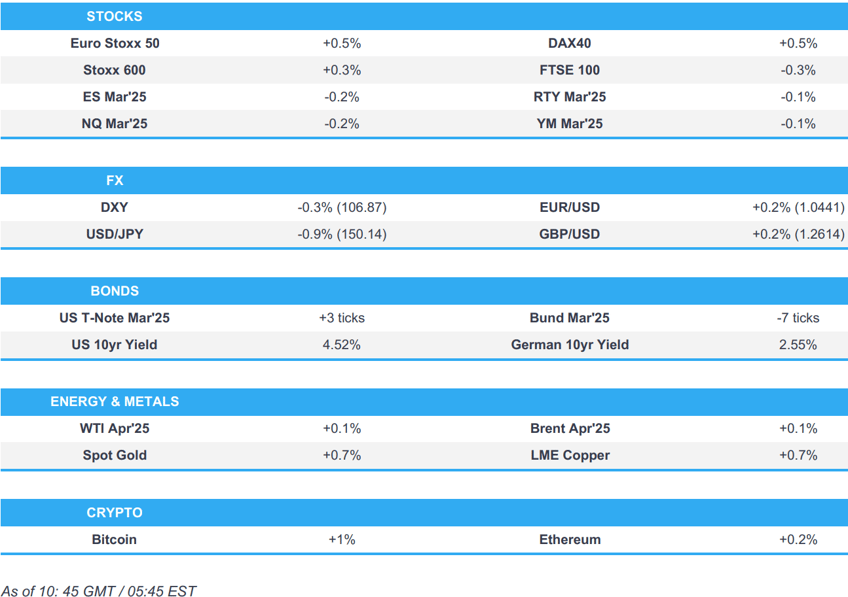

- US President Trump remarked that a new trade deal with China is possible; EU's Sefcovic says they are prepared to talk about reducing the 10% US auto tariff.

- European bourses opened mixed but have gradually edged higher; US futures modestly lower.

- USD is softer vs. peers, JPY benefits from yield dynamics, AUD boosted post-jobs.

- USTs inch higher continuing post-FOMC price action while EGBs remain in the red.

- Crude and metals benefit from the softer Dollar; Rio Tinto says “Near-term market conditions are expected to remain challenging in 2025”.

- Looking ahead, US Initial Jobless Claims, Philly Fed Index, EU Consumer Confidence, NZ Trade, Australian PMI, Japanese CPI, Speakers including ECB’s Makhlouf, Fed’s Goolsbee, Musalem, Jefferson & Barr, Supply from US.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

TARIFFS/TRADE

- US President Trump said he will announce tariffs on cars, semiconductors, chips, pharma and probably lumber over the next month or sooner, while he is looking at a 25% tariff on lumber and forest products. Trump also said he is speaking to China on TikTok and later commented that a new trade deal with China is possible.

- EU Trade Commissioner Sefcovic said the EU is prepared to talk with the US about reducing its 10% tariff on cars as part of a broader negotiation aimed at avoiding a transatlantic trade war, according to POLITICO.

- China Commerce Ministry says China has been doing its best to push for EU negotiations. Hoped that the EU side will heed industry's calls and promote bilateral investment cooperation through dialogue. Urges the US to stop misleading the American people and international community. Urges the US to handle US-Sino relations in an objective and rational manner

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 +0.3%) opened mixed, but sentiment has gradually improved as the morning progressed to display a more positive picture in Europe, paring back the hefty losses seen in the prior session.

- European sectors hold a positive bias vs initially opening mixed. Basic Resources is the clear outperformer, with gains facilitated by strength in metals prices alongside post-earning upside in Anglo American (+3%) and Rio Tinto (+1%). Banks are towards the middle of the pile; Lloyds (+3.6%) saw its profit plunge 20%, but optimism stems from a GBP 1.7bln share buyback. For the Autos sector, both Mercedes (-2.5%) and Renault (-2.4%) dip after their results.

- US equity futures are modestly lower across the board, but sentiment has been improving a touch in recent trade, in tandem with the broadly positive risk tone in Europe.

- Tesla (TSLA) aims to start India sales around Q3, via ET citing sources.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is softer vs. all peers with DXY hampered by strength in the JPY on account of widening yield differentials. US yields were knocked lower post-FOMC minutes after the account showed various participants believed it might be appropriate to pause/slow balance sheet runoff. Today's Fed speaker slate includes Goolsbee, Musalem, Jefferson & Barr. Elsewhere, today's other scheduled highlights include Treasury Secretary Bessent at 12:00GMT/07:00ET on Bloomberg TV with weekly claims and Philly Fed data to follow thereafter. DXY has returned to a 106 handle but is currently holding above Wednesday's 106.87 low.

- EUR is slightly firmer vs. the USD but to a lesser degree than most peers following losses on Tuesday and Wednesday. On the trade front, EU Trade Commissioner Sefcovic said the EU is prepared to talk with the US about reducing its 10% tariff on cars as part of a broader negotiation. EUR/USD is currently stuck within yesterday's 1.0400-61 parameters.

- USD/JPY retreated overnight amid initial gains in Japanese yields (and softness in their US counterparts post-FOMC minutes) alongside the negative risk appetite in Tokyo. The pair breached below the 150 mark in early European trade; further downside brings into play its 9th December low at 149.68.

- GBP is a touch firmer vs. the USD but to a lesser degree than peers. UK newsflow for today has been light in a week where markets have digested firmer than expected labour market data and a mixed inflation report. Direction for Cable may be dictated more by the USD leg of the equation; currently tucked within Wednesday's 1.2562-1.2639.

- Antipodeans are both notably stronger vs. the USD with AUD bolstered by stronger-than-expected jobs data in Australia in which employment change topped forecasts at 44k (exp. 20k) and was solely fuelled by full-time jobs. Sentiment was also bolstered by comments from US President Trump that a new trade deal with China is possible.

- PBoC set USD/CNY mid-point at 7.1712 vs exp. 7.2856 (prev. 7.1705).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are modestly firmer. Action for USTs was pronounced in the later part of the US session given FOMC Minutes, 20yr supply, Trump/tariff updates and a handful of speakers. Since, US-specific newsflow has slowed a touch and we are now largely awaiting further details on Trump’s latest remarks, US data, Fed speak and the US Treasury Secretary. As it stands, USTs are holding toward session highs of 109-04+ having eclipsed Wednesday’s 109-00 best.

- Bunds are in the red. Bear-steepened on Wednesday before lifting off worst in-fitting with Treasuries, a move which slowed in APAC trade but briefly recommenced early doors this morning to a 131.63 peak. Though, this proved fleeting with the constructive European risk tone, ongoing reassessment following Schnabel’s hawkish remarks on Wednesday and the implications of Trump’s latest rhetoric weighing. Given this, Bunds continue to bear-steepen with the German 10yr yield notching an incremental new 2.55% WTD peak.

- On auctions, Spain was strong but spurred no move while the record French offering saw a 5x cover for the 2029 line and the top-amount sold. Lifting OATs from a 123.00 low by 15 ticks, sending them just into the green for the session.

- Gilts are echoing EGBs. The arguments around tariffs are much the same. Specifics include confirmation that UK PM Starmer will be visiting the US next week to meet with US President Trump. Potentially of note, initially reporting around this intimated it could be a joint visit with French President Macron - updates since suggest this is not the case. Currently at the lower-end of a 91.96-92.29 band.

- Italian Foreign Minister says they need European bond issuance to finance defence spending.

- Spain sells EUR 5.5bln vs exp. EUR 4.5-5.5bln 2.40% 2028, 2.70% 2030 & 3.55% 2033 Bono.

- France sells EUR 13.5bln vs exp. EUR 11.5-13.5bln 2.4% 2028, 0.0% 2029, 2.75% 2030 OAT.

- Click for a detailed summary

COMMODITIES

- A choppy session for crude prices thus far with the complex subdued in early European trade after experiencing gains in late APAC trade, and following Wednesday's indecisive performance amid geopolitical uncertainty due to the recent US turnaround in foreign policy and with prices contained after bearish private sector inventory data. Brent resides in a 75.72-76.30/bbl range.

- Subdued action in natural gas with prices in Europe subdued by the prospect of milder weather in the upcoming period. Earlier today, a Russian attack damaged Ukrainian gas production facilities, according to the Energy Minister.

- Precious metals trade higher across the board amid the ongoing geopolitics, tariffs, USD weakness from FOMC minutes, and broader momentum after spot gold hit a fresh record high this morning. Spot gold topped USD 2,950/oz to a USD 2,954.95/oz peak at the time of writing (vs low 2,933.85/oz).

- Base metals trade higher across the board following a choppy APAC session but with the complex later supported by the softer Dollar and as sentiment during early European trade tilts higher. 3M LME copper resides in a 9,452.95-9,547.00/t range at the time of writing.

- Russian attack damaged Ukrainian gas production facilities, according to the Energy Minister. Brent resides in a 75.72-76.30/bbl range.

- US Private Inventory Data (bbls): Crude +3.3mln (exp. +2.2mln), Distillate -2.7mln (exp. -3.5mln), Gasoline +2.8mln (exp. +0.8mln) Cushing +1.7mln.

- US President Trump said they will fill up the SPR fast and will cut taxes on domestic producers of oil and gas.

- Click for a detailed summary

NOTABLE DATA RECAP

- German Producer Prices MM (Jan) -0.1% vs. Exp. 0.6% (Prev. -0.1%); YY (Jan) 0.5% vs. Exp. 1.3% (Prev. 0.8%)

NOTABLE EUROPEAN HEADLINES

- French President Macron to visit the US early next week, it is unclear whether this will be a joint meeting with UK PM Starmer, is likely US President Trump will meet them separately, according to reporter Rahman.

- Nordea believes the Riksbank will not deliver any further rate cuts and will remain at 2.25% for the entire horizon (prev. expected a cut to 2.00% in May); due to inflation being higher than expected.

NOTABLE US HEADLINES

- Fed Vice Chair Jefferson (voter) said the Fed can take time when weighing the next monetary policy move and US economic performance has been quite strong, while he added that US monetary policy remains restrictive, the US labour market is solid and inflation has eased but is still elevated. Jefferson also said the best thing the Fed can do is to achieve its dual mandates on inflation and employment, as well as noted that they are fully committed to getting inflation back to target and will do what it takes. Furthermore, he said the Fed is in a watch-and-wait mode about the state of government policy.

- Fed's Goolsbee (2025 voter) said inflation has come down but it is still too high and once inflation has come down, rates can come down more.

- US President Trump said the golden age of the US is back and it is open for business, while he will be working with Congress to pass the largest tax cuts in US history and will dramatically cut taxes with no taxes on tips and hopefully no taxes on social security. Furthermore, Trump said they are considering a new concept where they will give 20% of the DOGE savings to American citizens and with 20% to go to paying down debt.

- US President Trump said he is not happy with Boeing (BA) about Air Force One and could buy a used plane or a plane from another country, but also commented that he would not consider buying a plane from Airbus (AIR FP).

- US Pentagon later commented that the budget review aims to save about USD 50bln which will be spent on programs aligned with US President Trump's priorities.

- US Commerce Secretary Lutnick said President Trump's goal is to abolish the Internal Revenue Service, according to a Fox interview cited by Reuters.

- TikTok makes global layoffs at trust and safety unit as part of restructuring, according to Reuters sources.

- US House Speaker Johnson says he is waiting on a "few" developments that "might have a big effect" on the reconciliation bill, via Punchbowl

GEOPOLITICS

- Russia's Kremlin says if the UK were to deploy 30,000 European troops in Ukraine, it would be a concern.

- Russia's Kremlin say they have resumed talks on the prisoner exchange with the US

- Ukrainian President Zelensky is scheduled to meet Thursday in Kyiv with US envoy Kellogg and said it is crucial that this discussion and the overall cooperation with the US remain constructive, according to Axios' Ravid.

- US President Trump said he spoke with Russian President Putin and Ukrainian President Zelensky to end the war, while he repeated language that suggested Ukraine started the war, as well as stated that Zelensky could have come to talks if he wanted to and had done a terrible job. Furthermore, Trump said he hopes to see a ceasefire soon and separately noted a deal can be made with Russia, while he also stated that they are going to resurrect the critical mineral deal with Ukraine and that Greenland is needed from a security standpoint.

- Russian Deputy Chief of Staff said Ukraine's losses exceeded one million military since the start of the military operation 3 years ago, according to Al Jazeera.

- Russian general staff said more than 800 square km of the Kursk region were taken back from Ukrainian forces which is about 64% of the total taken by Ukraine and Russia is advancing in all directions in the Kursk region.

- Russia conducted an attack on Kyiv on Wednesday evening in which powerful explosions were reported to shake the capital, while authorities reported air defences were in action, according to Kyiv Post.

CRYPTO

- Bitcoin is in the green and trades around the USD 97k mark; Ethereum climbs above USD 2.7k.

APAC TRADE

- APAC stocks mostly declined with sentiment dampened by ongoing geopolitical uncertainty and after US President Trump's latest comments in which he repeated criticism against Ukrainian President Zelensky and said he will announce tariffs on cars, semiconductors, chips, pharma and probably lumber over the next month or sooner.

- ASX 200 was pressured with mining, materials and financials among the worst performing sectors, while participants digested a slew of earnings releases including from the likes of Rio Tinto and Fortescue.

- Nikkei 225 suffered from the ill effects of a firmer currency and slipped beneath the 39,000 level as Japan's 10yr yield initially climbed to its highest since November 2009.

- Hang Seng and Shanghai Comp conformed to the downbeat mood amid trade frictions and US tariff threats, while China unsurprisingly maintained the Loan Prime Rates. However, the mainland index eventually returned to flat territory and there were recent reports that US President Trump is eying a bigger and better trade deal with China that would include substantial investment and commitments for China to buy more US products.

NOTABLE ASIA-PAC HEADLINES

- PBoC holds a 2025 macro prudential work conference; will step up the analysis of macroeconomic and financial work. Real Estate: Will help the real estate market stop falling and stabilise. Support the construction of a new model of real estate development. Yuan: Will promote cross-border use of Yuan. Will develop Yuan offshore market. Will let currency swap and Yuan settlement play their roles.

- Times' Waterfield posts "Russia pressed the US to withdraw security guarantees from eastern European and Nordic Nato allies in Riyadh, a new “Yalta” to divide Europe into spheres of American and Russian influence, according to a senior Romanian official".

- Chinese Loan Prime Rate 1Y (Feb) 3.10% vs. Exp. 3.10% (Prev. 3.10%); 5Y 3.60% vs. Exp. 3.60% (Prev. 3.60%)

- RBNZ Governor Orr said he is feeling more positive about the inflation situation and expects the cash rate will be around 3% by year-end, while he added “in an environment of low and stable inflation”. Orr later commented that there would have to be an economic shock to cut by 50bps again.

- NetEase Inc (NTES) Q4 2024 (USD): EPS 1.89 (exp. 1.76), Revenue 3.70bln (exp. 3.71bln)

- Alibaba Group Holding Ltd (BABA) Q4 2024 (CNY): EPS 21.39 (exp. 19.12.), Revenue 280.154bln (exp. 279.34bln)

DATA RECAP

- Australian Employment (Jan) 44.0k vs. Exp. 20.0k (Prev. 56.3k)

- Australian Full Time Employment (Jan) 54.1k (Prev. -23.7k); Unemployment Rate 4.1% vs. Exp. 4.1% (Prev. 4.0%)