The meltdown in bonds, or rather meltup in rates, continued today especially after the red hot JOLTS and ISM prints and today's 10Y auction simply confirmed just how ugly it is getting out there, when the reopening sale of $39BN in 9-year, 10-month notes priced not just ugly but with the highest yield since August 2007!

The auction stopped at a high yield of 4.680%, up a whopping from 44.5bps from 4.2520% last month. And even though this was the highest yield since August 2007...

... the demand was clearly not there, and the auction tailed the When Issued by 0.2bps, the first tail since October.

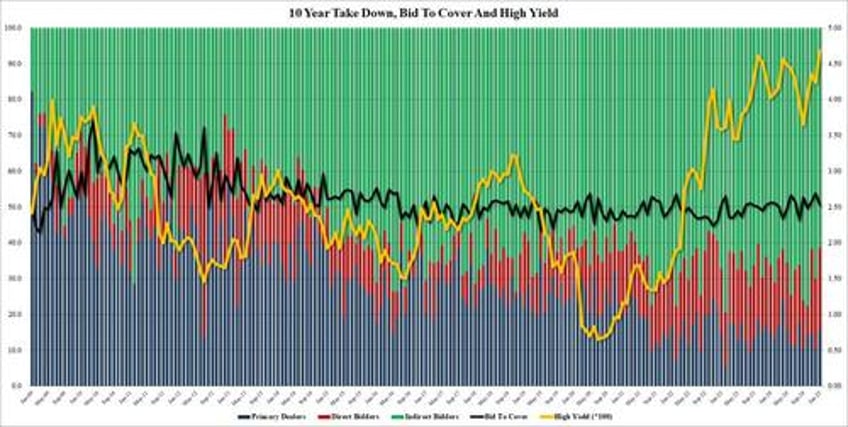

The bid to cover was 2.53, down from 2.70 in December, and the lowest since October.

The internals were also ugly, with Indirects sliding to 61.39% from 70.0%; this was the lowest foreign award since October 2023. And with Directs taking 22.97%, or the highest since November, Dealers were left holding 15.6%, the highest since August, and an ominous warning that the time for the Fed to restart "taking" bonds from Dealers is almost upon us.

Overall, this tailing auction of benchmark paper was ugly, even if the market response to the results was somewhat muted, but that's only because the 10Y is now trading at 4.70%, the highest since April 2024, and only in October 2023 were yields even higher. Of course, back then the yield surge promptly led to a 1% tumble in rates amid fears of a sharp economic slowdown. This time, however, there is virtually no weakness in the data (at least until Trump goes into the White House), and it is quite possible that yields may rise substantially more before they inevitably drop.