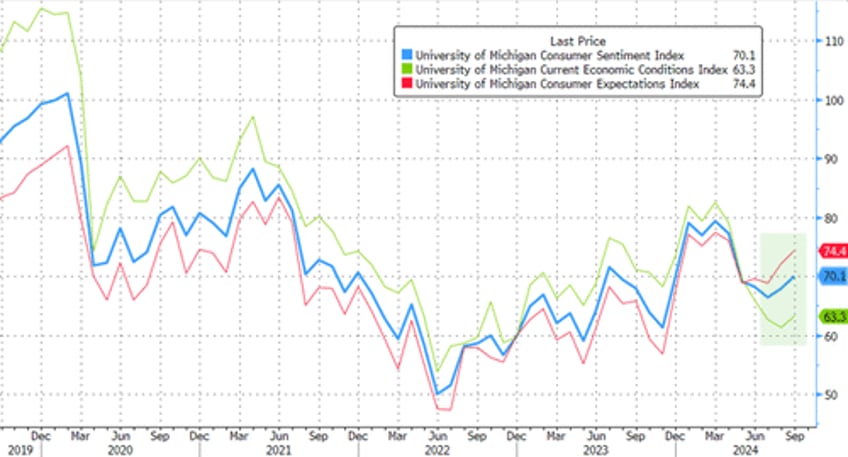

The headline UMich consumer sentiment index rose in September with both 'current conditions' and 'expectations' picking up...

Source: Bloomberg

This increase was seen across all education groups and political affiliations.

Furthermore, all five index components gained, led by a 6% surge in one-year business expectations. The expectations index is now 13% above a year ago and reflects greater optimism across a broad swath of the population.

Buying Conditions improved across the board in September...

Source: Bloomberg

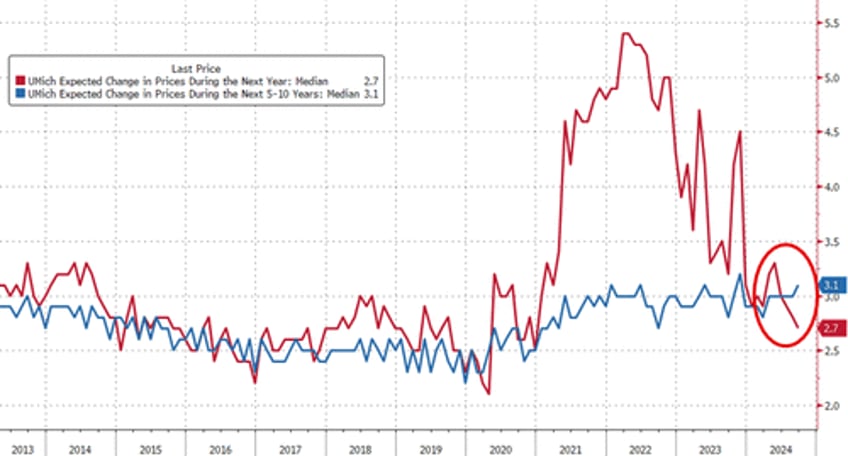

And short-term inflation expectations tumbled to the lowest since Dec 2020 (as medium-term inflation expectations picked up)...

Source: Bloomberg

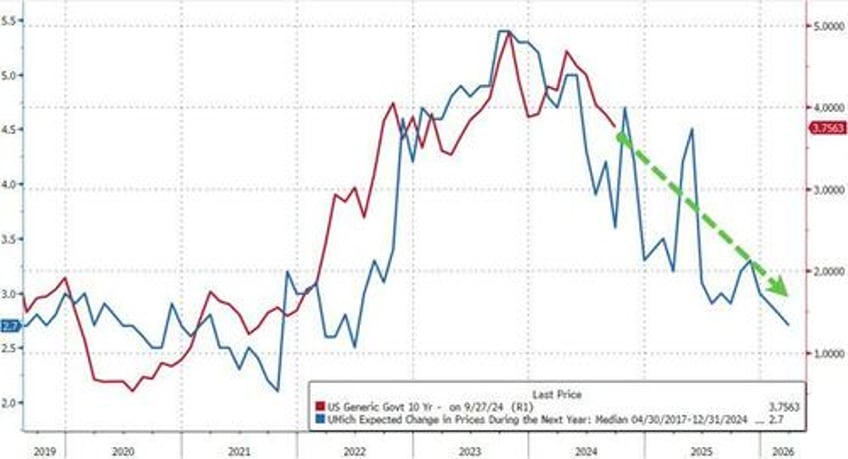

Finally, if inflation expectations are to be believed, 10Y Treasury yields are set to drop dramatically from here...

Source: Bloomberg

Which is interesting since in the same survey, the number of respondents who see interest rates higher in the next year reached a record high...

Source: Bloomberg

UMich reports that sentiment appears to be building some momentum as consumers’ expectations for the economy brighten.

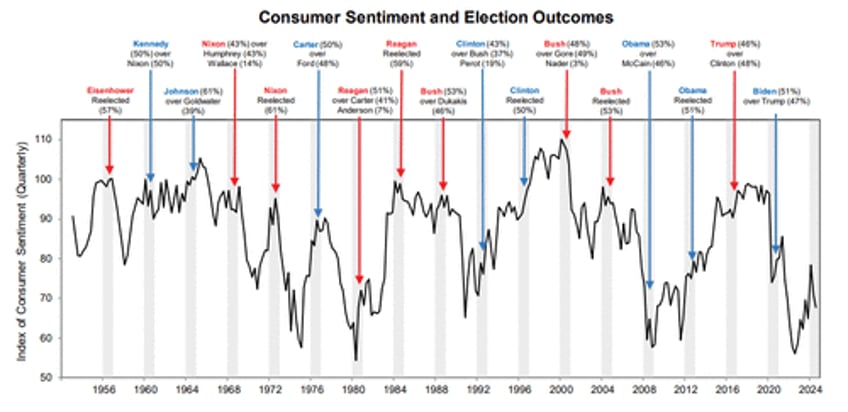

At the same time, many consumers continue to report that their expectations hinge on the results of the upcoming election.

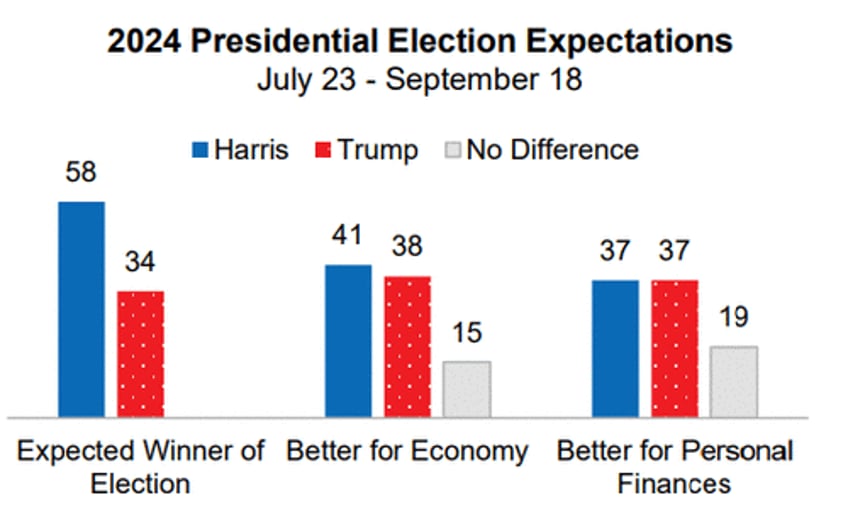

Relative to August, consumers across political parties are increasingly expecting a Harris presidency, though about two-thirds of Republicans still expect Trump to win.

So, to summarize the confusion - we are about to see a resurgence in 'buying'... which will apparently 'help lower inflation'? ...and we are sure that 51 nobel laureate economists will back this 'economic' framework.