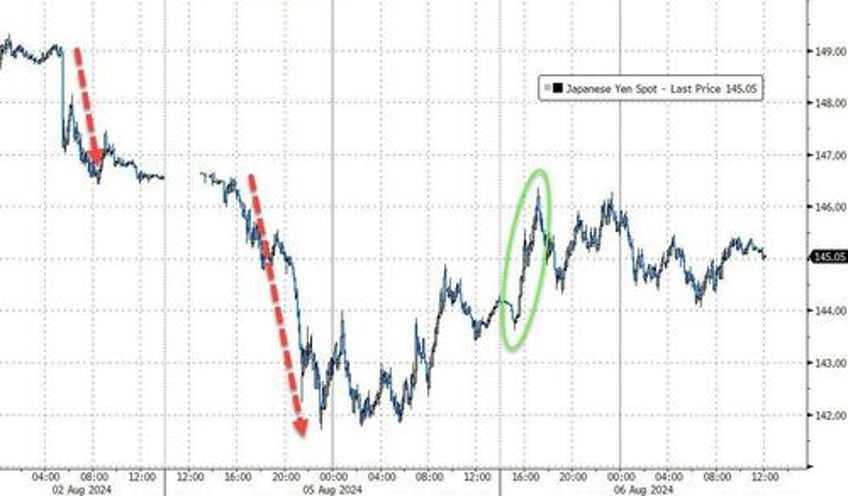

A lack of ongoing collapse in the yen overnight (did BoJ quietly step in?)...

Source: Bloomberg

...and no new macro news to feed the recession narrative, provided just the recipe for a Turnaround Tuesday rally in stocks. Notice that the entire US equity complex moved together (no cycs vs defs or tech vs energy or small vs large diffs) and each time the indices tested back down to unchanged, a mysterious bid magically arrived. As we note below, once the S&P hit its 100DMA, all the majors started selling off, erasing a good chunk of today's gains...

...most notably, the algos lifted the S&P perfectly to its 100DMA... and immediately reversed...

As Bloomberg noted, it’s an old cliché but the phenomenon known as Turnaround Tuesday - when markets rebound from a selloff at the start of the week - is an opportunity that shows up time and again in the data. The bad news is such recoveries don’t guarantee a bottom has been reached.

Investor psychology during a rout tends to begin with jitters on Thursday, hedging on Friday and all-out selling on Monday, according to Brent Donnelly, veteran trader and president of trading analysis firm Spectra Markets.

By Tuesday, the downdraft is primed for a reversal, he wrote in a note published Monday.

“I wouldn’t expect this to be a durable bounce,” said Nick Ferres, chief investment officer at Vantage Point Asset Management in Singapore.

“There is likely to remain volatility into October, November. Any counter trend rally today and persisting for a few weeks would be something to trim risk into.”

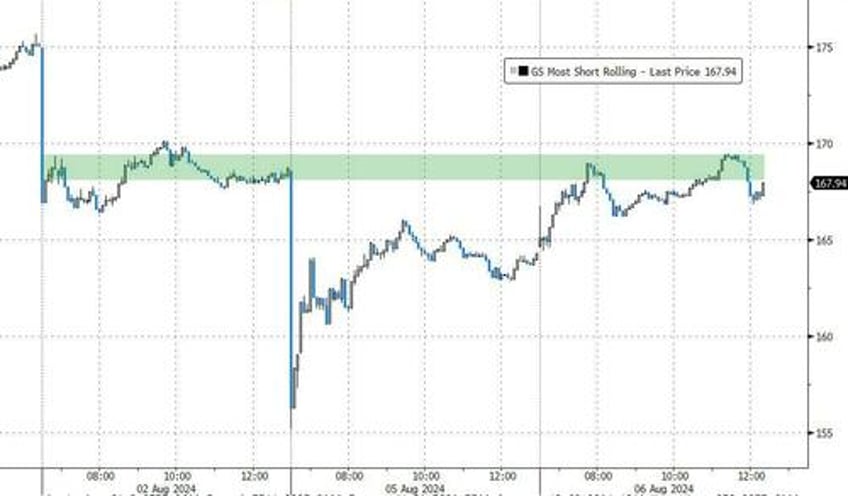

'Most Shorted' stocks squeezed up to a technical resistance level and stalled...

Source: Bloomberg

Mag7 stocks rebounded today but were unable to recover yesterday's losses...

Source: Bloomberg

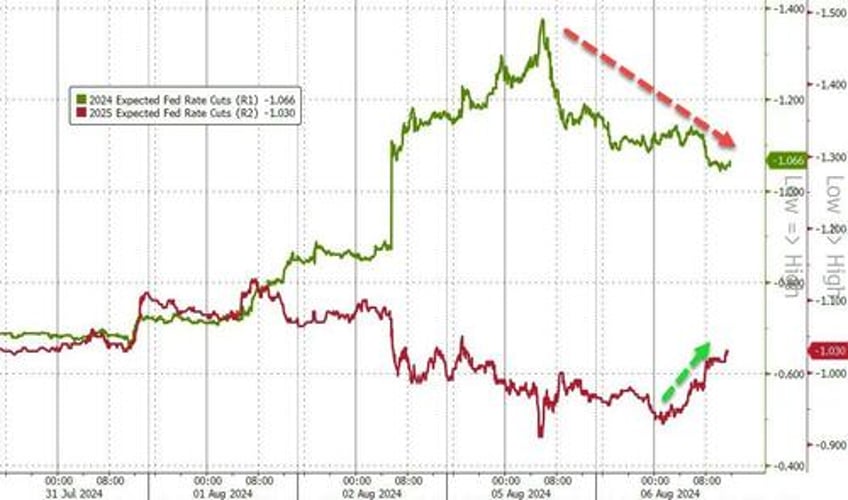

Overall, rate-cut expectations have retraced most of Friday's surge (with 2024 expectations re-shifting back into 2025)...

Source: Bloomberg

For context - pre-payrolls, the market was pricing in 200bps of cuts to the end of 2025. At its peak yesterday, the market priced-in over 230bps of cuts and today that has drifted back to around 210bps.

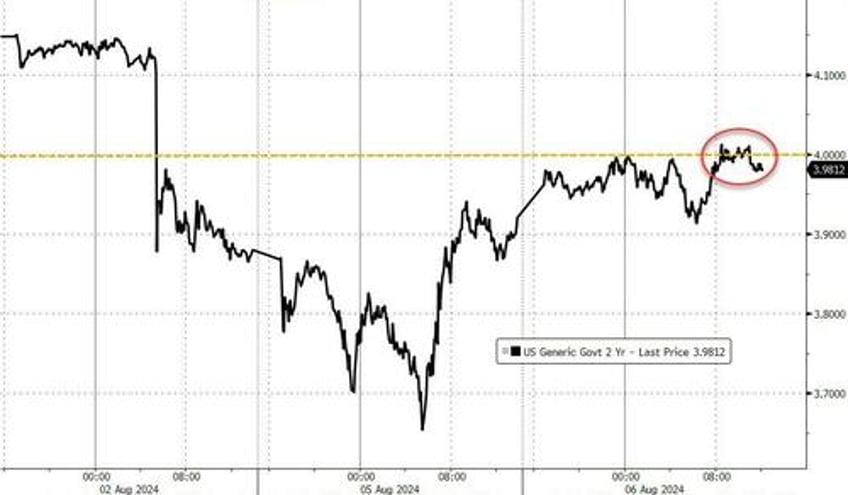

The overall drop in rate-cut expectations pushed Treasury yields higher (with the long-end underperforming - 2Y +6bps, 30Y +10bps today). All yields remain below payrolls plunge highs for now...

Source: Bloomberg

The 2y yield tested up to 4.00% once again...

Source: Bloomberg

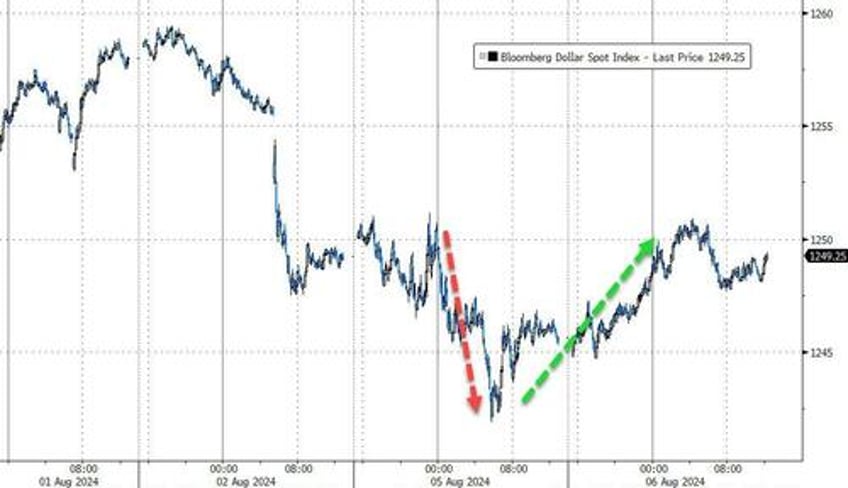

The dollar rallied back and erased yesterday's losses...

Source: Bloomberg

Gold dipped back below $2400...

Source: Bloomberg

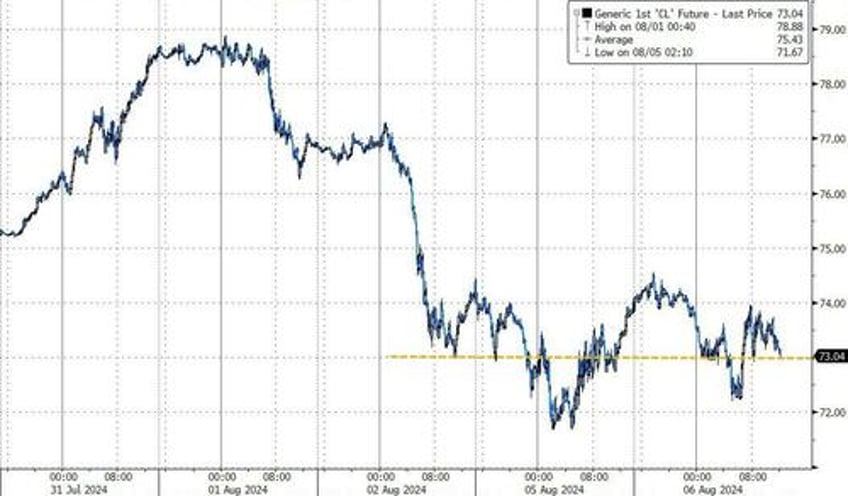

Oil limped very modestly lower today with WTI holding around $73...

Source: Bloomberg

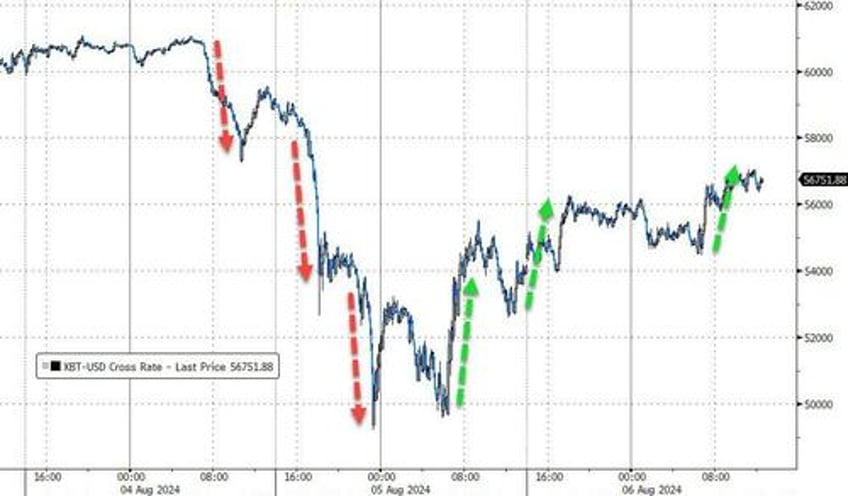

Bitcoin extended its bounce off $50k yesterday, testing $57,000 intraday today...

Source: Bloomberg

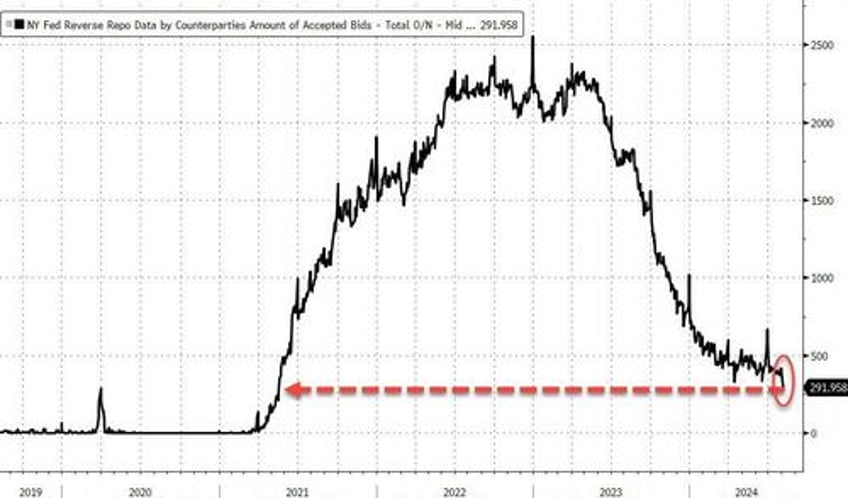

Finally, usage of The Fed's Reverse Repo facility plunged back below the $300BN mark for the first time since May 2021...

Source: Bloomberg

How long before liquidity fears start to reignite?