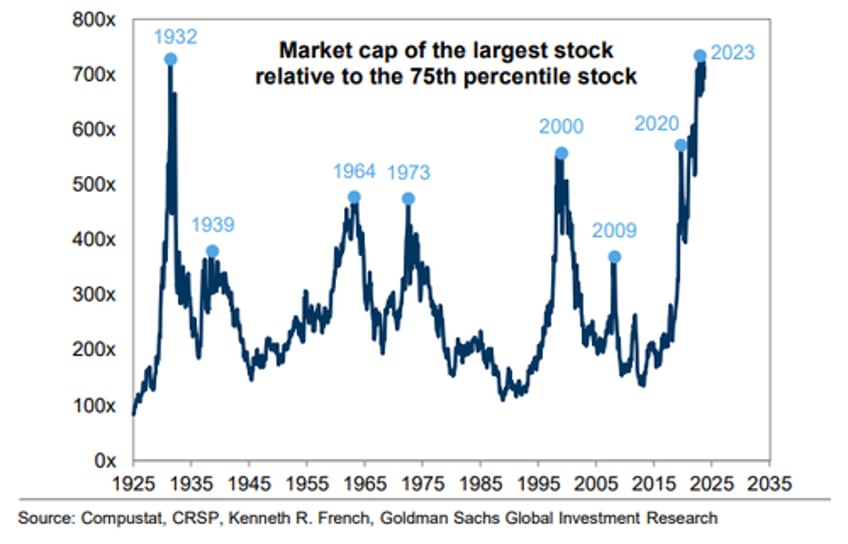

The latest batch of 13F report showed that in a quarter that saw the Mag7 become the most concentrated block of stocks since the Great Depression, hedge funds reduced their exposure to tech giants including Amazon and Apple in Q3 as the stock market rally broadened beyond the biggest tech names.

According to a Bloomberg analysis of the 13F filings, hedge fund holdings of Amazon fell by $11 billion to $34 billion in the three months ending Sept. 30, a result of both net selling and its slumping stock price. In individual hedge funds, Arrowstreet Capital and Viking Global both sold more than 5 million of the company’s shares. Among other notable changes, we already noted how Warren Buffett’s Berkshire Hathaway cut its position in Apple by about 25% to $70 billion.