Submitted by QTR's Fringe Finance

Part of what I love about having this blog is that it is cathartic for me when I want to be heard, understood, or otherwise just bitch and moan about things in the world of finance, the economy, and politics that I find askew.

From the jump, one of the things I have written about is how dead wrong both sides of the political aisle have our fiscal and monetary policy. With monetary policy, both parties have quietly fallen in line under the mutated breed of Keynesian economics our Federal Reserve implements, which rests on the sole idea of printing money and praying that either hyperinflation doesn’t occur or the economy doesn’t collapse.

Republicans occasionally criticize the Federal Reserve and pepper in objections here and there about our abuse of the dollar, but when all is said and done, they fall in line behind monetary policy as it stands today. Democrats have gone full non sequitur and, through the miracle of faux-intellectual academic bullshit squared, have somehow convinced themselves that none of the basic rules of economics—such as debits and credits and supply and demand—exist anymore.

When it comes to fiscal policy, Democrats are the main offenders. Republicans have a longer track record of wanting to rein in spending and reduce the size of government, whereas Democrats are often pushing for larger government and more spending. There have been exceptions, like when Bill Clinton balanced the budget and when Donald Trump ran some of the largest deficits in the country’s history, but that’s the general gist of things.

No matter what lens you look at it through, the nation has racked up an accelerating tab of debt at a pace that is mind-boggling. For example, just over the last month, the United States added over $300 billion to our national debt, which is now fast approaching $36 trillion.

It’s been a mainstay of this blog that I believe our spending addiction is going to end very poorly for the United States. And sadly, I’ve made some peace with it. I truly don’t believe there’s turning back from the dire situation we’re in now.

But let me clue you in on something I haven’t made peace with.

After the devastating effects of Hurricane Helene, FEMA has all of a sudden come out and said it doesn’t have enough funds to make it through hurricane season. Homeland Security Secretary Alejandro Mayorkas warned this week that FEMA is running low on funds.

“We are meeting the immediate needs with the money that we have. We are expecting another hurricane hitting,” Mayorkas said. “FEMA does not have the funds to make it through the season.”

While Mayorkas didn’t specify the exact funding needed, his comments reflect growing concerns from President Biden and lawmakers that a supplemental spending bill may be necessary this fall to support recovery efforts.

I’ve spent the last four years watching as millions of people have crossed unchecked through our southern border and have been treated like royalty by the Biden administration while everyday citizens struggle with rising prices, crumbling infrastructure, and the negative effects of suffocating regulation.

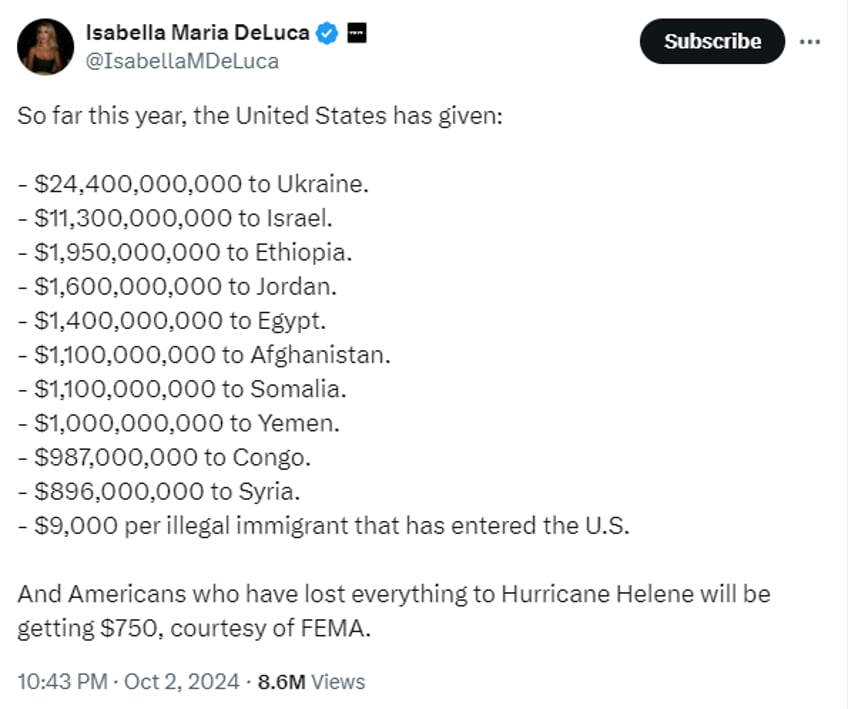

I’ve also spent the last four years watching the United States dole out close to $50 billion in foreign aid, mainly to Ukraine to help it press on with a war that realistically it has little chance of winning, while shaking down waitstaff, Uber drivers and anybody using Venmo for purposes of more than $600 for tax receipts.

And in my short time in the world of finance, I’ve seen enough omnibus spending bills—with funds allocated for things like border security in Jordan, Lebanon, Egypt, Tunisia and Oman and family planning to halt population growth that "threatens biodiversity or endangered species"—to have developed a deep loathing for how our government and our Treasury manage finances.

So when sorry-ass Alejandro Mayorkas—who has sworn up and down for the last three years that there’s no crisis at the southern border while parts of the country have been overrun and overwhelmed by unchecked, undocumented, and sometimes criminal migrants—takes to publicly decrying that FEMA is out of money in the midst of one of the largest domestic disasters in the country’s history, it’s absolutely revolting to watch.

🔥 50% OFF FOR LIFE: Using the coupon entitles you to 50% off an annual subscription to Fringe Finance for as long as you wish to remain a subscriber: Get 50% off forever

Not only is it grotesque because of how we have squandered away hundreds of billions of dollars on things that everyday U.S. citizens are not going to see an impact from, but it’s even worse when examined under the umbrella of how we run monetary policy in this country.

There once was a day when, if you needed to fund government entities, you actually had to have the revenue coming in from taxpayers because we couldn’t just print dollars ad infinitum anytime we wanted. Those were the days of sound money, and they are long gone.

What FEMA being broke today means not just that we have pissed away the money that we could have allocated for it to non-U.S. citizens — it’s far more insulting than that. It means that in a day and age where we can theoretically print endless fiat dollars and have an ‘infinite amount of cash’—an idea that I think is completely batshit insane, but our Fed governors don’t—that we still have not stocked the coffers of our domestic agencies with the bare minimum necessary for them to help the American people when they need to.

In other words, if the money is all fake, and we can conjure up as much of it as we want without any consequences, as both political parties would have you believe over the last several decades, why should FEMA ever be asking for more money to help hurricane victims?

If we want it, the solution isn’t bringing in more money from taxpayers, nor is it even spending less on other useless bullshit. The solution is literally moving a couple of decimal places on an Excel spreadsheet somewhere, probably at the New York Federal Reserve, and then in the Treasury Department, and then hitting a button.

As I’ve written a million times on this blog, this is a deeply troubling way to run monetary policy that is ultimately going to result in devastation for the country, in my opinion. But it takes things to a new level of sad for me to realize that not only do we not have the decency to run monetary policy in an honorable way in this country, we don’t even have the decency to press a couple buttons, make the hollow gesture to stock FEMA’s bank accounts before the nation goes bankrupt and at least fake as though we care about our own citizens anymore.

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author.

This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.