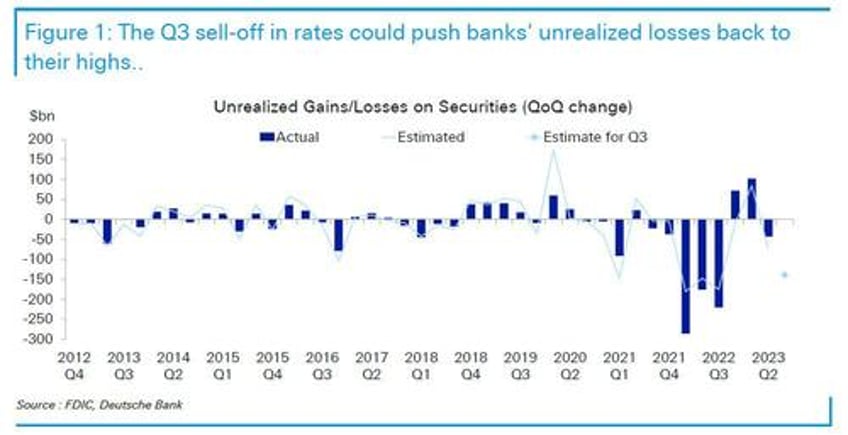

Today's modest normalization notwithstanding, the recent move in rates has been historic: as noted earlier, we have seen a massive +73.5bps rise in 10yr US yields during Q3, while 30yr yields soared +83.9bps, the largest move since Q1 2009. This staggering parallel shift has resulted in huge unrealized losses on bank's fixed income portfolios (which amount to $5.4 trillion in debt securities), and which according to DB calculations will reveal another $140 billion in unrealized losses, pushing the cumulative total to a new record at or above $700 billion.

Of course, there is a simple scenario in which banks don't suffer any losses: all that would take is for yields to tumble right back down to where they were 3 months ago.