’s all the more frustrating that during those years, we kept being told that it is transitory, softening, calming, cooling, settling down, and essentially not much of a problem anymore. We look back and know now that it was never true.

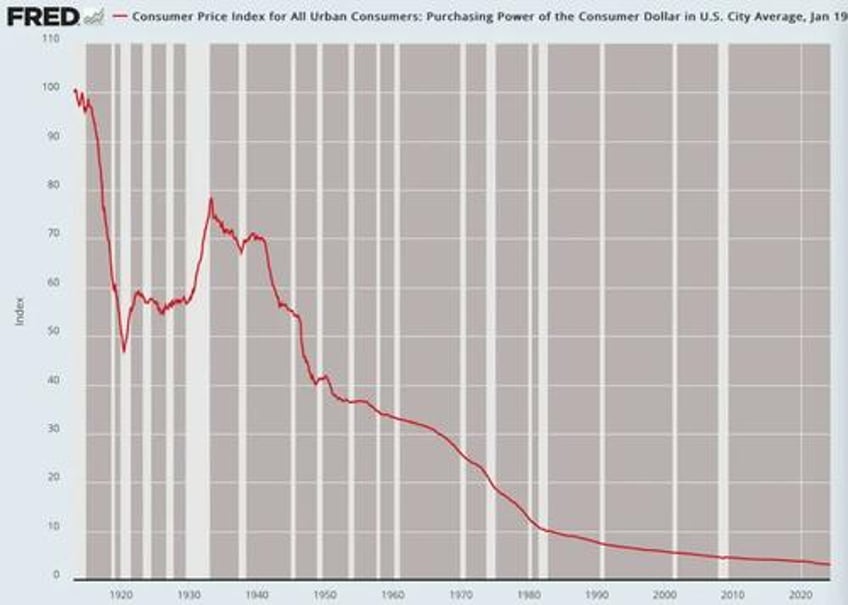

In reality, three years is a very short time for a major currency to lose at least a quarter of its domestic purchasing power. In the postwar period, it took from the war’s end until 1965 for that to happen. This was also the loss from 1982 to 1992, from 1992 to 2000, and from 2001 to 2012.

That’s hardly a record of stable money, but it is manageable, from the standpoint of accounting and psychology. We were used to it.

What’s happened to the dollar over the past three years is a more extreme loss than anything experienced since the late 1970s. Back then, the dollar lost a quarter of its value between 1975 and 1979, which roughly fits with current experience.

Keep in mind that the current numbers are likely underestimated because they exclude interest rates and completely miscalculate categories such as rent and health insurance (do you believe that health insurance costs less today than in 2018?). Moreover, the inflation index cannot account for the full impact of shrinkflation, quality changes, and hidden fees.

In any case, and even using conventional numbers, the bad news is that the dollar of 1913 has a purchasing power of about 3 cents today.

(Data: Federal Reserve Economic Data (FRED), St. Louis Fed; Chart: Jeffrey A. Tucker)

Any purchasing power loss sets in motion a gravitational pull against living standards. It means working harder, scrambling more, adding income to the household revenue stream, and otherwise never quite getting ahead. It also eats into savings by punishing rather than rewarding thrift as should be the case.

But for this to happen in such a short period of time from 2021 to the present is extremely damaging to economic structures. It also damages our understanding of the world around us.

You know this feeling. Not long ago, when you were out shopping, you had a sense if something was a bargain or a ripoff, overpriced or underpriced, something to snap up or leave on the table. Now, everything seems too expensive, but you cannot know for sure.

I see people all the time at the store who pick up an item, look at the price in shock, pull out their phones to price compare, discover that it is pretty much in line with market standards, decide whether they must have the thing, and then reluctantly put it in their cart with some element of disgust.

Inflation turns the once-happy experience of being out and about in the commercial marketplace into a grind and an annoyance. For many people, it is utterly terrifying because they are having a hard time staying ahead no matter what.

Have you ever been in a foreign country, using an unfamiliar currency, and attempted to haggle with a vendor on the street? It is extremely disorienting simply because you are out of your element. You don’t know if you are getting a good deal or being pillaged. This is because the prices you are quoted are detached from any context that you know.

Inflation brings this problem home. Suddenly, everything feels unfamiliar and you lose your footing. Societies that have dealt with extreme versions of hyperinflation like Weimar in 1922 utterly fall apart. We are nowhere close to that problem but still experience elements of the results. Even inflation on our current level can usher in dramatic social and cultural changes: It was the inflation of the 1970s that converted U.S. households from one income to two (and now three).

Now imagine this problem from the point of view of a business manager. Every good or service you need for your business is nothing but up in price. It blows up the accounting ledger. And your employees are demanding more, not only to pay their own bills but also because they know of another firm vying for their services.

Well-heeled and highly capitalized businesses fare much better in this environment. Those living off credit, paying high rates, and running very thin margins lose out to the competition that is in a better financial position. The pain is intensified given that in the year before the great inflation began, many small businesses were forcibly closed by the government in the name of stopping a virus.

Having barely gotten through that period, they then faced a barrage of other absurdities. They dealt with capacity restrictions, supply-chain breakages, and then mask mandates on employees and customers. Following that, there was a looming threat, emanating from a Biden administration edict that was later reversed by the court, to make their employees take an experimental shot.

The wounds of this period are still obvious everywhere, but life didn’t return to normal. Instead, this inflation began, which hit the core of business operations in other ways.

Every business facing inflation has to figure out the key issue: how to absorb the blow. End-user consumers must face higher prices, but how high can they go before a quiet revolt begins to happen? Contrary to what you hear, no business wants to raise its prices on the consumer (there are some exceptions for luxury goods and so on, but this is hardly the norm). They do not like making their customers unhappy.

There have been some innovations in how this hot potato gets passed on. It can come in the form of smaller portions and packages, ingredients of lesser quality, or new fees snuck in here and there. Many restaurants found that they have far more flexibility in raising prices on beer, wine, and cocktails because these are things that people get regardless and are unused to examining the price structure of carefully before purchasing.

This worked for a while, but it is not a complete solution. Plus, the public has become newly aware of these fees. They start to infuriate people who incorrectly blame the business rather than the inflation itself. The Biden administration has even begun a kind of verbal war against fees, threatening to turn regulators loose on the problem.

For the most part, people take for granted the existence and meaning of prices and the information they convey. The network of pricing structures governs our lives in ways we do not entirely notice.

Think of your own consumption habits. For generations now, Americans habitually go through vast amounts of paper towels to clean every spill and wipe every counter. We think nothing of it. But if those towel rolls were $15 each, think what that would do to your kitchen habits. You would likely discover the merit of cloth towels. It would change everything.

This once-small example pertains to vast amounts of your life. We go through toothpaste like it is nothing, but if the tubes were $50 each, you would see people suddenly discover the merits of straight baking soda, which is a fraction of the price, cleans as well or better, and lasts far longer.

In a complex modern economy with elaborate capital structures, prices serve as information-generating systems for the world that allow for rational use of resources throughout the whole of the production structure.

Without them, we would all be flying blind, producers and consumers alike. Accounting would be impossible and hence there would be no chance for rational calculation. Economizing would become hopeless. The societies that have variously attempted to implement what’s called “socialism”—meaning the abolition of ownership and market-based exchange of capital goods—have discovered that the result is nothing but chaos.

Every systemwide hit to the price system is an attack on economic rationality. Socialism as a system is one version, but there are many others. Price controls rob producers and consumers of valuable information they need for business. These take many forms; for example, minimum wage laws that force people out of the job market and make it impossible for businesses to operate, as we are seeing in California today.

Inflation also amounts to an attack on the functionality of prices themselves. With stable money, prices work as guides to action, tools of rationality, points of connection between people who otherwise do not know each other, and as building blocks of a global communication network that requires no central management.

Blowing up the price system and distorting it with inflationary pressures reduces its ability to make our lives better and eats away at productivity. It’s just another form of robbery. For this to hit just after lockdowns is a deep attack on U.S. economic vitality. We’ll all be paying a heavy price for many years.