- APAC stocks were ultimately mixed amid cautiousness as braced for a slew of global central bank rhetoric including Fed Chair Powell's speech at the Jackson Hole Symposium.

- Fed's Collins (2025 voter) said the timing seems appropriate to begin easing monetary policy and policy is well-positioned, while she wants a gradual approach to interest rate cuts.

- USD/JPY retreated beneath the 146.00 level and saw further downside alongside comments from BoJ Governor Ueda at a parliamentary grilling.

- Israel's Channel 13 reported that the Israeli army is preparing for a response from Hezbollah next week if the talks on Gaza collapse.

- European equity futures indicate a flat open with Euro Stoxx 50 futures unchanged after the cash market finished flat on Thursday.

- Looking ahead, highlights include ECB SCE, Canadian Retail Sales, Jackson Hole Symposium, Speeches from Fed Chair Powell, Fed's Goolsbee & BoE’s Bailey.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were lower and Treasury yields were firmer as participants awaited Fed Chair Powell's speech at Jackson Hole on Friday, while US data releases were mixed but continued to alleviate fears surrounding the labour market and economic growth concerns as initial jobless claims, for the week that coincides with the payrolls report, ticked marginally higher above expected but nowhere near enough to stoke fears around the labour market. Furthermore, US S&P Global Flash PMIs were varied as Manufacturing disappointed but Services and Composite topped forecasts, while there was a slew of Fed commentary from Schmid, Collins & Harker in which the latter two both gave a nod to a September rate cut but Schmid said he still needs to see more data before supporting a reduction.

- SPX -0.89% at 5,571, NDX -1.68% at 19,492 DJIA -0.43% at 40,713, RUT -0.95% at 2,150.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Collins (2025 voter) said timing seems appropriate to begin easing monetary policy and policy is well-positioned, while she wants a gradual, methodical approach to interest rate cuts and noted there is a clear path to achieving Fed's goals without an unneeded downturn.

APAC TRADE

EQUITIES

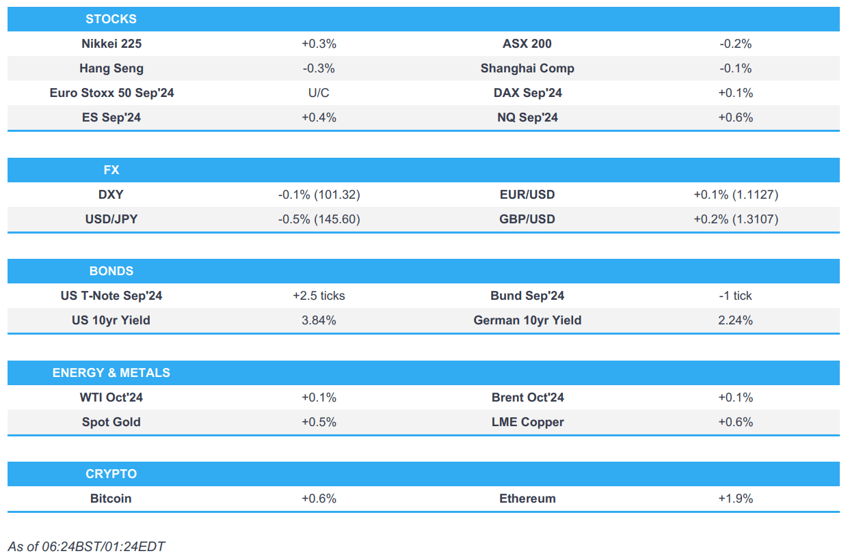

- APAC stocks were ultimately mixed amid cautiousness as braced for a slew of global central bank rhetoric including Fed Chair Powell's speech at the Jackson Hole Symposium.

- ASX 200 was restricted amid notable weakness across the commodity-related sectors.

- Nikkei 225 swung between gains and losses after Japanese CPI printed mostly in line with expectations, while there was also a slew of commentary from BoJ Governor Ueda who stood by last month's BoJ rate hike.

- Hang Seng and Shanghai Comp. initially diverged with the former pressured by underperformance in NetEase and Baidu due to earnings disappointment, while the mainland was indecisive amid very few fresh catalysts.

- US equity futures found some slight reprieve following yesterday's selling pressure but with price action limited ahead of the looming key event.

- European equity futures indicate a flat open with Euro Stoxx 50 futures unchanged after the cash market finished flat on Thursday.

FX

- DXY traded rangebound after recently snapping a 4-day losing streak with the help of the latest data releases from the US including PMIs and Jobless Claims which were mixed but ultimately quelled economic hard landing and labour market concerns, while the attention remained on Fed Chair Powell's upcoming speech at Jackson Hole.

- EUR/USD mildly rebounded after finding support again at the 1.1100 level.

- GBP/USD just about reclaimed the 1.3100 status amid light catalysts and with BoE Governor Bailey also scheduled to speak at the Fed's symposium in Wyoming.

- USD/JPY retreated beneath the 146.00 level and saw further downside alongside comments from BoJ Governor Ueda at a parliamentary grilling where he said there was no change to their stance that they would adjust the degree of monetary easing if the price outlook is likely to be achieved. Furthermore, Japanese headline National CPI topped forecasts while the core metrics printed in-line.

- Antipodeans were kept afloat but with price action rangebound owing to the mixed risk appetite.

- PBoC set USD/CNY mid-point at 7.1358 vs exp. 7.1480 (prev. 7.1228).

FIXED INCOME

- 10-year UST futures retraced some of the prior day's declines as all focus turned to Jackson Hole.

- Bund futures attempted to nurse losses after bouncing off support near the 134.00 level.

- 10-year JGB futures tracked the recent declines in global counterparts with prices not helped by recent comments from BoJ Governor Ueda and mostly in-line Japanese CPI data.

COMMODITIES

- Crude futures were uneventful after recouping some of the recent losses amid light energy-specific catalysts.

- Yemen's Houthis said they targeted the Sounion oil tanker in the Red Sea.

- Spot gold mildly rebounded from this week's worst levels but remains beneath the USD 2,500/oz level.

- Copper futures recovered from yesterday's lows but with the upside limited amid the cautious risk tone.

- China's Industry Ministry revised steel production capacity replacement measures and stated that from today, all regions will suspend announcements of new steel production capacity replacement plans.

CRYPTO

- Bitcoin saw two-way price action and partially faded its early advances.

NOTABLE ASIA-PAC HEADLINES

- BoJ Governor Ueda said concerns about a slowing US economy caused the recent market rout and they closely watching market moves with a sense of urgency as uncertainties remain, while there is no change to the stance that they would adjust the degree of monetary easing if the price outlook is likely to be achieved. Ueda said the July rate hike decision was based on their inflation forecast and the risk of inflation overshoot, as well as stated that the BoJ's policy path to a neutral interest rate remains highly uncertain but noted that Japan's short-term interest rate is still very low so if the economy performs well, the BoJ will adjust rates to levels deemed neutral to the economy. Ueda said they may conduct operations nimbly if there's a sharp rise in long-term yields.

- Japanese Finance Minister Suzuki said there is a potential risk of Japan's financial health deterioration from a rate hike as government debt is high and they cannot rule out the possibility of Japan's economy falling back into deflation. Furthermore, Suzuki said a weak yen has merits and demerits, while he cannot tell if a strong yen has bigger merits or demerits. Suzuki added the FX intervention in July was effective and intervention was conducted to respond to speculative moves and excessive volatility.

- Tenders showed that state-linked Chinese entities use Amazon's (AMZN) Cloud unit to access restricted AI chips and models including Nvidia (NVDA) chips banned from export to China, according to Reuters.

DATA RECAP

- Japanese National CPI YY (Jul) 2.8% vs. Exp. 2.7% (Prev. 2.8%)

- Japanese National CPI Ex. Fresh Food YY (Jul) 2.7% vs. Exp. 2.7% (Prev. 2.6%)

- Japanese National CPI Ex. Fresh Food & Energy YY (Jul) 1.9% vs. Exp. 1.9% (Prev. 2.2%)

- New Zealand Retail Sales Volumes QQ (Q2) -1.2% (Prev. 0.5%)

- New Zealand Retail Sales YY (Q2) -3.6% (Prev. -2.4%)

GEOPOLITICAL

MIDDLE EAST

- Israeli, Egyptian and US officials reportedly held talks in Cairo on Thursday evening to try to come to an agreement on how to secure the Egypt-Gaza border and reopen the Rafah crossing, according to Axios.

- Israel's Channel 13 reported that the Israeli army is preparing for a response from Hezbollah next week if the talks on Gaza collapse.

- EU foreign policy chief Borrell said he discussed with the Iranian Foreign Minister the cessation of military cooperation with Russia and defusing regional tensions, according to Al Jazeera.

OTHER

- Ukraine’s Air Force said it used a US-made GBU-39 bomb to strike a Russian military target in Russia's Kursk region.

- NATO air base in the German town of Geilenkirchen has raised its security level based on intelligence information indicating a potential threat, according to Reuters.

- China's Foreign Ministry said in China-Belarus joint communique that both sides support the peaceful settlement of conflicts, constructive bilateral dialogue among countries, and international cooperation based on mutual benefit and mutual respect.

EU/UK

DATA RECAP

- ECB's Kazaks said EZ inflation is consistent with further gradual ECB rate cuts; assume two more rate cuts this year and there is no reason now not to follow through, according to Reuters.

- UK GfK Consumer Confidence (Aug) -13.0 vs. Exp. -12.0 (Prev. -13.0)