By Russell Clark, of The Capital Flows and Asset Markets substack

I am generally of the view that risk can not be destroyed, but it can be transferred. Or in other words, you can protect one asset, but normally at the cost of another. There are lots of versions of this type of thinking in economics - beggar-thy-neighbor devaluation currency policies, helps businesses but reduce domestic wages. Central banks and governments can control either the exchange rate or the interest rate, but not both. Fiscal deficit spending, should be accompanied by higher interest rates, and a weaker currency. Emerging market investors are very familiar with the trade off - what the government gives you in spending, the currency markets take away with currency weakness.

For example, Brazil is running a 10% of GDP fiscal deficit - much larger than in the 2000s.

And like the US, the equity market Brazil has done well. The equity market is not far off highs.

But Brazil has suffered a weak currency due to this spending, so the USD returns to Brazilian assets have been poor. Below is EWZ, a USD ETF that track Brazilian stocks. Currency weakness has overwhelmed equity performance.

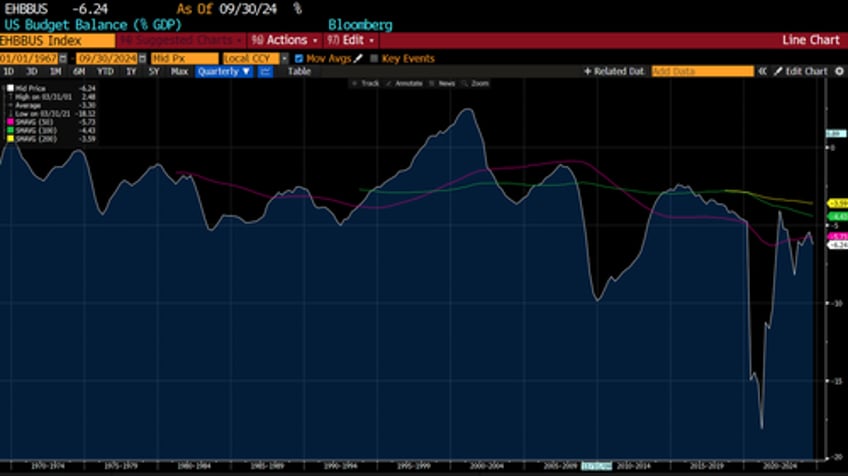

The US, particularly since Trump has come to be a political force, has had similar fiscal balance to Brazil - and with Trump’s re-election is likely to go wider.

As you should be aware, the US dollar has been strong, and US asset markets have been very good. S&P 500 looks nothing like EWZ

Theory and practice would have suggested that the Trump Trade should have seen good equity markets, but weak US dollar and much higher interest rates, and yet currency markets and interest rates have been very supportive. Certainly, this is what happened back in the 1970s when government spending was also growing rapidly. Dollar weakened dramatically, and interest rates spiked.

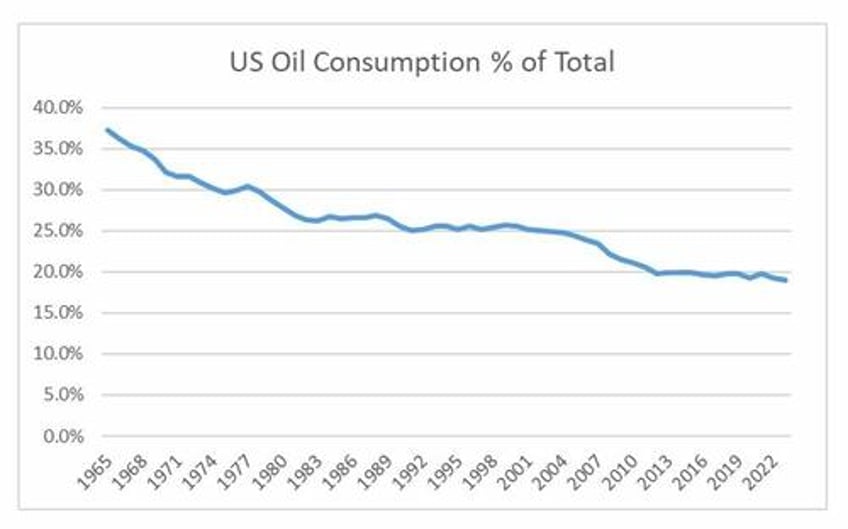

Why is it not happening this time? One big difference is that the US consumer is not as important to commodities as it used to be. In 1970s, the US was 30% of total oil consumption, but now is only 20%.

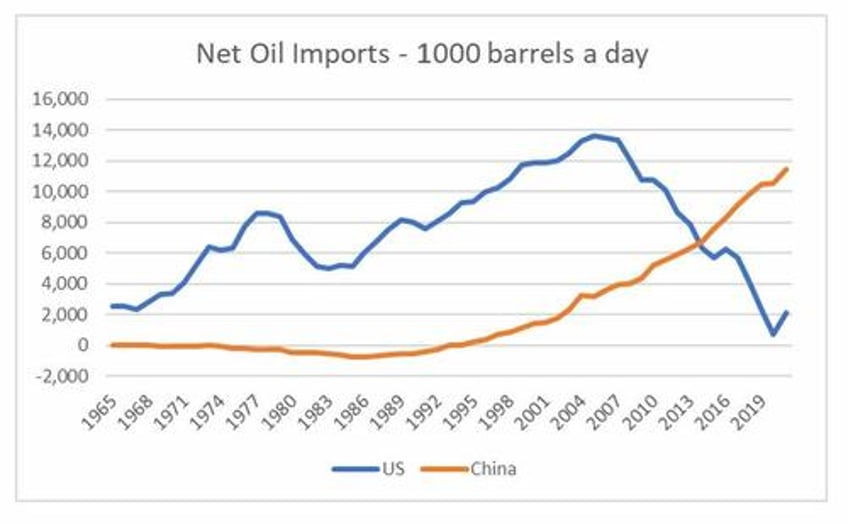

Even more importantly, the US is not the main player in the tradable oil market. China is by far the major importer of oil

And this probably hints at the secret to the “Trump Trade”. The combination of fiscal spending, and aggressive policies to contain Chinese economic growth means that there is much less transmission of expansive fiscal policy to commodity markets.

Collapsing bond yields in China point to the Trump trade likely continuing to work.

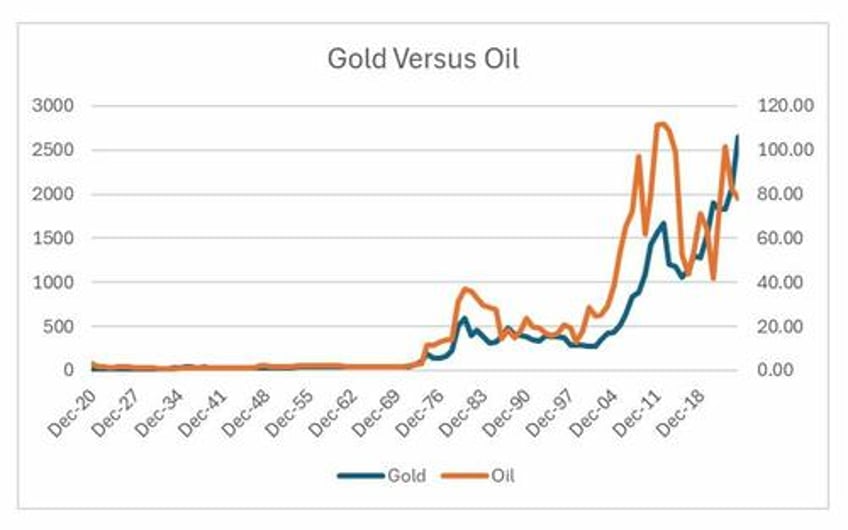

Another way to think about it, is that the market has definitely noticed that the US government now treats fiscal deficits as a free lunch, and hence we have seen gold outperform treasuries (my GLD/TLT trade). Here is a long term graph of that trade.

Generally speaking, gold prices and oil prices moving in different directions is unusual. This year gold is up strongly, while oil prices are down.

For lovers of ratios, oil has rarely been this cheap compared to oil, and even more so when not in the midst of a recession, which is what typically drives oil cheaper than gold.

This analysis would seemingly imply that the only constraint to US fiscal policy is the price of oil. There is some evidence to support this view. When the Soviet Union started to go into decline in the 1980s, falling demand and prices coincided with the 1980s and 1990s boom in the US. You could think that US asset prices and economy expand until they meet a physical constraint. Deflation and stagnation in the rest of the world is therefore “good” for the US.

China has not collapsed like the Soviet Union (yet), but its bond market is pointing to economic stagnation. Economically the Trump Trade could keep going, but there are two unknowable risks, related to China and Trump. First, in 2017, China began a stimulus program that pushed commodity prices higher. There is a risk that they repeat this policy. The second risk is that China sees the likely success of Russia in Ukraine, and decides to move to a war footing on the issue of Taiwan, which would be a very stimulatory policy change. The Trump re-election makes both more likely - but as long as Chinese bond yields are falling, the Trump Trade looks like a winner.