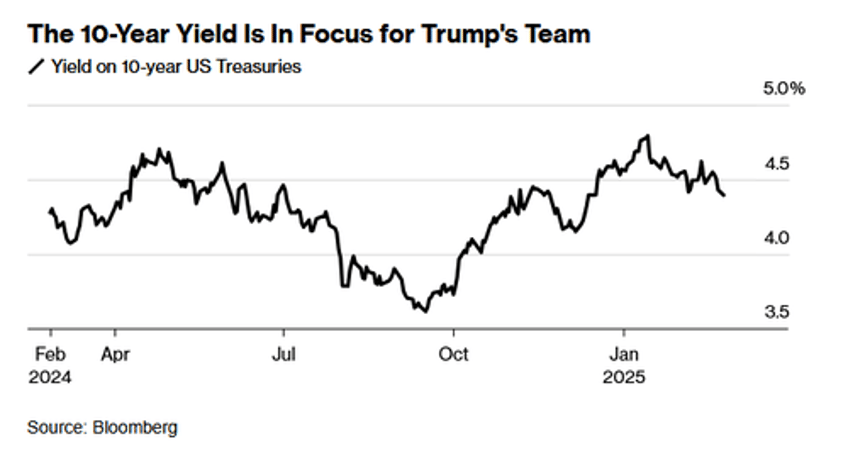

During Donald Trump’s first term, some investors bought into the Trump 1.0 Put. The trade was based on the market’s belief that Trump believed the stock market’s performance was a referendum on his presidency. Accordingly, investors thought that Trump would do everything he could to backstop the stock market if it fell. Thus, some investors thought it worthwhile to sell puts, collect the proceeds, and sit back comfortably, not fearing losses. According to a Bloomberg article, US Treasury Yields Offer A Scorecard For The White House’s Cost Cutting Vows, Trump’s second term proxy may be the Trump 2.0 Put.

The Trump 2.0 Put has a similar meaning to the 1.0 Put, except it pertains to the bond market. Per Bloomberg:

Trump has famously obsessed with the stock market as a real-time referendum on his presidency.

But now, with Musk and Treasury Secretary Scott Bessent in his ear at the start of his second term, much of the attention has shifted to another benchmark — the 10-year Treasury bond yield.

Trump made a fortune in real estate. As such, he is keenly aware that interest rates and leverage greatly impact economic growth.

The administration seems to appreciate that Powell has little control over longer-term rates that are much more impactful on economic activity. As such, Trump, with the guidance of Treasury Secretary Scott Bessent, is focused on lowering long-term interest rates. To do this, they must first get bond investors to reduce or eliminate their fears of high deficits and inflation. These fears manifest themselves in the bond term premium.

If the Trump plan effectively reduces yields, those writing puts on bonds or outright long bonds may benefit from the Trump 2.0 Put.

Market Trading Update

Yesterday, we discussed that the recent weakness was part of a corrective cycle and could last longer. We have recently discussed money flows, which have continued to support the market over the last month; however, that has changed. As we saw on Monday and Tuesday, money flows have peaked and turned lower as selling pressure continues to build in the market. More importantly, there has been a clear risk-off rotation, with money flowing into bonds and out of high-beta areas like technology and bitcoin.

That rotation has pushed Treasury bonds, as represented by TLT, above their 100-DMA and the downtrend line from last October. While bonds are getting overbought short-term, they remain on a buy signal and now have a higher year-to-date return than the S&P 500 index. I expect to see a pullback and retest of support at the rising trend line, but if the breakout above the 100-DMA holds, we could see a further move. Such will be particularly the case if economic data continues to weaken.

Another aspect of the rotation in Treasury bonds suggests that recent equity market weakness may not be over yet. As such, bonds’ hedging value remains key to a risk-managed portfolio. If you are long Treasury bonds, continue to hold them for now and take profits if you own them as a trading position. If you are looking for an entry point be patient and buy pullbacks that don’t violate the rising trend line from the 2025 lows.

House Buying Conditions

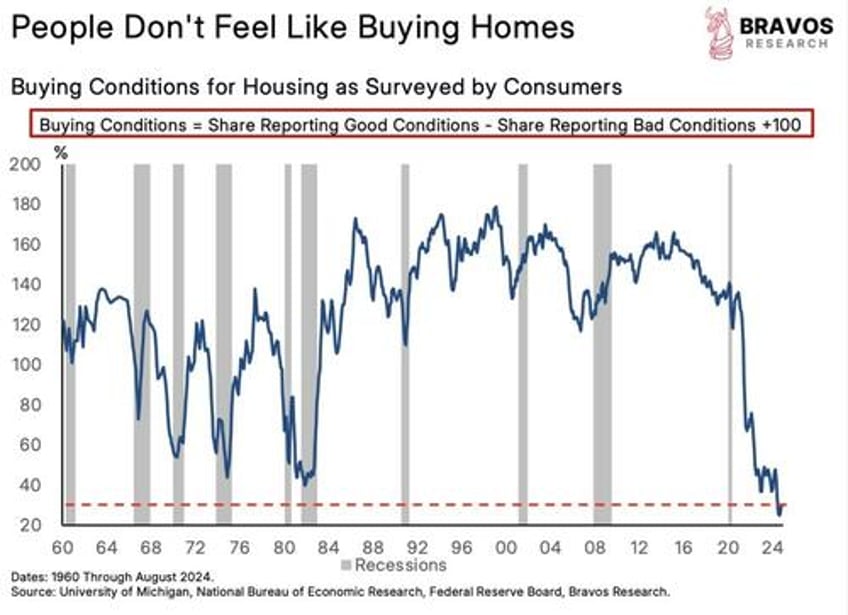

Not surprisingly, 6-7% mortgage rates and stubbornly high home prices make it financially challenging to buy a home. The first graph below, courtesy of Bravo Research, shows that home-buying conditions have been the worst since at least 1960.

Making matters worse, high mortgage rates have precluded many potential sellers from selling. Consequently, the supply of homes for sale remains low. We are not breaking news with our commentary thus far.

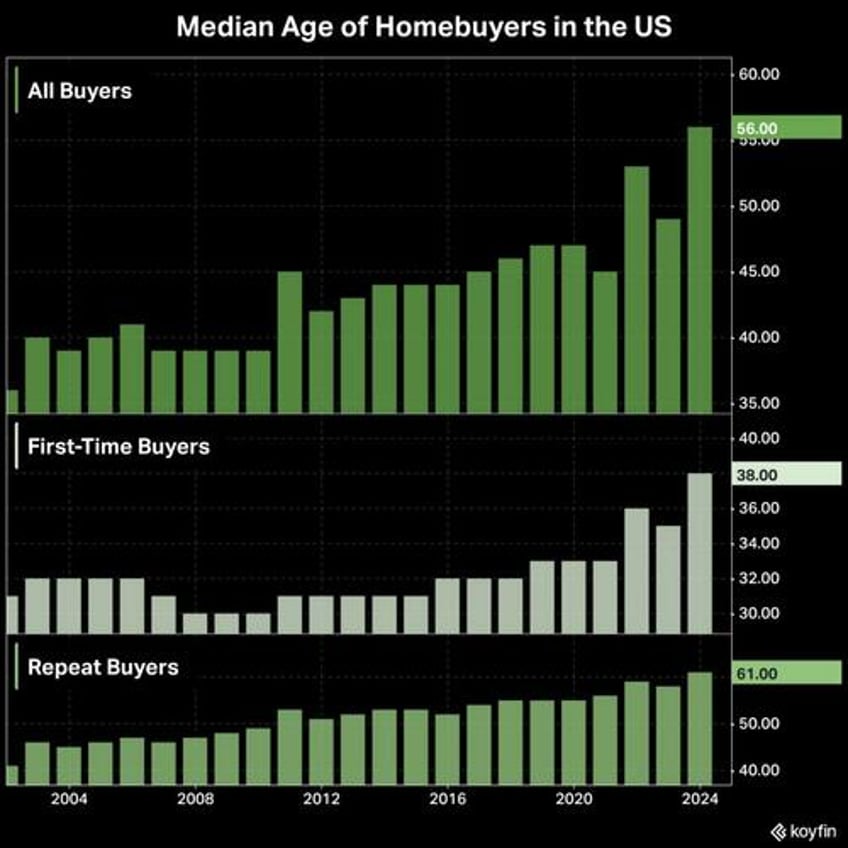

However, where this gets very interesting is in the ages of buyers. As the Koyfin graph shows, in just a few years, the median age of homebuyers has risen by about 7 to 8 years to 56. The median age for first-time buyers is 38. Affordability is a problem, and as the data show, older people, who are most likely more financially established, are the dominant transactors in the current market. Home prices and/or mortgage rates must fall to improve the housing market’s health.

Until then, expect the number of homes selling to stay near 20+ year lows. Moreover, older people will likely remain the dominant transactors.