By Dhaval Joshi, Chief Strategist at BCA Research

Summary

The US economy is highly unusually ‘inverted’. The constraint on the economy is not labor demand, it is labor supply.

Hence, the US economy has highly unusually entered a labor demand recession without entering a GDP recession.

Nevertheless, for the stock market, a labour demand recession implies a profits headwind, because it is only when profits come under pressure that labour demand goes into recession.

Against this, wage disinflation would allow long-duration bond yields to fall, which would provide a countervailing valuation tailwind.

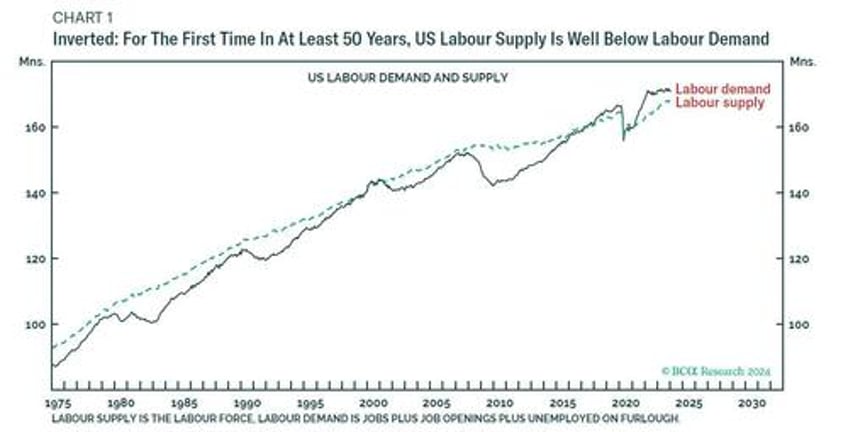

The pandemic might seem like a distant memory, but for the US economy the pandemic’s legacy is still the big story. For the first time in at least fifty years, US labor supply is running well below labor demand. The big story is that the US economy is ‘inverted.’

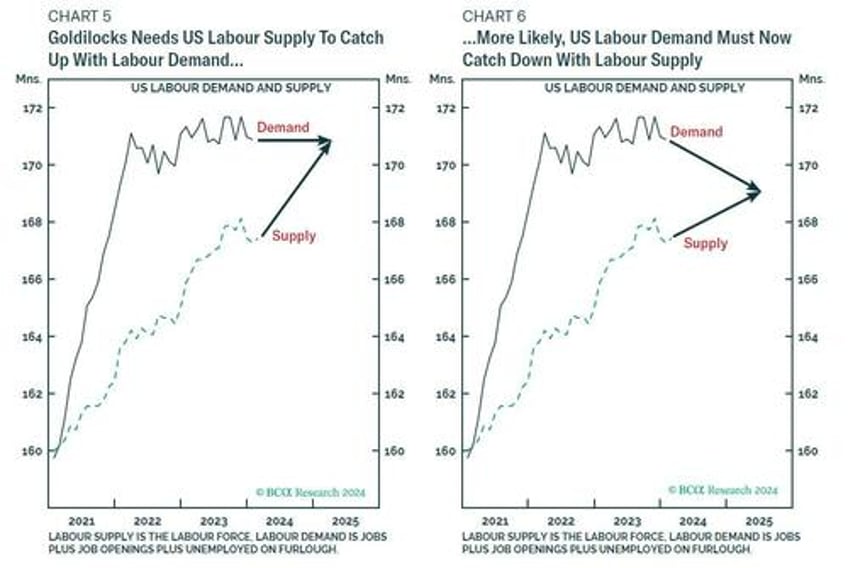

Therefore, we must analyze the post-pandemic inverted economy very differently to the pre-pandemic economy. Normally, labor demand – being less than labor supply – is the constraint on economic output and thereby drives the cycle. But in an inverted economy, labor supply – being less than labor demand – is the constraint on output and thereby drives the cycle.

Before the pandemic, all downswings caused labor demand to fall well below labour supply. In the subsequent upswings, labor demand gradually caught up with supply…until the next downswing caused a fresh slump in labor demand. And the cycle repeated. Importantly though, all pre-pandemic cycles were driven by the demand side.

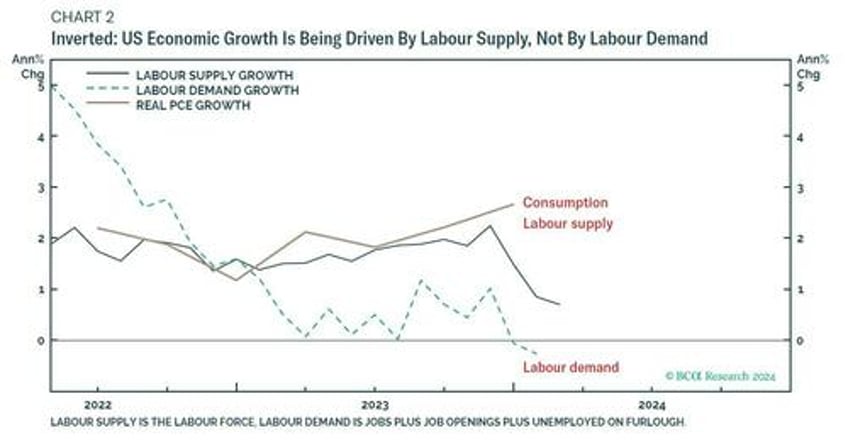

Then came the pandemic, and the longstanding pattern inverted. Labor supply suffered the more protracted slump, from which it has gradually caught up with labor demand. Meaning that in the last couple of years, the cycle is being driven not by what is happening to labor demand, but by what is happening to labor supply.

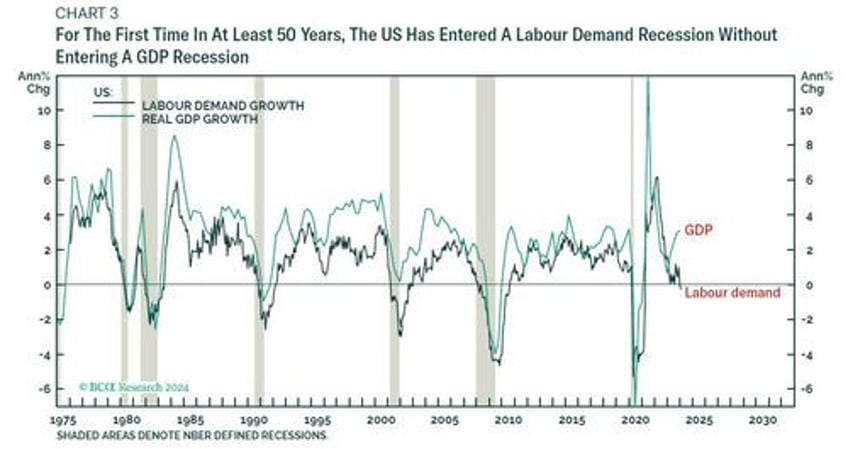

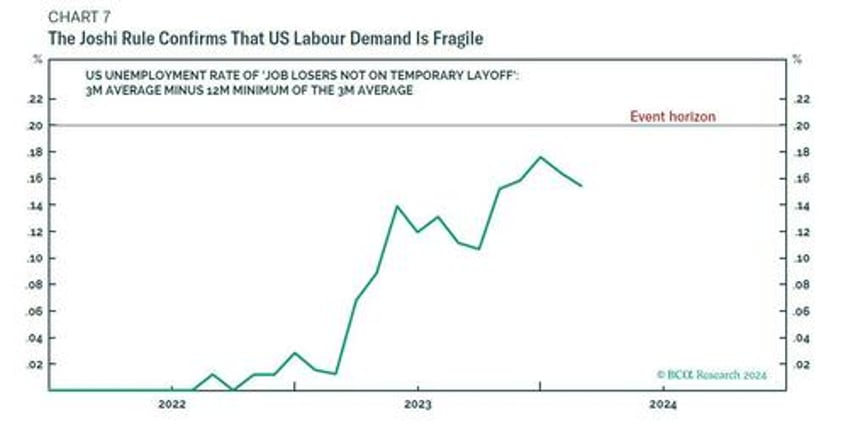

Interest rate hikes work by choking demand, which is exactly what has happened recently. US labor demand is tipping into recession. Jobs plus job openings today are less than they were a year ago. Whenever this happened pre-pandemic, the economy tipped into recession too. But for the first time in at least fifty years, the economy is entering a labor demand recession without entering a GDP recession.

This is because in an inverted economy the constraint on the economy is not labor demand, it is labor supply. Despite weaking

labor demand, labor supply has played catch up to demand and thereby driven economic growth.

As labor supply has caught up with labor demand, it has narrowed the gap between demand and supply. This has created the perfect macro backdrop of robust economic growth with wage disinflation, a Goldilocks setup for financial assets. The pressing question for the coming 6-12 months is, what happens next to labor supply, labor demand, and their interplay?

Why The US Economy Inverted

But first, let’s tackle the obvious question. Why is US labor supply running well below labor demand?

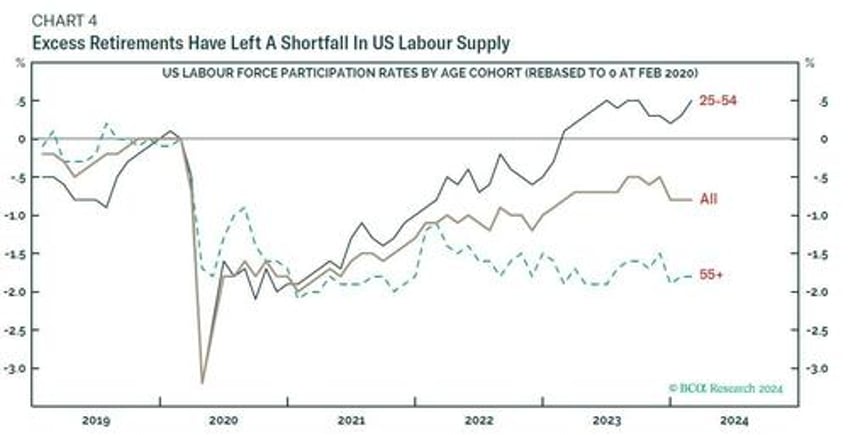

There are two reasons: after the pandemic, prime aged (25-54) workers left the labor force; and older aged (55+) workers retired early, generating millions of so-called ‘excess retirements.’

The economically inactive make no contribution to labor supply. Yet they still consume the goods and services that generate labor demand. This they do by using savings or, in the case of early retirees, by tapping into their retirement assets and income early. Thereby, the plunge in prime-aged labor participation combined with excess retirements caused labor supply to fall well below labor demand.

Subsequently, the plunge in prime-aged labour participation has fully reversed, causing labor supply to recover strongly. But the excess retirements have not reversed and are unlikely to reverse

This means that the strong recovery in labor supply is now exhausted, with labor supply still several million people below labor demand. The economy is still inverted.

US Labour Demand Is Already In Recession, But GDP May Dodge The Bullet

To repeat, US labor demand has already tipped into recession. But in the inverted economy – where labor supply is the constraint on output – labor supply is driving the GDP cycle.

It follows that a GDP recession would require one of two things:

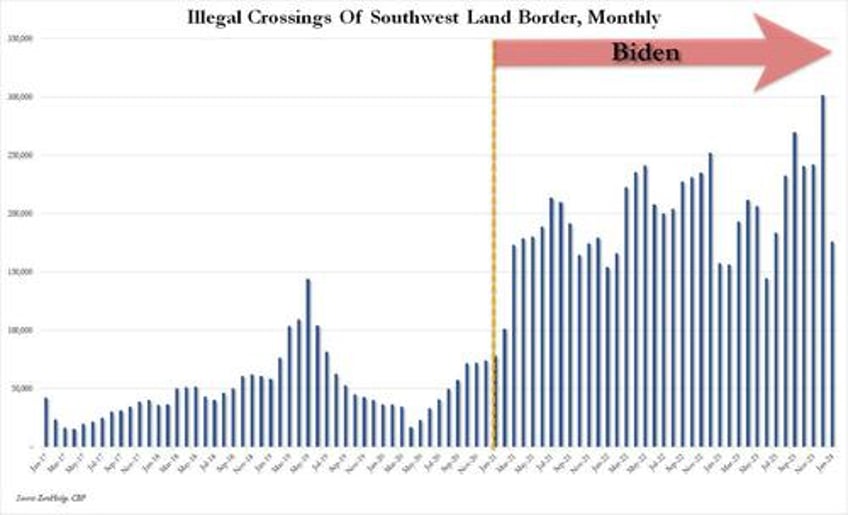

- Labor supply must outright contract. However, with the recent surge in illegal migration – most of which does eventually get counted in the survey-calculated labor supply – a sustained contraction in labor supply seems unlikely. Of course, this could change under a new Trump administration, or...

- Labor demand must contract so sharply – by about 3.5 million jobs – that the economy would ‘un-invert’. Once un-inverted, contracting labor demand would once again drive GDP into recession, as in all pre-pandemic cycles.

But if labor demand contracts more gently – as now – then the US economy could experience a sustained labor demand recession without a GDP recession, making it difficult for the National Bureau of Economic Research (NBER) to designate it an official recession.

This ‘halfway house’ in which GDP is not in recession, but labor demand is in recession and gently ‘catching down’ with labor supply is a distinct possibility – because it is the least painful way for the Federal Reserve to steer wage inflation back down to the 3 percent rate that is needed for price inflation to stabilise at 2 percent (Chart 5 and Chart 6).

Yet though the economy could dodge the ‘NBER official recession’ bullet, a labor demand recession combined with stagnant per capita real incomes would very much feel like a recession.

For the stock market, a labor demand recession implies lower profits because it is only when profits come under pressure that labor demand goes into recession. Against this, wage disinflation would allow long-duration bond yields to fall, which would provide some countervailing support to stock valuations. In combination this would imply the stock market was rangebound while high-quality bonds rallied.

But there is another factor to consider. The euphoric pricing of anything AI-related is a separate and independent risk to the stock market. Absent this risk the macro backdrop would imply a neutral allocation to stocks versus cash. But this additional risk ratchets down my 6-12-month allocation to mildly underweight.

For those who can time this, go underweight stocks when the ‘Joshi rule’ is triggered. Or, when the rally reaches a collapsed complexity that presages an imminent reversal.

More in the full note available to pro subscribers.