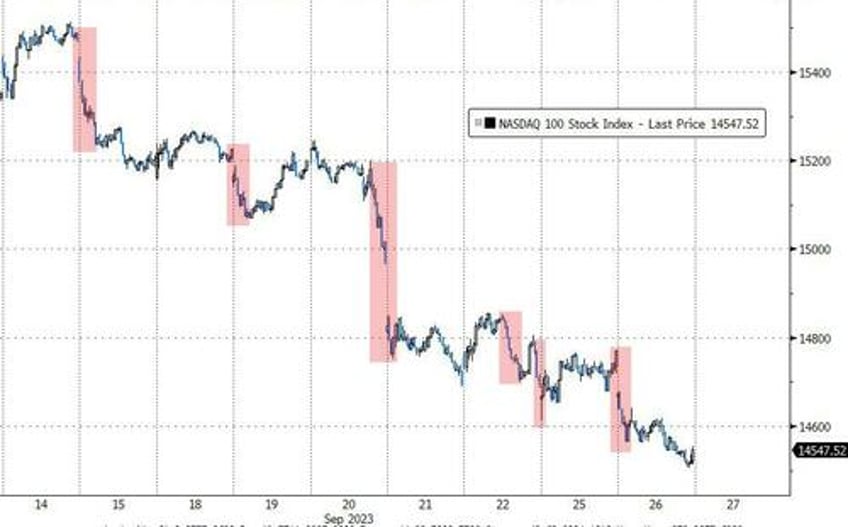

The last few days have seen a regime change in the US equity (and bond) markets, as The Fed reset expectations of "higher for longer" rates (slapping some sanity back into markets that have ignored soaring real rates for months, because 'soft landing' or 'goldilocks' or 'Fed Puts'). This shift to degrossing in the face of higher rates has been exaggerated dramatically by a negative gamma environment...

This morning there is a modest bounce, but as Goldman Sachs' flow-of-funds guru, Scott Rubner, warns in a new note this morning: