After the six week UAW strike ended officially yesterday, there's one thing we know for sure: it's going to put upward pressure on the price of vehicles for time to come. The six-week strike concluded on Monday when General Motors secured a provisional labor agreement with the UAW, following similar deals with Ford and Stellantis.

But as the Wall Street Journal pointed out on Monday, the labor costs are going to hamper the automakers for years to come. Ford has already come out and said the new deal will add $850 to $900 per vehicle in additional costs.

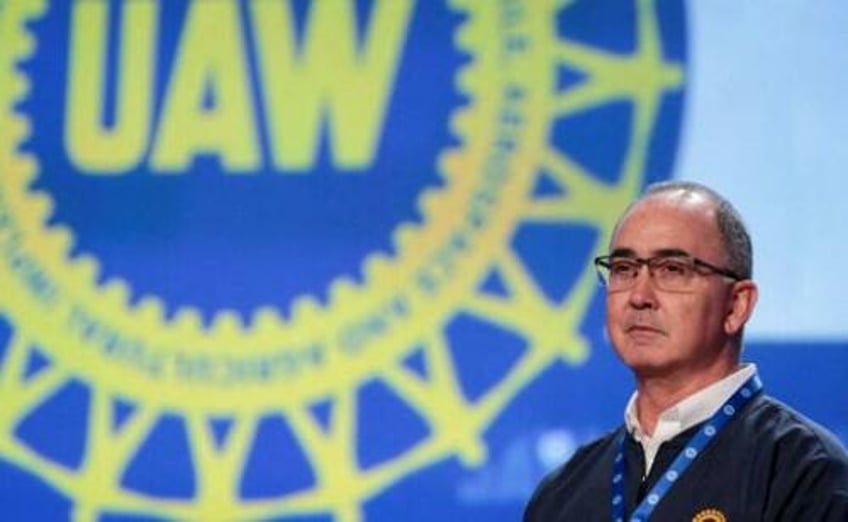

UAW President Shawn Fain, apparently unable to grasp the concept that if the automakers go bankrupt there's a chance no one will have jobs, proudly proclaimed on Monday: “We wholeheartedly believe that our strike squeezed every last dime out of General Motors.”

He added: “When we return to the bargaining table in 2028, it won’t just be with the Big Three, but with the Big Five or Big Six.”

The Journal noted that by the contract's 2028 expiration, most union workers at Detroit automakers would earn mid-$80,000s annually, excluding overtime. Initially resistant, companies eventually agreed to reinstate cost-of-living adjustments, relinquished by the UAW in 2009.

The union also secured several key victories, including the right to strike over plant closures, better pay for temp workers, and a shorter path to max wages. Additionally, the UAW won the reopening of a previously idled Illinois factory.

Auto executives entered these negotiations aware that they'd have to be more generous than in years past, given the tight labor market, inflation, and the UAW's invigorated bargaining power.

Union leaders capitalized on this momentum to achieve significant contract improvements, positioning the union for further gains, including attempts to unionize non-union U.S. auto plants like those of Tesla, Toyota, and Volkswagen.

Ford's CFO said: “We have work to do. We have to identify efficiencies. We have to increase productivity. It is a record contract.”

Pending votes in the upcoming weeks will determine the fate of preliminary deals that feature a 25% wage hike over a four-year period. Alongside cost-of-living adjustments, this would elevate the highest hourly wage for manufacturing employees to roughly $42.

The recent tentative agreements with UAW would mark the most lucrative contracts for auto workers since the 1960s, surpassing total wage increases from the last 22 years, the article notes. GM CEO Mary Barra said the deal would allow continued investment and job creation.

However, GM and Ford stock have declined, reflecting concerns beyond labor issues, like Ford's missed Q3 earnings and GM's autonomous driving setbacks.

Finally, both companies were also forced to scale back their electric vehicle (EV) investment plans, citing less-than-expected market demand and the need to re-engineer tech to cut costs.

Regulatory pressures still make abandoning electric transition plans untenable. Meanwhile, Tesla and Chinese automakers continue to gain ground. Industry analysts see clouds forming over traditional automakers, including the potential for profit margins to erode as consumer willingness to spend may decline.

In other words, the effects of higher labor costs have already hampered the companies' stocks and slowed EV adoption, which is obviously counterintuitive to the left's pro-union stance. And it won't be long until this "record contract" the UAW is celebrating eventually winds up being the catalyst for layoffs, we're sure.