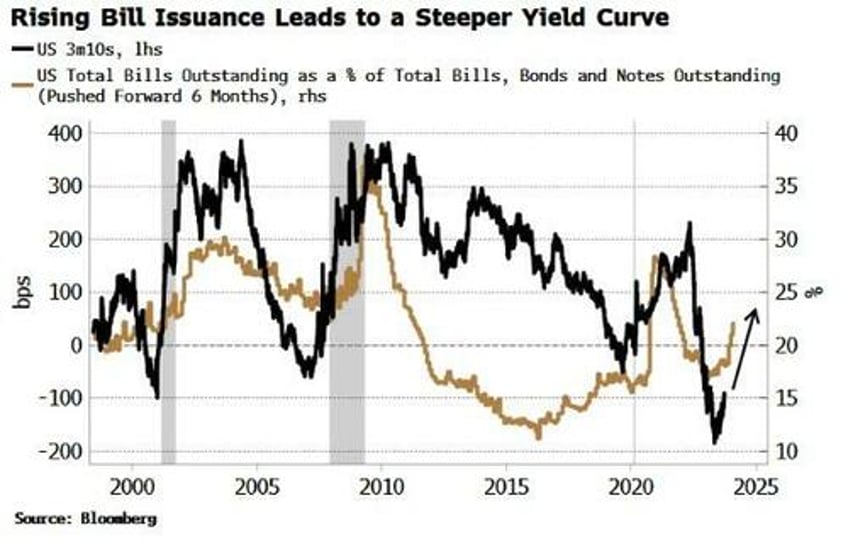

The increase in Treasury bill issuance in recent weeks is a further support for a steepening in the yield curve.

The yield curve is finally making headway in re-emerging from its deep inversion. The 2s10s curve is over 50 bps off its low, at -55bps, 3m10y is almost 100 bps higher than its nadir, while both 5s30s and 10s30s either are or have recently uninverted.

There should be more to come. Leading indicators for the yield curve are few and far between as the the curve itself tends to lead (although the lead times can sometimes be too long to be of practical use for investors).

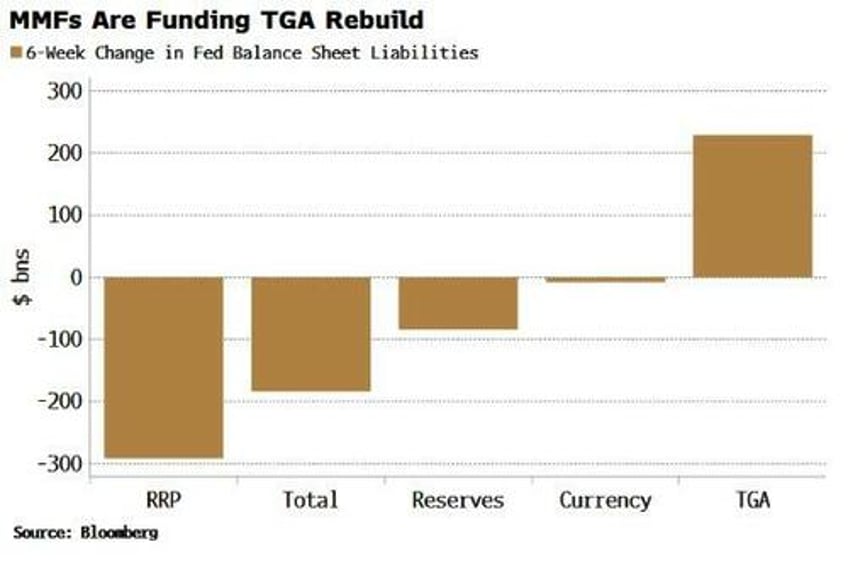

Nonetheless, the increase in bill issuance is supportive of further steepening in the yield curve. The Treasury aims to rebuild its cash balance, i.e. its account at the Fed (the TGA), to $750 billion by year end. It is in the process of doing this aggressively, with the TGA rising by almost $300 billion since mid-August.

TGA rebuild is normally done through issuing bills, and that is happening now. Bill issuance has dwarfed bond and note issuance in recent weeks. Normally such a rapid rise in the TGA would spell danger for risk assets, as reserves would be prone to dropping precipitously.

But here the Fed’s reverse repo facility (RRP) has ridden to the rescue.

Bill rates are high enough above the RRP rate that (mainly) money market funds (MMFs) have been buying the issued bills, and drawing down on the RRP to buy them. Reserves have fallen only $85 billion over the last six weeks, despite $220 billion of TGA rebuild and ~$100 billion of QT.

Increased bill issuance is filling the TGA, and it also points to a steeper yield curve, as shown in the chart below.

The relationship is counter-intuitive at first. Increased issuance at the short end would mechanically lead to a flatter curve. But the fact the relationship is the other way suggests that demand is the more dominant driver of yields in the medium term. There is an elastic demand for bills (even more so when there is $1.8 trillion of liquidity on hand in the RRP), so that when supply increases, demand rises to meet it, while reducing demand further along the curve.

That’s perhaps even more germane in the current environment. If longer-dated bonds are losing their hedging capabilities in a positive stock-bond correlation environment, then shorter-dated debt or bills become increasingly attractive.