The last few months have been volatile - to say the least - for US durable goods orders, with preliminary January data showing an enormous 6.1% MoM plunge in the headline (worse than the already bad 5% decline expected). That is the weakest MoM print since the middle of the COVID lockdowns in April 2020, dragging year-over-year orders growth down to -0.8% - the lowest and first annual contraction since August 2020...

Source: Bloomberg

Excluding transportation equipment, orders fell 0.3%.

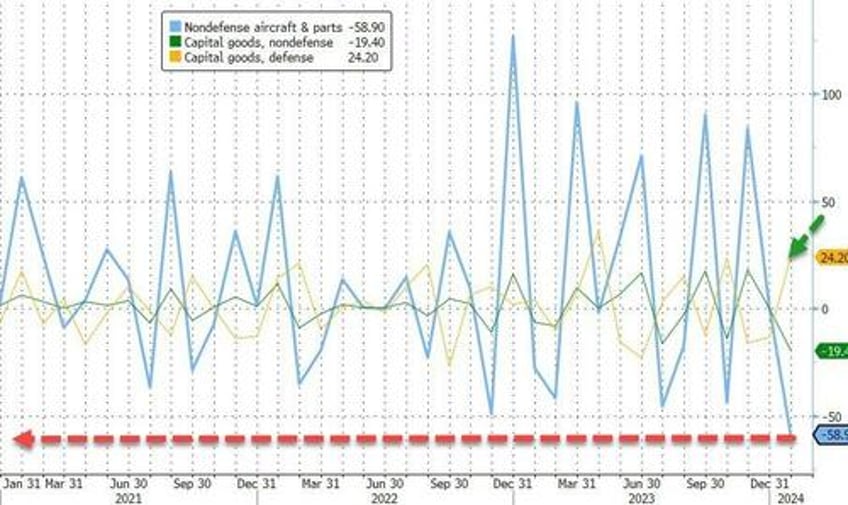

It appears Boeing's doors-flying-off-our-planes issue had some impact as non-defense aircraft orders crashed 58.5% MoM (the worst since 2019 (Max...). But the numbers were helped by war spending being up 24.2% MoM...

Source: Bloomberg

Boeing reported only three orders in January, the fewest in more than three years after a near-catastrophic accident early in the month led regulators to ground some of its planes.

On the bright side, core capital goods shipments, a figure that is used to help calculate equipment investment in the government’s gross domestic product report, bounced back from contraction in December...

Source: Bloomberg

So as goes Boeing, so goes the manufacturing economy... and as goes NVDA, so goes the stock market? Fuck yeah 'Murica!