Shares of United Parcel Service Inc. slumped Tuesday after the delivery company reported second-quarter earnings that showed package volume impacts from labor negotiations with its 340,000 unionized workers.

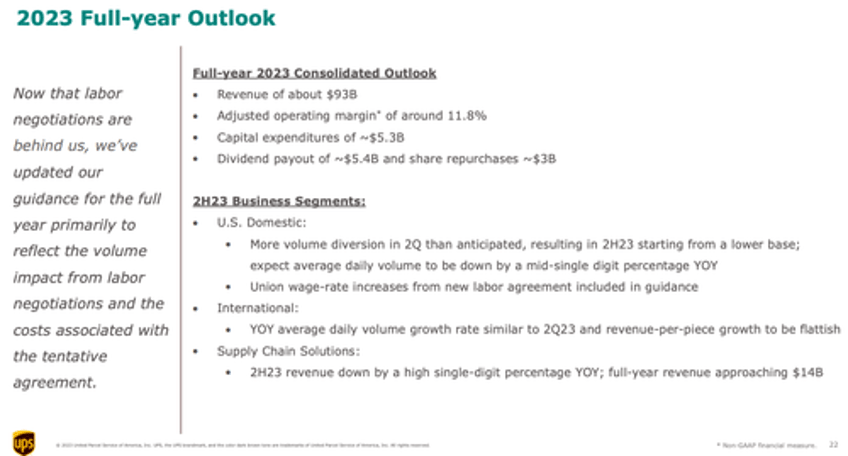

"UPS is updating its full-year 2023 consolidated revenue and adjusted operating margin targets primarily to reflect the volume impact from labor negotiations and the costs associated with the tentative agreement reached with the International Brotherhood of Teamsters on July 25, 2023," the company wrote in a press release.

The press release continued, "UPS now expects full-year 2023 consolidated revenue to be about $93 billion and an adjusted operating margin of around 11.8%."

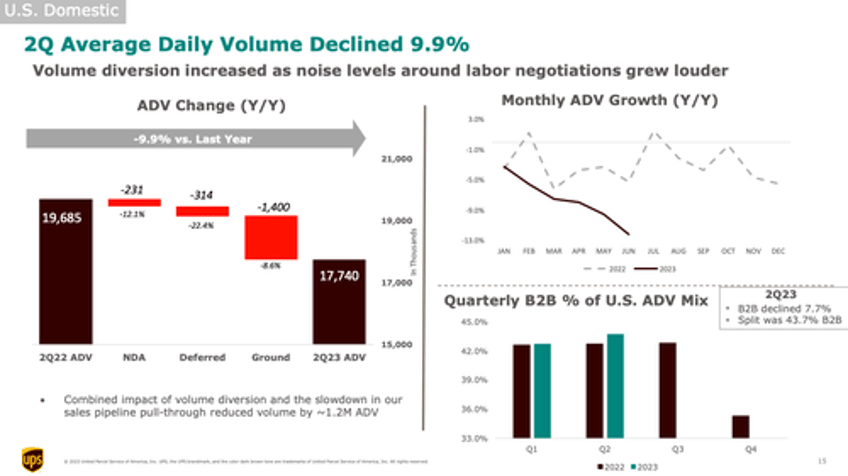

Domestic revenue declined 6.9% over the quarter as average daily package volume plunged 9.9%. However, the drop was offset by a 3.3% increase in revenue per package.

Here are the highlights from the second quarter:

Adjusted EPS $2.54 vs. $3.29 y/y, estimate $2.50

EPS $2.42 vs. $3.25 y/y

Revenue $22.06 billion, -11% y/y, estimate $23 billion

US package revenue $14.40 billion, -6.9% y/y, estimate $14.81 billion

International package revenue $4.42 billion, -13% y/y, estimate $4.68 billion

Supply Chain Solutions revenue $3.24 billion, -23% y/y, estimate $3.51 billion

Average revenue per package $13.92, +1.5% y/y, estimate $14.04

Total operating expenses $19.28 billion, estimate $20.28 billion

And here's the yearly outlook:

Sees revenue about $93 billion, saw about $97 billion, estimate $96.63 billion (Bloomberg Consensus)

Still sees capital expenditure about $5.3 billion, estimate $5.29 billion

More on the full-year outlook from the earnings presentation:

During a conference call, Chief Executive Officer Carol Tomé told analysts that labor negotiations impacted package volume. She explained:

"We expected negotiations with the Teamsters to be late and loud and they were. As the noise level increased throughout the second quarter, we experienced more volume diversion than we anticipated."

Last month, UPS reached a tentative deal with the International Brotherhood of Teamsters, averting a disastrous strike that would've wreaked havoc on America's domestic supply chains.

Voting on the new contract with union members begins on Aug. 3 and ends on Aug. 22.

Here's Wall Street's response on the earnings report (list courtesy of Bloomberg):

JPMorgan, Brian Ossenbeck (neutral):

Says expectations were increasingly negative coming into the event but it appears the Teamsters negotiation was more disruptive than management expected given the implied impact on volume and operating costs

Says FDX should react favorably to the commentary on lost volumes

BMO, Fadi Chamoun (market perform, PT $180):

Says 2Q results were above consensus on an EBIT basis, with strong pricing more than offsetting weaker volumes/revenues, underscoring continued strong execution by UPS in a tough macro

Notes that 2023 guidance was lowered reflecting impact of the Teamsters' agreement on volumes and costs

Citi, Christian Wetherbee (buy):

While the quarter was better than expected on strong cost control, the outlook was worse

UPS continues to execute very well with cost controls responding quickly to volume weakness

Bloomberg Intelligence, Lee Klaskow:

Says EPS estimates for UPS may need to be lowered due to the additional costs associated with its new labor agreement and lost revenue from shippers diverting volume away from the carrier as the risk of a strike increased in 2Q

Here is UPS' full earnings report: