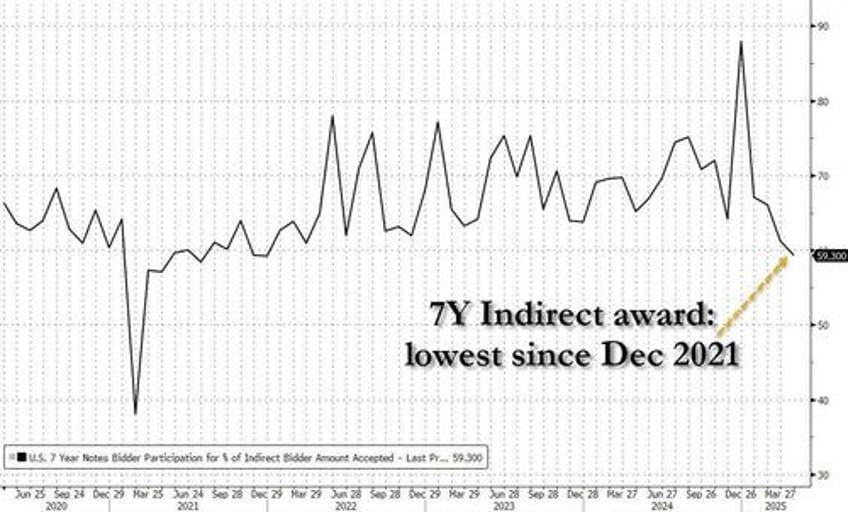

The week's last coupon auction is in the books, and perhaps because people are just tired of dealing with the non stop headline ping pong, it was also the ugliest.

The sale of $44BN in 7Y paper priced at a high yield of 4.123%, down 11bps from March and tailing the When Issued 4.121% by 0.2bps; this was the second straight tail and follows 6 consecutive stop throughs.

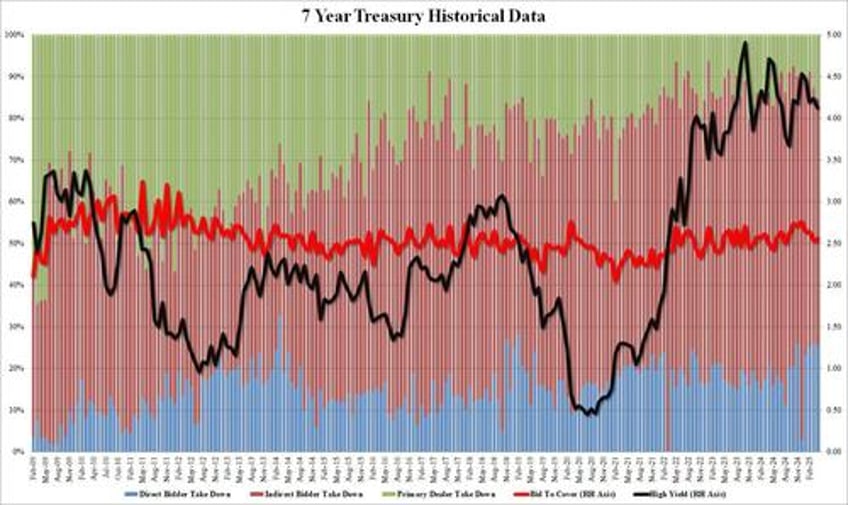

The bid to cover was largely unchanged from last month, printing at 2.55, up from 2.53 in March but below the six-auction average of 2.67.

But it was the internals where once again all the action was: While Directs were a high 25.44%, but not abnormally high, and in fact the number was down from 26.1% last month, it was once again Indirects that was the weakest link: foreign buyers took down just 59.3% of the full allotment, down from 61.2% in March and the lowest since December 2021. Dealers were left holding 15.3%, which actually was the highest going back all the way to May 2024.

Overall, this was a rather weak auction, not just the tail but more ominously, the continued decline in foreign demand. The flip side, of course, is that if Indirects really collapse the Fed will have no choice but to step in and start monetizing coupons. All it will need is an excuse, and at a time when Powell is feuding with Trump why the Fed should not step in, the outcome will likely be quite hilarious.