- US Senate voted 54-46 to pass the stopgap funding bill to keep the government funded through September 30th.

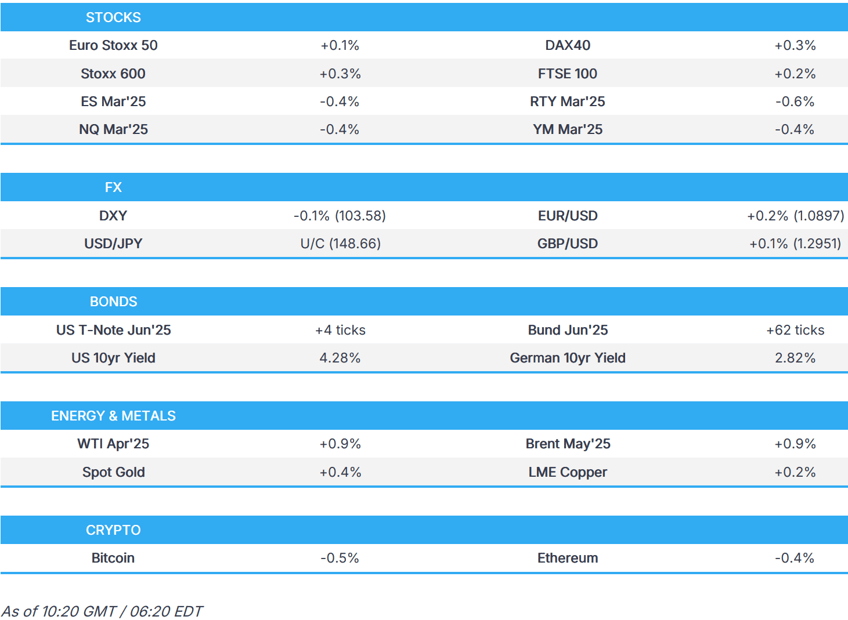

- European bourses modestly firmer whilst US futures are in negative territory.

- USD is a touch softer ahead of a risk-packed week; Antipodeans benefit from Chinese data and as China unveiled a plan to boost weak consumption.

- EGBs bid with OATs leading after Fitch while Bunds await fiscal updates.

- Gas deflates after US President Trump said he will speak with Russia's President Putin on Tuesday and may have something to announce on Ukraine-Russia talks by Tuesday.

- Looking ahead, US Retail Sales & ECB’s Lagarde.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

TARIFFS/TRADE

- US President Trump said he has no intention of creating exemptions on steel and aluminium tariffs, while he added that he will impose reciprocal and sectoral tariffs on April 2nd.

- US Secretary of State Rubio said they will potentially engage in bilateral negotiations with countries on new trade arrangements once tariffs are imposed.

- Canada’s Defence Minister said they are reconsidering F-35 purchases amid tensions with Washington and are having conversations with other fighter jet makers.

- Companies urged in a joint letter to EU Commission President von der Leyen for "Buy European" policies in public procurement.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 +0.3%) opened mixed, and traded indecisively on either side of the unchanged mark; though sentiment gradually picked up as the morning progressed.

- European sectors hold a positive bias, but with the breadth of the market fairly narrow. Energy takes the top spot, lifted by underlying strength in oil prices; the complex is buoyed by heightened geopolitical tensions after the US struck Houthi targets. On that, the militant group said it would continue naval operations until the Gaza blockade is lifted and aid is let in. Basic Resources benefits from the risk tone, and after constructive Chinese activity data overnight, with particular focus on the stronger-than-expected Industrial Production data.

- US equity futures (ES -0.4%, NQ -0.4%, RTY -0.6%) are lower across the board, with slight underperformance in the RTY, giving back some of the significant strength seen on Wall Street on Friday.

- Intel's (INTC) new CEO plans to overhaul the chip design and manufacturing business, plans to restart AI efforts and produce chips at annual cadence as it looks at further cuts, Reuters reports.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD net softer vs. peers in what has been a weekend lacking in incremental newsflow on the trade front aside from Trump reiterating that he has no intention of creating exemptions on steel and aluminum tariffs, adding that he will impose reciprocal and sectoral tariffs on April 2nd. Focus is also on the US government averting a shutdown. DXY is currently tucked within Friday's 103.57-104.09 range, ahead of US Retail Sales.

- EUR is steady vs. the USD and tucked within Friday's 1.0830-1.0912 range. Incremental macro drivers over the weekend for the EZ are lacking and therefore markets are bracing for the outcome of tomorrow's vote in the Bundestag on the German reform package. ECB's de Guindos remarked that he believes inflation is converging on 2% and everything is going in the "right direction". However, this provided little traction for the EUR.

- GBP is a little firmer and trades within a 1.2926-58 range, in what has been a catalyst-thin session thus far, but has focus remains on Thursday's BoE meeting.

- JPY is a little lower and the marginal G10 underperformer today, partly thanks to slightly positive risk tone following constructive Chinese data which has lifted Antipodeans and European stocks. USD/JPY currently towards the mid-point of a 148.47-149.09 range.

- Antipodeans continue to extend on the upside on Friday, with gains today facilitated by the constructive Chinese activity data and after China unveiled a special action plan to boost consumption.

- PBoC set USD/CNY mid-point at 7.1688 vs exp. 7.2199 (Prev. 7.1738)

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- EGBs bid with OATs outperforming after Fitch left France's rating alone on Friday. More broadly, benchmarks bid with yields weighed on by pressure in European gas benchmarks ahead of the Putin-Trump call. Action which has lifted OATs by over 70 ticks at best with Bunds not far behind.

- Bunds also potentially acknowledge further complaints lodged with the Constitutional Court ahead of Tuesday's Bundestag vote on fiscal reform, reform which Merz believes will pass though he acknowledges it will be close; firmer by over 50 ticks and just shy of the 128.00 mark.

- USTs await US Retail Sales before the latest update to Atlanta Fed's GDPnow tracker which is currently running at -2.4% though the gold-adjusted figure is -0.4%. Firmer by a handful of ticks but essentially contained with yields mixed and the curve flatter.

- Gilts are following EGBs but magnitudes are much less pronounced. UK specifics light once again but the clock counts down to next week's OBR update and before that a welfare reform announcement.

- Click for a detailed summary

COMMODITIES

- Crude is on a stronger footing today, with gains attributed to heightened geopolitical tensions after the US struck Houthi targets. Further for the region, the militant group said it would continue naval operations until the Gaza blockade is lifted and aid is let in. Brent'May currently sits at the upper end of a USD 70.68-71.80/bbl range.

- European gas is lower, after optimistic updates from Trump over the weekend, where he said he would speak to Russian President Putin on Tuesday.

- Precious metals are mixed, with spot gold firmer by around USD 7/oz, whilst silver is a little lower. The yellow-metal has slipped below the USD 3,000/oz mark, to currently trade at the upper end of USD 2,982.36-2,994.12/oz range; upside today has been facilitated by the aforementioned heightened geopolitical tensions.

- Base metals are mixed, with the complex failing to materially benefit from the constructive Chinese activity data overnight, where Industrial Production printed above expectations but with Urban unemployment and House Prices remaining at subdued levels. 3M LME Copper is a little firmer today and trades within a USD 9,776.45-9,845.35/t range. Elsewhere, Trump reiterated his firm stance on tariffs, stating there would be no exemptions on steel and aluminium duties and confirming reciprocal and sectoral tariffs will be imposed on April 2nd.

- Iraq agreed to double electricity imports from Turkey.

- India's February Gold imports at USD 2.3bln; February oil imports at USD 11.8bln

- Click for a detailed summary

NOTABLE DATA RECAP

- UK Rightmove House Prices MM (Mar) 1.1% (Prev. 0.5%); YY (Mar) 1.0% (Prev. 1.4%)

NOTABLE EUROPEAN HEADLINES

- ECB's de Guindos says that the administration of US President Trump has increased economic uncertainty due to tariff deregulation. Trade was is bad for the global economy. Effect of tariffs on inflation may be compensated by lower economic activity. Believes inflation is converging on 2% and everything is going in the "right direction". Increased uncertainty has made the current situation more opaque compared to six months ago. Spain will need to spend 2.7% GDP on Defence in four years and raise its budget by EUR 6bln per year. Seeing a decrease in services inflation due to evolution of wages, should lead overall inflation to the 2% target.

- UK Chancellor Reeves is to pledge to change the law to restrict merger investigations by the Competition and Markets Authority, according to FT.

- Britain’s largest regulators will be given performance reviews by ministers and set targets for cutting red tape and growing the economy, according to The Times.

- Moody’s raised Greece’s sovereign rating from Ba1 to Baa3; Outlook revised to Stable from Positive and affirmed Spain at A; Outlook Stable. It was also reported that Fitch affirmed France at AA-; Outlook Negative, affirmed Portugal at A-; Outlook Positive, and affirmed Poland at A-; Outlook Stable.

- German Economy Ministry says economic weakness continues at the start of 2025 amid subdued domestic/foreign demand and increased uncertainty.

- German Ifo institute has lowered their economic forecasts to 0.2% for 2025 and 0.8% in 2026.

NOTABLE US HEADLINES

- OECD Economic Outlook, Interim Report March 2025; cuts global growth outlook - cites trade tensions

- US Senate voted 54-46 to pass the stopgap funding bill to keep the government funded through September 30th, while President Trump signed the budget appropriations bill into law.

- US President Trump’s administration was reportedly considering a new travel ban that would impact 43 countries, with a draft plan developed by the State Department several weeks ago.

- US Treasury Secretary Bessent said he’s not worried about the recent downturn that’s wiped trillions of dollars from the equities market, while he stated that markets will do great over the long term if they put good tax policy in place, deregulation and energy security, according to NBC’s Meet The Press.

- US President Trump invoked the Alien Enemies Act against Tren De Aragua which he declared is attempting and threatening invasion against the US, while he said any Venezuelans aged 14 or older who are TDA members and not US citizens or lawful permanent residents are liable to be “apprehended, secured and removed as alien enemies”.

GEOPOLITICS

MIDDLE EAST

- US President Trump ordered the US military to launch ‘decisive and powerful’ military action against Houthis in Yemen and told Iran to end support for Houthis immediately, while the Pentagon said US strikes against Houthis will last days or weeks., Furthermore, it was later reported that the death toll from the US attacks on Yemen reached 53.

- US Defence Secretary Hegseth said the US campaign will be unrelenting, while he added that Iran has been enabling the Houthis far too long and they better back off.

- US Secretary of State Rubio commented that the US military campaign in Yemen will go on until the Houthis no longer have the capability to strike ships and said there is no way Houthis would have the ability to attack shipping unless they had support from Iran.

- US Secretary of State Rubio spoke with Russian Foreign Minister Lavrov on Saturday and told him about US operations against Houthis, while Lavrov stressed the need for an immediate cessation of the use of force against Yemen Houthis and said it is important for all parties to engage in political dialogue in order to find a solution that avoids further bloodshed, according to Reuters.

- Yemen’s Houthis said naval operations will continue until the Gaza blockade is lifted and aid is let in, while the group said it targeted a US aircraft carrier with ballistic missiles and drones in the Red Sea but showed no proof, according to Reuters.

- Iranian Revolutionary Guards top commander Salami said Tehran will respond decisively and destructively to any enemy taking threats into action and noted that Yemen’s Houthis take strategic and operational decisions on their own, according to state media.

- Israeli air strike killed nine in Gaza amid ceasefire disputes. It was separately reported that the Israeli PM’s office said Israel will continue Gaza ceasefire talks in accordance with the US proposal for the immediate release of 11 living hostages and half of the dead. Furthermore, an Israeli delegation was in Egypt discussing hostages with senior Egyptian officials and PM Netanyahu moved to dismiss the head of the Shin Bet security service, according to the PM’s office cited by Reuters.

- Syria’s military fired rockets and shells at Lebanon on Sunday after accusing Iran-backed Hezbollah of executing three Syrian army personnel, according to Bloomberg.

RUSSIA-UKRAINE

- Ukrainian President Zelensky said Ukraine’s partners must define a clear position on security guarantees and the path to peace must begin unconditionally, while he added there must be a foreign troop contingent based on Ukraine soil as part of a peacekeeping arrangement and the question of territory is complex and should be discussed later.

- Russian Defence Ministry said Russia will demand Kyiv's neutral status and NATO's refusal to accept Ukraine in a peace treaty on Ukraine, while Russia opposes any troops in Ukraine as part of post-conflict guarantees, not just NATO troops. Furthermore, it was stated that the issue of unarmed observers as part of post-conflict international support for Ukraine may be discussed only once a peace treaty is worked out.

- US President Trump said he will be speaking with Russia's President Putin on Tuesday and may have something to announce on Ukraine-Russia talks by Tuesday. Trump added that land and power plants are the focus of talks toward a Russia-Ukraine deal and they are already talking about "dividing up certain assets" between the two sides.

- US President Trump said it feels like Russia is going to make a deal with them and stated that they had pretty good news coming out of Russia. Trump also announced that General Kellogg was appointed as Special Envoy to Ukraine and will no longer be an envoy to Russia.

- US envoy Witkoff said differences between Ukraine and Russia have narrowed and they had positive discussions with Russian President Putin, while Witkoff said he expects Trump and Putin to speak this week and that US negotiating teams will meet with Ukrainians this week and will also meet with Russians.

- UK PM Starmer said following a meeting with world leaders that they reaffirmed commitment to Ukraine’s long-term security and agreed that Ukraine must be able to defend itself and deter future Russian aggression, while they agreed military planners would convene again in the UK this week to progress practical plans for how militaries can support Ukraine’s future security. Furthermore, Starmer said they will accelerate military support, tighten sanctions on Russia’s revenues and will continue to explore all lawful routes to ensure that Russia pays for the damage it has done to Ukraine, as well as commented that Putin’s response to the ceasefire proposal is not good enough.

- Russia launched an air attack on Ukraine's capital of Kyiv and the Russian Defence Ministry said its forces retook control of two settlements in Russia’s Kursk region.

- Ukrainian drone attack targeted energy facilities in Russia's Astrakhan region and sparked a fire, according to the regional governor.

OTHER

- Azerbaijan’s Defence Ministry said Armenian forces opened fire on Azeri positions on Sunday, while Armenia’s Defence Ministry said the statement by Azerbaijan does not correspond to reality.

- North Korea said its nuclear forces will 'exist forever' and criticised G7 states for nuclear hegemony, while it will steadily update and strengthen its nuclear armed forces and said demand by G7 for North Korea to abandon nuclear weapons is a provocation. It was also reported that North Korea condemned the US deployment of additional stealth fighter jets to Japan, according to KCNA.

CRYPTO

- Bitcoin and Ethereum are a little lower, with the former holding around USD 83.5k.

APAC TRADE

- APAC stocks began the week on the front foot following last Friday's resurgence on Wall St and amid encouraging Chinese activity data but with gains capped owing to geopolitical tensions after the US conducted strikes on Yemen's Houthis and with participants awaiting this week's central bank decisions.

- ASX 200 gained with the advances led by notable strength in the commodity-related sectors and following encouraging data from Australia's largest trading partner.

- Nikkei 225 climbed at the open despite the lack of obvious catalysts, while Japan's largest labour union anticipates an average 5.46% wage increase this year which would surpass 5% for the second consecutive year and would be the highest in 34 years but is still below the union's 6.09% pay increase demand.

- Hang Seng and Shanghai Comp were positive with sentiment underpinned following recent support pledges and after encouraging Chinese activity data in which Industrial Production topped forecasts and Retail Sales matched estimates. However, gains in the mainland were limited as data also showed an increase in Urban Unemployment and House Prices remained in deep contraction territory.

NOTABLE ASIA-PAC HEADLINES

- China's State Planner Vice Chair says consumption is improving, though consumer confidence remains weak.

- PBoC detailed measures to improve the quality and efficiency of financial services and will grow the financial ecosystem that supports tech innovation, while state media reported that China should choose the right timing and strength for monetary easing.

- China’s State Council released a special action plan to boost domestic consumption which includes measures to increase residents’ income, pensions and wages, as well as establishing a childcare subsidy scheme and increasing revenue from land reform including rural areas.

- China’s NDRC said it is to encourage foreign investment in technology and manufacturing with the state planner to release an expanded list of industries it seeks to attract foreign investment in.

- China's stats bureau spokesperson said China's economy remains resilient but achieving the 2025 growth target will not be easy and the external environment is becoming more complex and severe. The spokesperson added that China's property market faces some pressures, despite signs of stabilising but they expect China's consumer prices to improve further and expect Q1 economic operations to be steady. Furthermore, it was stated that macroeconomic policies will provide more support for the economy and the employment situation remains largely stable with the rise in the February jobless rate still within normal ranges.

- PBoC says Official says it will use policy tools such as reserve requirement ratio and relending and discount facilities.

- Dozens of foreign CEOs set to attend Beijing's CDF business summit this month; some expected to meet President Xi, according to Reuters sources.

- CAICT says shipments of phones within China are down 14.3% Y/Y in January. Shipments of foreign-branded phones, such as Apple (AAPL) -20.6% Y/Y.

DATA RECAP

- Chinese Industrial Production YY (Feb) 5.9% vs. Exp. 5.3% (Prev. 6.2%)

- Chinese Retail Sales YY (Feb) 4.0% vs. Exp. 4.0% (Prev. 3.7%)

- Chinese Unemployment Rate Urban Area (Feb) 5.4% (Prev. 5.1%)

- Chinese China House Prices MM (Feb) -0.1% (Prev. 0.0%); YY (Feb) -4.8% (Prev. -5.0%)