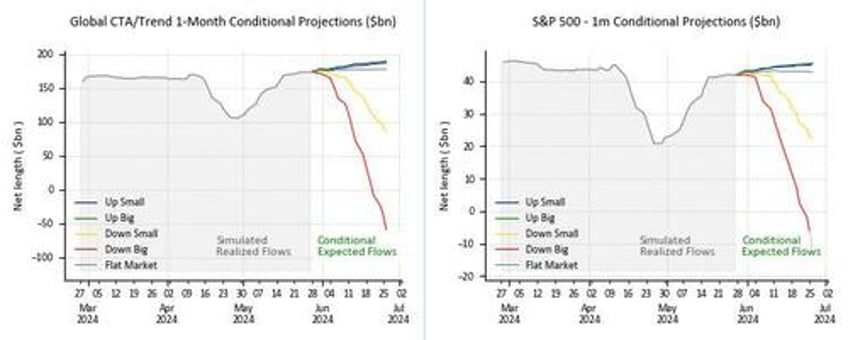

Looking at the (somewhat charred) market landscape today, Goldman trader John Flood writes that while month-end pension rebal is small, with just $9BN of equites for sale, on the other side of the equation, CTAs have $2.2BN of US equities to buy this week at current market levels, roughly offsetting each other.

On the technical side, CTA momentum will remain positive (AKA small demand will continue) as long as the S&P remains above 5198. Meanwhile, a much more powerful corporates continue to buy over $5b of US equities every trading session (and will continue to do so until 6/14/24 when open window closes).