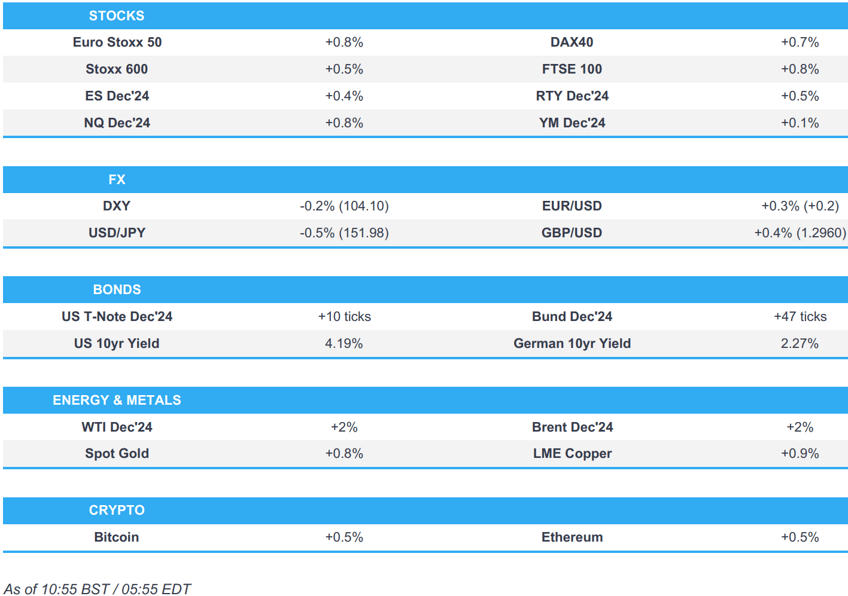

- European bourses are entirely in the green and reside just off session highs; US futures also gain, with NQ outperforming after strong TSLA (+10.7%) results.

- Dollar is on the backfoot giving back some of this week’s gains, JPY outperforms with USD/JPY scaling back to a 151 handle.

- USTs/Bunds are on a firmer footing, with EZ PMIs continuing to paint a dire picture in Europe; Gilts are the clear underperformer amid reports that Chancellor Reeves will announce major changes to fiscal rules releasing GBP 50bln for spending.

- Crude continues to pick up, catching a bid following unconfirmed reports which indicated a fire in proximity to an Iranian nuclear facility in Karaj; XAU/base metals are firmer

- Looking ahead, US Flash PMIs, US Weekly Claims, New Home Sales, ECB's Lane & McCaul, Fed's Hammack, BoE's Bailey & Mann.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (+0.7%) began the session very modestly in positive territory, and sentiment has continued to improve as the morning progressed; as it stands, indices generally reside at session highs. The complex was generally unreactive to the French/German/EZ.

- European sectors hold a strong positive bias; Travel & Leisure tops the pile, lifted by post-earnings gains in Evolution (+12.8%) and Sodexo (+4.5%). Autos were initially towards the middle of the pile, but moved up the gears amid Bloomberg reports that China is pressuring automakers to pause expansion in the EU due to the escalating trade conflict.

- US Equity Futures (ES +0.5% NQ +0.5% RTY +0.5%) are broadly on a firmer footing, in tandem with strength seen across European indices, and in an attempt to reclaim some of the pressure seen in prior session.

- Notable European earnings: Kering (+2%, rev. miss & guidance cut), Hermes (+1.9%, Sales beat), Barclays (+3.8%, strong results), Unilever (+3.9%, Sales beat).

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is softer vs. peers with the recent rally in DXY pausing for breath. Fresh macro drivers for the US have been on the light side, but will pick-up in the form of jobless claims and PMIs, later today. DXY remains on a 104 handle and within Wednesday's 104.09-104.57 range.

- EUR is firmer vs. the USD but to a lesser extent than peers in the wake of this morning's PMI data. EUR/USD was nudged lower in early trade following soft French PMI metrics; thereafter, the pair was granted some reprieve following slightly more encouraging German figures before the final EZ release printed mixed but underscored the complex growth picture for the region. EUR/USD currently sits around 1.08.

- GBP was top of the G10 leaderboard early doors following a Reeves-induced jump in UK yields before upside for the pound was tempered by a softer outturn for UK PMI data. Cable is currently contained within yesterday's 1.2908-95 range and below its 100DMA at 1.2964.

- JPY is clawing back some ground vs. the USD in an attempt to reverse the recent trend which saw USD/JPY print a fresh multi-month peak at 153.18 yesterday. By way of comparison, yesterday's low is still some way of at 150.97. Japanese Finance Minister Kato attempted to jawbone the currency overnight.

- Antipodeans are both firmer vs. the USD as markets trade in a more pro-risk environment. AUD/USD has managed to move back above its 200DMA at 0.6628; NZD/USD is currently tucked within yesterday's 0.5991-0.6053 range.

- PBoC set USD/CNY mid-point at 7.1286 vs exp. 7.1284 (prev. 7.1245).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- Bunds are on a firmer footing and were heading higher into the French PMI metrics, which were weak and sparked some modest upside to a 133.27 peak. Thereafter, a strong (relatively speaking) set of data from Germany saw EGBs essentially pare this move to current levels of around 133.11. EZ PMIs were mixed and ultimately had little impact on price action.

- Gilts gapped lower by 41 ticks and then extended lower by another 14 to a 95.70 base. Pressure which came on the back of a Guardian report that Chancellor Reeves will today confirm she will change the figure underpinning the existing fiscal rule to a broader measure, something she is expected to announce to the IMF later today. UK Flash PMIs were soft across the board with the outlook tepid and weighed on by numerous points of uncertainty; metrics which lifted Gilts modestly into the green, to a short-lived 96.31 peak. As it stands, Gilts are currently trading around 96.09.

- USTs are firmer and pulled around alongside the above Flash PMIs ahead of its own release and weekly jobs data. Holding towards the 111-12 session high with the curve modestly flatter though with action across it a touch mixed at points as the belly finds itself the marginal laggard from a yield perspective.

- Click for a detailed summary

COMMODITIES

- Crude is on a firmer footing, initially catching a bid following unconfirmed reports which indicated a fire in proximity to a Iranian nuclear facility in Karaj; this move ultimately proved fleeting given the lack of details. Soon after, upside returned alongside a pickup in broader sentiment with Brent Dec currently near highs at around USD 76.34/bbl.

- Spot gold is firmer, bolstered by the softer USD and yield environment in the US and EZ. At a USD 2737/oz peak, which is the lowest daily-high for the week thus far.

- Base metals are generally in positive territory, given the encouraging risk tone which has emerged despite a cautious APAC handover.

- Iraq's Kerbala (140,000bpd) refinery to operate at around 50% capacity in the coming days.

- Click for a detailed summary

NOTABLE DATA RECAP

- French HCOB Composite Flash PMI (Oct) 47.3 vs. Exp. 49.0 (Prev. 48.6); HCOB Services Flash PMI (Oct) 48.3 vs. Exp. 49.9 (Prev. 49.6); HCOB Manufacturing Flash PMI (Oct) 44.5 vs. Exp. 44.9 (Prev. 44.6); "The HCOB Nowcast predicts only slight growth as the fourth quarter kicks off."

- German HCOB Composite Flash PMI (Oct) 48.4 vs. Exp. 47.6 (Prev. 47.5); HCOB Services Flash PMI (Oct) 51.4 vs. Exp. 50.6 (Prev. 50.6); HCOB Manufacturing Flash PMI (Oct) 42.6 vs. Exp. 40.8 (Prev. 40.6); "The start to the fourth quarter is better than expected. With services growing at a faster pace and manufacturing shrinking not as quickly as in the previous month, growth in the fourth quarter is a distinctive possibility".

- EU HCOB Composite Flash PMI (Oct) 49.7 vs. Exp. 49.8 (Prev. 49.6); HCOB Services Flash PMI (Oct) 51.2 vs. Exp. 51.5 (Prev. 51.4); HCOB Manufacturing Flash PMI (Oct) 45.9 vs. Exp. 45.3 (Prev. 45.0)

- UK Flash Composite PMI (Oct) 51.7 vs. Exp. 52.6 (Prev. 52.6); Flash Manufacturing PMI (Oct) 50.3 vs. Exp. 51.4 (Prev. 51.5); Flash Services PMI (Oct) 51.8 vs. Exp. 52.4 (Prev. 52.4); “The early PMI data are indicative of the economy growing at a meagre 0.1% quarterly rate in October."

NOTABLE EUROPEAN HEADLINES

- ECB's Holzmann said a quarter-point rate cut is probable in December and they are unlikely to have a 50bps cut in December but such a move is possible, while another option is a hold due to the October move, according to Bloomberg.

- ECB's Vasle says no urgency in talking about undershooting inflation target and cutting rates below neutral; should keep cutting rated in "measured" increments.

NOTABLE US HEADLINES

- Tesla Inc (TSLA) Q3 2024 (USD): Adj. EPS 0.72 (exp. 0.58), Revenue 25.18bln (exp. 25.37bln). Gross margin 19.8% (exp. 16.8%), expects slight growth in vehicle deliveries in 2024. +10% in the pre-market

- T-Mobile US Inc (TMUS) Q3 2024 (USD): EPS 2.61 (exp. 2.42), Revenue 20.16bln (exp. 20.01bln).

- International Business Machines Corp (IBM) Q3 2024 (USD): Adj. EPS 2.30 (exp. 2.23), Revenue 14.97bln (exp. 15.07bln).

- Boa weekly total card spending (Oct 19th) +1.9% Y/Y vs. prev. +0.8%; saw broad-based increases in spending growth

GEOPOLITICS

MIDDLE EAST

- "An Iranian opposition organisation reports a fire at the nuclear power plant in the city of Kharaj; There are no reports from official Iranian media", via N12 News. Note, original N12 report on X has since been deleted.

- Israel Broadcasting Corporation announced IDF's readiness to respond to the Iranian missile attack. Thereafter, Israeli Broadcasting Authority, via Sky News Arabia, reports "Israel on the verge of launching an attack on Iran despite US pressure"

- Explosions were heard in Syria's capital Damascus as a result of Israeli aggression, according to Syrian state TV.

- Iraqi armed factions loyal to Iran announced the targeting of a vital target in the Golan with drones.

- Pentagon said US Secretary of Defense Austin expressed concern in a call with his Israeli counterpart about reports of strikes against the Lebanese army, according to Sky News Arabia.

- Turkey hit PKK targets in Northern Iraq and Syria after a deadly attack in Ankara, according to Turkish security sources.

OTHER

- US President Biden said the US is announcing today that it will provide USD 20bln in loans to Ukraine.

- US asked G7 to consider sanctions on Russian palladium and titanium, according to Bloomberg.

CRYPTO

- Bitcoin is on a firmer footing and trading just beneath USD 69k.

APAC TRADE

- APAC stocks traded somewhat cautiously following the losses stateside where the major indices declined as participants digested earnings releases and negative stock-specific updates, while yields also continued to edge higher.

- ASX 200 initially retreated following a further deterioration in manufacturing PMI data but then gradually clawed back opening losses with the recovery spearheaded by resilience in defensives and tech.

- Nikkei 225 traded indecisively as participants reflected on recent currency moves and Japanese PMI data contracted.

- Hang Seng and Shanghai Comp were pressured amid weakness in the tech and property sectors with the latter industry not helped after Moody’s noted that several developers are to feel earnings pain, while macro newsflow remained quiet and a continuation of the firm liquidity efforts by the PBoC also failed to inspire a turnaround.

NOTABLE ASIA-PAC HEADLINES

- Japanese Finance Minister Kato said no comment on FX levels and intervention but noted it is desirable for currencies to move stably reflecting economic fundamentals and is closely watching FX moves with a sense of urgency, while he added that one-sided, rapid FX moves were recently seen in the FX market.

- BoJ Financial System Report: "Japanese banks have sufficient capital bases and stable funding bases to withstand stress similar to the global financial crisis..."

DATA RECAP

- South Korean GDP QQ Advance (Q3) 0.1% vs. Exp. 0.5% (Prev. -0.2%); YY Advance 1.5% vs. Exp. 2.0% (Prev. 2.3%)

- Japanese JibunBK Manufacturing PMI Flash SA (Oct) 49.0 (Prev. 49.7); Services PMI Flash SA (Oct) 49.3 (Prev. 53.1)

- Japanese JibunBK Composite PMI Flash SA (Oct) 49.4 (Prev. 52.0)

- Australian Judo Bank Manufacturing PMI Flash (Oct) 46.6 (Prev. 46.7); Services PMI Flash (Oct) 50.6 (Prev. 50.5)

- Australian Judo Bank Composite PMI Flash (Oct) 49.8 (Prev. 49.6)