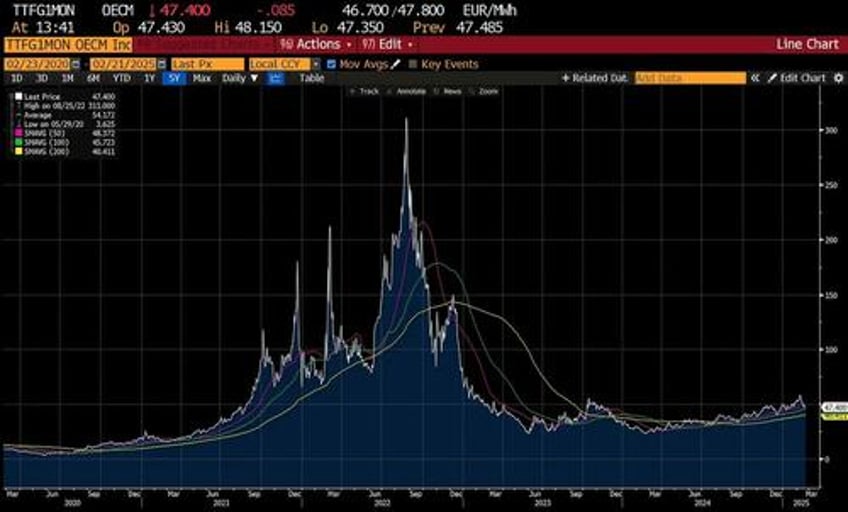

Trump has done exactly what he said he was going to do, and negotiated with Russia directly to end the war in Ukraine. The Trump deal with Russia could be very bullish for Europe, as it could see Russian sanctions lifted, and oil and gas prices fall. This would be particularly bullish for Germany, as it has suffered from high energy prices. Although far less than in 2022, European energy prices are far higher than in the US or Russia.

Likewise, increased food supply from Ukraine and Russia could be bring down food prices - which would be bullish.

After decades of stagnation, Europe has broken out of its range, even as the Trump deal with Putin would seemingly be a negative.

It is easy to argue the opposite way. Generally speaking, when a dictator has succeeded in using force to increase their power and prestige, it is difficult for them to give up the gun, and the Baltics, like Ukraine used to be part of the Soviet Union. It is hard to find any equity weakness in this area. MSCI Baltics has ripped.

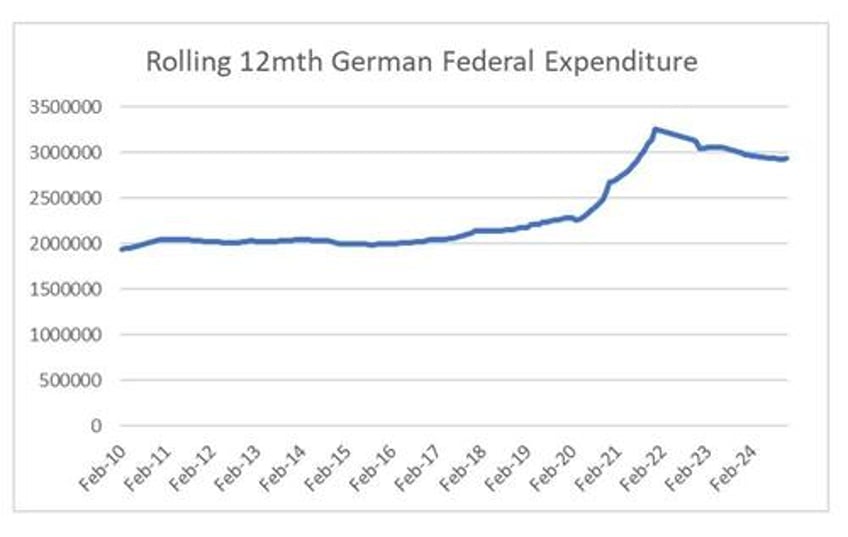

My best guess for all this bullishness would be the likelihood that the German government is going to abandon is fiscal austerity, and move to a more US style fiscal expansion - which should be good for equities and bad for bonds. That is Trump abandoning Ukraine has forced Germany to abandon austerity - and that is bullish.

The more interesting question is whether this is good for China or bad for China? On first blush, the market has decided it good. To be fair, for the Chinese tech sector we have also seen the emergence of DeepSeek and the rehabilitation of Jack Ma, and so the Hang Seng Tech index has doubled in 6 months.

On a more geo-political view, the implication is that President Trump is moving to a sphere of influence model - where Europe has to deal with Russia and its neighbours, while the US deals with its neighbours how it sees fit. The logic then is that China is free to deal with its neighbours how it sees fit too - and will not suffer consequences. In other words, China can harass and absorb Taiwan with impunity. For investors in Chinese assets this is bullish as you can now discount the risk of sanctions - which is what hurt foreign investors into Russia assets. Gazprom London listing is an example of this risk.

If Kissinger, who talked to Trump extensively during his first time, was still alive, then I would say this was unequivocally bad for China. “How so?” you might ask? Kissinger was instrumental in the ping pong diplomacy of the 1970s, that saw China and the US establish diplomatic relationships. For those you who learn history from popular culture (I learnt more about the royal family from “The Crown” that I ever learnt from any history class), Forrest Gump playing table tennis in China was basically seen as a way for the US to reach out to China. Kissinger was a prime mover in this. The driver of this détente was to isolate USSR- and from a economic point of view, betting on China versus Russia from this point of time made you a sure fire winner.

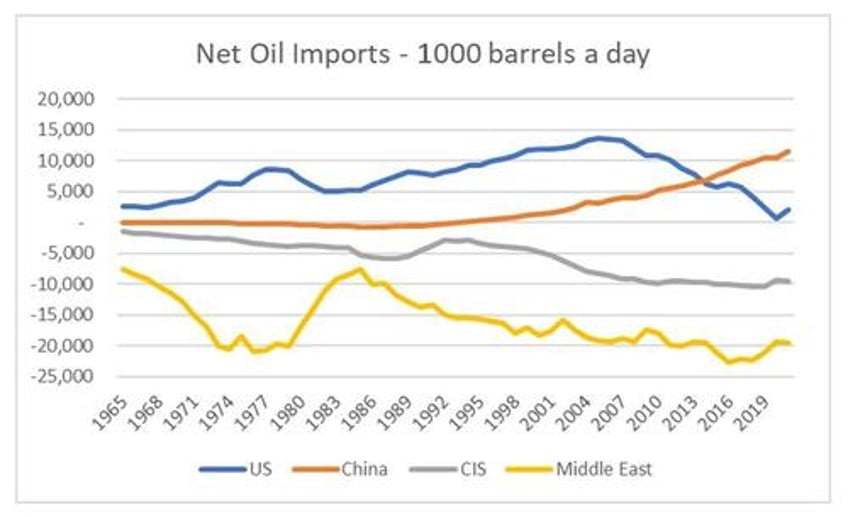

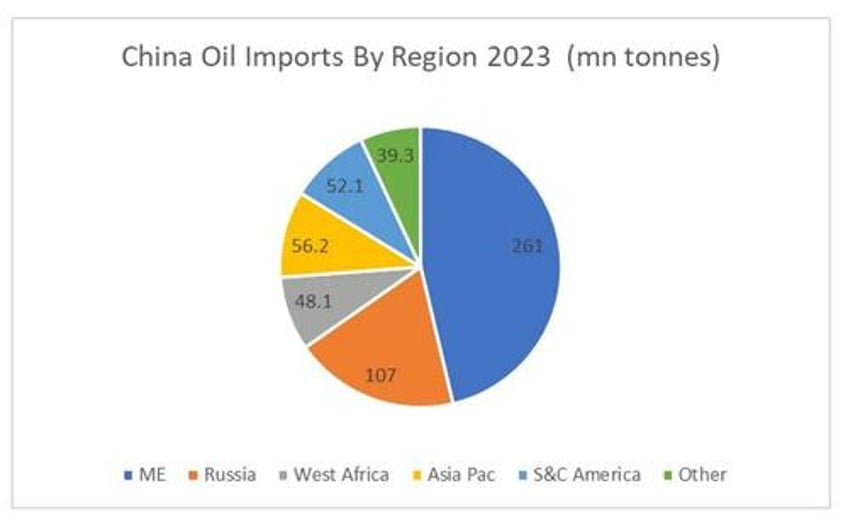

First of all there are two things to remember - China and Russia will always be important nations, by dint of the their population and land mass respectively. When they are aligned, they are very difficult to defeat, as we have seen in Ukraine, where Chinese technology has kept Russia in the game. But China and Russia are not natural allies - for most of their history they have faced off against each other. Hard to believe now, but the Soviet Union was not even that supportive of the Chinese Communist Party in its civil war for control of China, at least until the end of the Second World War. Prior to this, China/Russian relations has been defined by battle for control of the far east. If the US can bring Russia into the fold, then China become extremely exposed on oil imports, just at the US was in the 1970s.

China like the US in the 1970s is now heavily reliant on the Middle East for its oil. Bringing Russia into the fold would make energy a choke point for the Chinese economy.

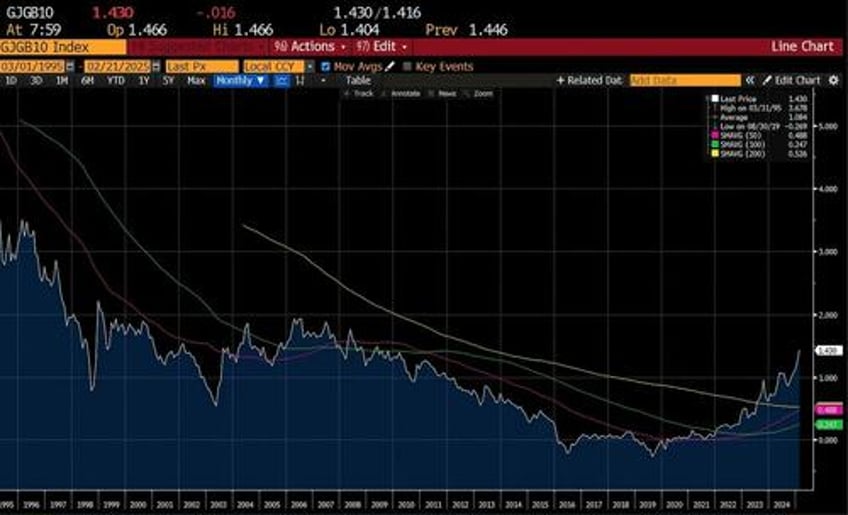

Kissinger is no longer with us - so I don’t know if this is part of the plan. But Trump has always signalled that China is the true enemy of the US, not Russia. And a secure Russia would probably go along with a strategy that weakened China, if only to prove the importance of Russia to both the US and China. The thing is Kissinger had a clear aim of avoiding an open clash between the USSR and USA. Trumps aims tend to be less clear, at least to me. If it is the Kissinger line of thinking, then the current rally in Chinese tech is clear trap. But if we are moving to sphere of influence, and deal with China, then perhaps they are a buy. I find geo-politics difficult to read - but all I know is that government spending is going to go up globally - and that is bad for bonds. Japanese bonds continue to be weak.

Politics is a funny thing I have found. It is not always clear how politicians are going to behave - which I why I suspect voters loved the move to free markets in the 1980s and 1990s - it was a move away from domineering politicians. Having fallen out of love with free markets - we are moving back to domineering politicians. Markets think a deal with Russia is bad for oil prices and good for China - but I could see the reverse being true.