The headline US durable goods new orders print for preliminary June data was a disaster - plunging 6.6% MoM (vs expectations of 0.3% MoM rise!). That dragged goods orders down

Source: Bloomberg

However, through the rose-colored glasses of everything's still awesome, core durable goods orders surprised to the upside (+0.5% MoM vs +0.1% exp, rebounding from May's 0.1% MoM decline)...

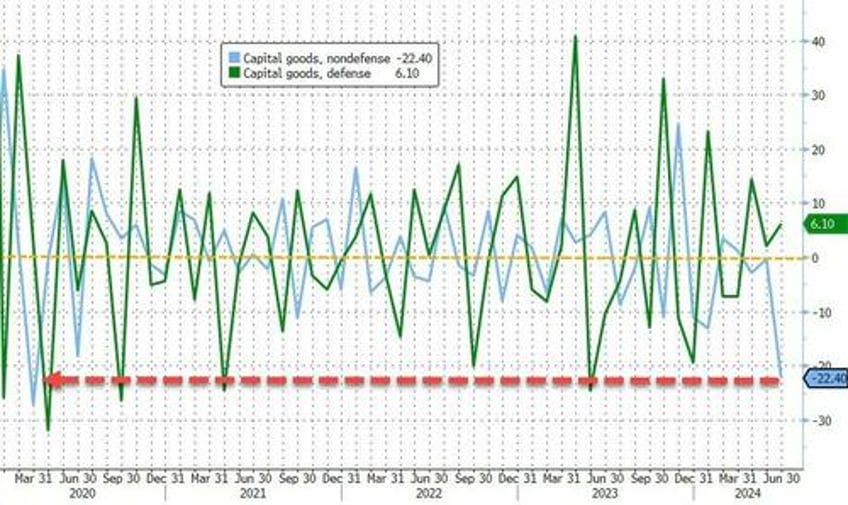

While war spending rose, non-defense spending is plunging...

Source: Bloomberg

Doesn't seem like it's supporting the big AI Capex boom narrative too much?