A supply chain storm is brewing for major US East and Gulf Coast ports, with the International Longshoremen's Association threatening to strike on Oct. 1. This could disrupt nearly half of all US imports while Boeing strikes paralyze commercial jet plants and rising concerns about United Auto Workers hitting Stellantis with a labor action.

D-Day is just one week away, and 45,000 workers are set to walk off major container ports along the East Coast. This would be the first work stoppage at these ports since 1977.

Late last week, the CEO of Flexport - one of the largest US supply-chain logistics operators - warned, "The biggest wild card in the presidential election that nobody's talking about? The looming port strike that could shut down all East and Gulf Coast ports just 36 days before the election."

At this point, a strike seems almost inevitable when the labor contract expires next Tuesday. ILA has demanded a massive 77% wage increase over six years, making the West Coast Workers' demand of 32% seem insignificant.

"Talks are not going well. In fact, they're not going at all. As of late last week, the union and the United States Maritime Alliance, the group that represents East Coast port companies, weren't even meeting at the bargaining table," Bloomberg Ian Kullgren and Chris Marr noted on Monday, adding, "ILA rejected the port operators' wage offer, saying in a Sept. 17 statement that the employers had "taken advantage of low-entry wage and a tiered progression system for thirty years."

If the work stoppage materializes next week, significant supply chain snarls could erupt across New Jersey, Baltimore, Virginia, Georgia, and Texas container ports.

"Even a two-week strike could disrupt supply chains until 2025," Grace Zwemmer, associate US economist with Oxford, warned in a new report.

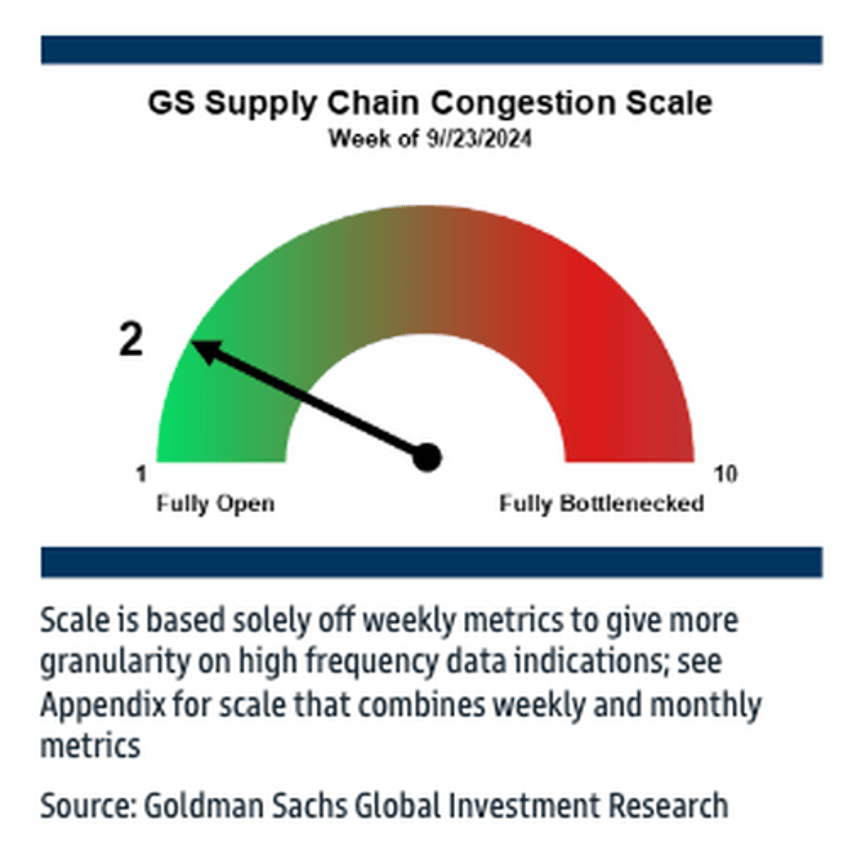

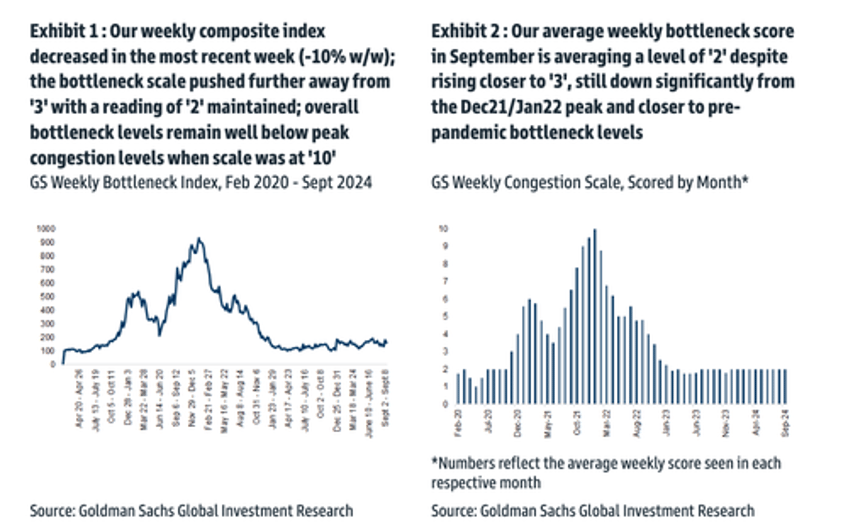

Goldman's Jordan Alliger and Andrzej Tomczyk provided clients at the start of this week with the understanding US congestion at ports is only 2 out of 10 ahead of potential strikes next week.

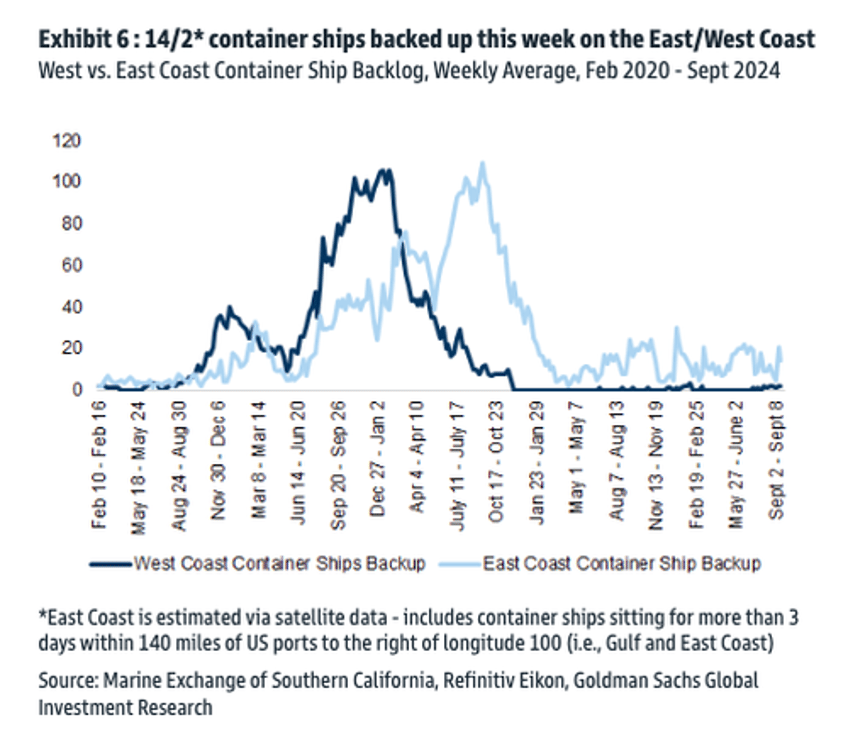

"While the ongoing potential for East/Gulf Coast port strikes looms and presents supply chain related uncertainty/risk (ILA longshoreman contract expiration coming up at the end of September), we generally think that today's more fluid supply chain environment puts retailers/shippers in a relatively safer place versus the 2022's West Coast longshore contract negotiating environment (at least from a backlog throughput/rebound efficiency perspective), when congestion was near all-time highs and consumer goods' demand was still above normal versus services demand (versus today's more balanced consumer demand environment)," the analysts wrote.

Current container ship backlogs at East and West Coast ports are much lower than at the start of Covid supply chain snarls a couple of years ago. This may indicate that if any work stoppage occurs, there is excess capacity at other US ports to handle the influx. Plus, this time around, momentum in the economy is trending down. And the feds aren't dumping helicopter money on consumers in the form of 'stimmy' checks.

In a separate note, Peter Sand, a chief shipping analyst at Xeneta, warned any labor action at the ports would have "severe consequences," adding that these container ships are already carrying "billions of dollars of cargo" on the sea heading towards the US and can't just turn around.

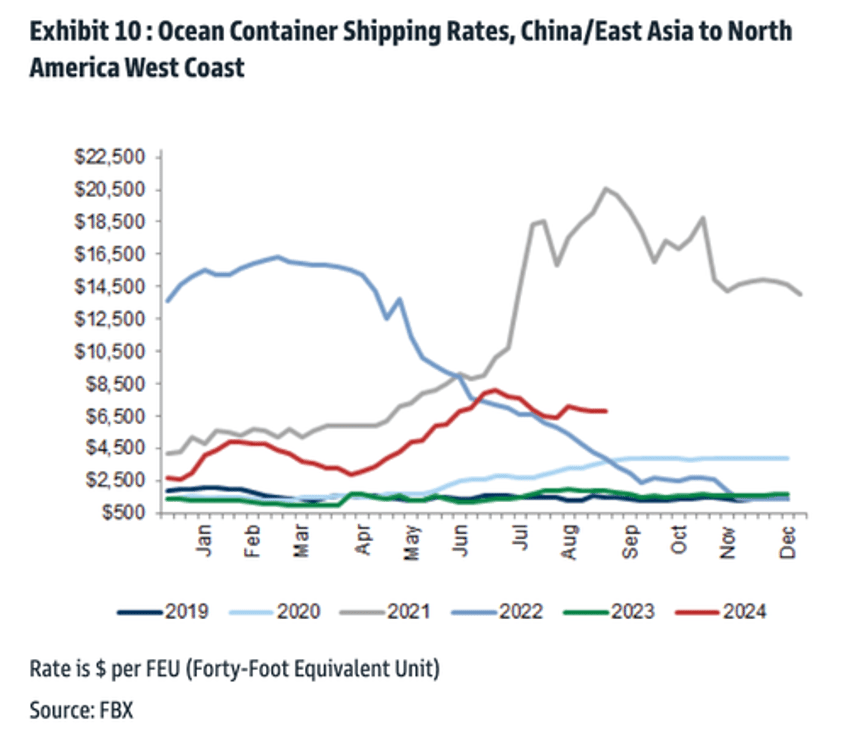

The work stoppage could send container rates even higher. Rates jumped earlier this year due to the Red Sea disruptions.

What a mess this could become next week that would only feed the inflation storm.