Rapidly rising real interest rates suggest the stock market is severely mispriced.

'Under prevailing economic theory, the expected forward return of cash from risky assets should be tied to this real rate. Historically it has been reasonably related. Since 2022, not so much. So much for economic theory!' https://t.co/g3jtkw4AI5 by @profplum99 pic.twitter.com/fMgUNyYnTE

— Jesse Felder (@jessefelder) August 20, 2023

Perhaps investors are simply expecting a return to ultra-low interest rates in the near future but that belief may be misguided.

"In the end, life is simple. Low rates push up asset prices. Higher rates push asset prices down. We are now in an era that will average higher rates than we had for the last 10 years." https://t.co/8LTQK5fvrq

— Jesse Felder (@jessefelder) August 19, 2023

Because there are structural issues behind the recent move higher in interest rates and they show no sign of improving any time soon.

'The outlook for the federal budget right now is essentially unprecedented—crisis-size deficits as far as the eye can see, even though the economy appears to be in good health. That prospect is making investors uneasy.' https://t.co/V0axnLoKag pic.twitter.com/hfMdGLn11X

— Jesse Felder (@jessefelder) August 25, 2023

For this reason, it may be an opportune time to consider real assets versus financial ones, especially due to the fact that they have never been cheaper than they are today.

'Have real asset prices bottomed relative to financial assets?' https://t.co/134LQQfGnz via @SoberLook pic.twitter.com/9PDoBT2cvI

— Jesse Felder (@jessefelder) August 25, 2023

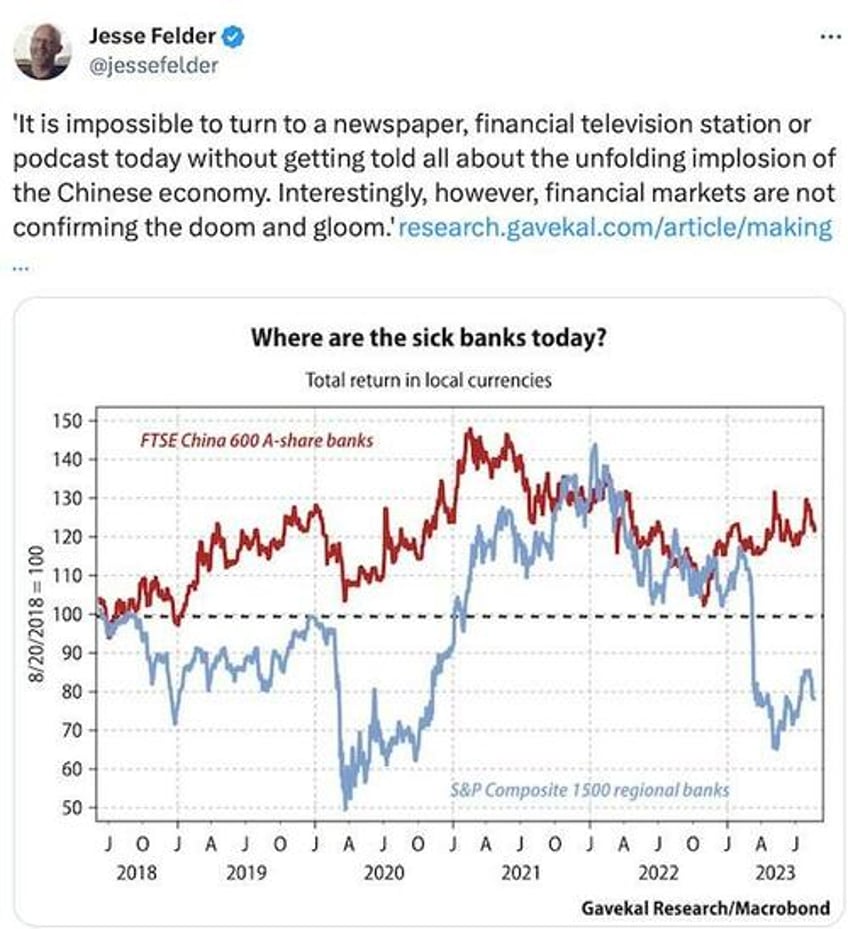

And it’s a bit ironic to read of all the troubles in the Chinese economy lately when markets suggest the real troubles are right here at home.