By Ye Xie, Bloomberg Markets Live reporter and strategist

China’s housing market is still struggling. Outstanding loans to the property sector fell on a yearly basis for the first time on record as consumers opt against buying homes.

The all-important sector clearly needs more support. But Beijing’s strategy is to shift resources from speculative sectors to more productive industries. In that sense, the difficult rebalancing is going according to the plan.

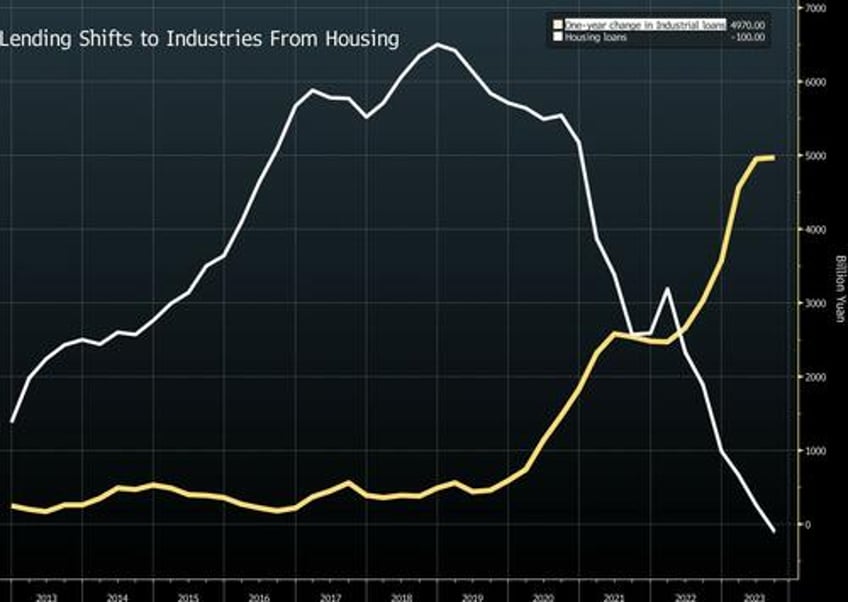

Wednesday’s data showed loans to the property sector fell 100 billion yuan to 53 trillion yuan ($7.3 trillion) at the end of September, from a year earlier, marking the first annual decline on record.

Despite various easing measures, the housing sector remains listless. The value of new home sales among the 100 biggest real estate companies fell 28% in October from a year earlier, compared to a decline of 29% the previous month.

Even China Vanke, the nation’s second-largest builder, is struggling and its dollar bonds are falling. This week, Fitch said the liquidity condition is weakening of listed Chinese property developers that haven’t defaulted yet.

Some of the pain in the housing market was intended by policymakers. President Xi Jinping wants to reorient the economy toward manufacturing and high-tech sectors, weaning it off the bloated housing industry. Indeed, in contrast to the shrinking housing market, lending to the industrial sector surged by almost 5 trillion yuan from a year earlier.

The challenge is that industries, such as electronic vehicles, are not big enough to fill in the holes left by the behemoth housing industry.

Beijing needs to deflate the sector slowly. But the bright side is that rebalancing of the Chinese economy is happening.