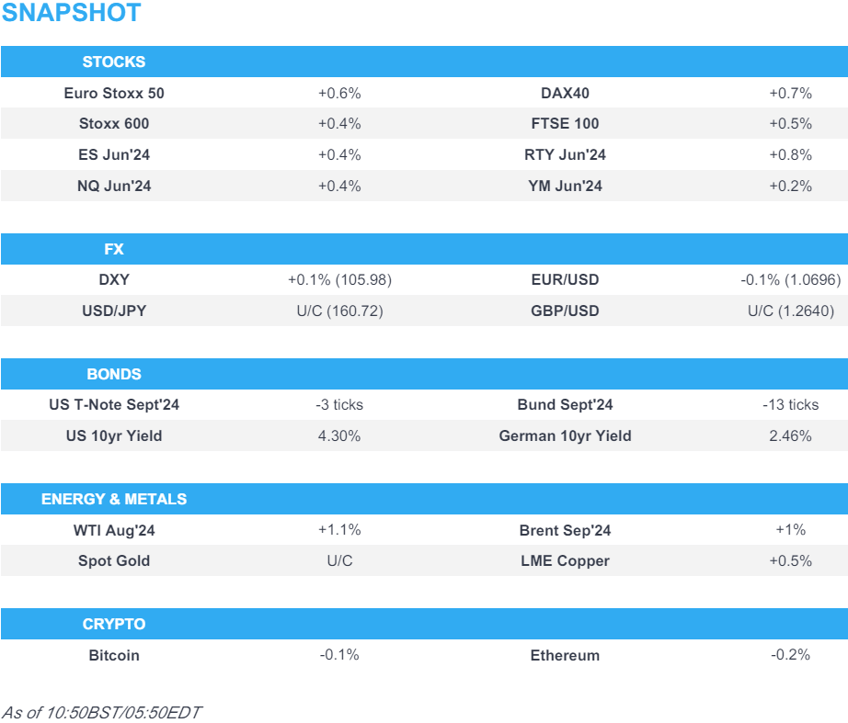

- Price action in European equities has been choppy, but are ultimately mostly firmer; US futures are modestly firmer ahead of US PCE

- French assets underperform ahead of Sunday’s legislative elections; CAC 40 -0.4%, OATs -31 ticks, OAT-Bund yield spread above 84bps

- Dollar is flat after initially being boosted by JPY weakness & post-presidential debate

- Bonds are subdued following the Presidential debate which saw the odds of a Trump victory inch higher

- Crude is firmer and towards session highs, XAU is flat whilst base metals gain

- Looking ahead, US PCE, Canadian GDP, Comments from Fed’s Barkin & Bowman

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US PRESIDENTIAL DEBATE

- US President Biden said during the first presidential debate that the US economy was falling when Trump came out of the presidency and that the Trump economy rewarded the rich and raised the deficit, while he said that Trump exaggerates and lies about border security in which everything he says is a lie.

- Former President Trump said they had the greatest economy in the history of the US under his administration and had the greatest economy in the world but Biden did something disastrous by encouraging illegal immigrants, while he added that immigrants from everywhere flock to the US because of Biden and are killing US citizens. Trump also said he achieved a lot in the field of economics and that inflation is currently killing the US which became a third-world country under the Biden administration, as well as noted that tariffs will reduce deficits and check countries like China. Furthermore, Trump said there was no terror under his administration and that the world is blowing up under Biden, while he added Iran was broke and Hamas would never attack Israel under his administration, as well as claimed that he would have the war between Russia and Ukraine settled before he takes office.

- CNN poll showed about 67% of debate followers saw Trump as the winner; 81% of registered voters who watched the debate said it had no effect on their choice for President, 5% said the debate made them change their mind on whom to vote for.

- Following the debate, Politico reports that some Democrats were so concerned by Biden's performance that they are discussing replacing him on the ticket; however, the likes of Governor Newsom said that kind of talk is “unhelpful” and “unnecessary”. Additionally, advisors acknowledged that not much is possible unless Biden steps aside.

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (+0.3%) are mostly firmer, taking positive leads from a strong APAC session; price action in Europe has been choppy thus far.

- European sectors are mixed; Energy takes the spot, benefiting from the gains in the underlying crude complex. Consumer Products & Services is the clear laggard, with the likes of Puma (-2.5%) hit following poor Nike results.

- US Equity Futures (ES +0.2%, NQ +0.4%, RTY +0.6%) are entirely in the green, ahead of US PCE. Nike (-12%) has sunk in the pre-market after it reported a beat on EPS, a miss on Revenue, noted that quarterly sales will fall 10% and warned on weakness in China.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is currently just shy of the 106 mark within a 105.87-106.13 range. Some desks attribute overnight strength in the USD to Trump outperforming Biden in the first tv debate. However, it is likely that ongoing upside in USD/JPY also played a role.

- USD/JPY has printed another multi-decade high at 161.27 with jawboning from Japanese officials and personnel adjustments unable to stop the rot for the currency. Officials in Japan will be hoping for a soft outturn for US PCE data today after Tokyo CPI picked up on a headline and core basis overnight. Currently flat on the session and holds around 160.70.

- EUR/USD is slightly softer and back on a 1.06 handle but within yesterday's 1.0676-1.0726 range. Asides from the fallout from the US PCE data, attention is increasingly turning towards the weekend risk associated with the French election.

- GBP is flat vs. the USD as the final release of Q1 UK GDP unable to instigate much in the way of price action. For now, Cable is tucked within yesterday's 1.2612-70 range.

- Antipodeans are both falling victim to the broadly firmer USD. AUD/USD a touch softer but largely in consolidation mode having not strayed from a 0.66 handle since June 17th.

- PBoC set USD/CNY mid-point at 7.1268 vs exp. 7.2727 (prev. 7.1270).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs came under pressure in APAC hours as the US election debate got underway. A debate which saw Biden perform particularly poorly with the odds of a Trump presidency lifting. Currently trading around 110-05 ahead of US PCE.

- Bunds were initially lower in tandem with broader weakness in Treasuries, and was fairly unreactive to French/Spanish inflation metrics thereafter. Currently lower by around 16 ticks and trading within Thursday's 131.68-132.19 bounds.

- OATs underperform ahead of Sunday's legislative first round election which has caused the OAT-Bund yield spread to widen to above 84bps.

- Gilt price action has been following peers, within initial underperformance on the back of the upwardly revised UK Q1 GDP figures.

- Click for a detailed summary

COMMODITIES

- Crude continues to climb. Upside which is a continuation of Thursday's marked gains for the complex, which began without clear or fresh fundamental catalysts. Brent higher by just under USD 1/bbl, and sitting above USD 86/bbl.

- Spot gold is flat, in what has been a rangebound and quiet session for the complex awaiting impetus from US PCE. XAU currently sits just under USD 2330/oz, with its 50 DMA at USD 2337/oz.

- Base metals are entirely in the green benefitting from the broadly positive risk tone, though with gains capped as participants await US PCE.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK GDP YY (Q1) 0.3% vs. Exp. 0.2% (Prev. 0.2%); GDP QQ (Q1) 0.7% vs. Exp. 0.6% (Prev. 0.6%)

- UK Lloyds Business Barometer (Jun) 41 vs Exp. 45 (Prev. 50)

- UK Business Invest QQ (Q1) 0.5% (Prev. 0.9%, Rev. 1.4%); Business invest YY (Q1) -1.0% (Prev. -0.6%, Rev. 2.8%)

- German Import Prices YY (May) -0.4% vs. Exp. -0.3% (Prev. -1.7%); Import Prices MM (May) 0.0% vs. Exp. 0.2% (Prev. 0.7%)

- Spanish CPI YY Flash NSA (Jun) 3.4% vs. Exp. 3.3% (Prev. 3.6%); Core 3.0% (prev. 3.0%); HICP Flash YY (Jun) 3.5% vs. Exp. 3.4% (Prev. 3.8%)

- French CPI Prelim YY NSA (Jun) 2.1% (Prev. 2.3%);CPI Prelim MM NSA (Jun) 0.1% vs. Exp. 0.1% (Prev. 0.0%); Producer Prices YY (May) -6.7% (Prev. -6.8%); Consumer Spending MM (May) 1.5% vs. Exp. 0.1% (Prev. -0.8%, Rev. -0.9%); Producer Prices MM (May) -1.4% (Prev. -3.6%); CPI (EU Norm) Prelim YY (Jun) 2.5% vs. Exp. 2.5% (Prev. 2.6%)

- German Unemployment Chg SA (Jun) 19.0k vs. Exp. 15.0k (Prev. 25.0k); Unemployment Rate SA (Jun) 6.0% vs. Exp. 5.9% (Prev. 5.9%); Unemployment Total SA (Jun) 2.781M (Prev. 2.762M); Unemployment Total NSA (Jun) 2.727M (Prev. 2.723M)

- Italian Consumer Price Prelim YY (Jun) 0.8% vs. Exp. 1.0% (Prev. 0.8%)

- Swedish Retail Sales YY (May) 0.8% (Prev. 0.5%); Retail Sales MM (May) 0.2% (Prev. 0.3%)

- Swiss KOF Indicator (Jun) 102.7 vs. Exp. 101.0 (Prev. 100.3, Rev. 102.2)

NOTABLE EUROPEAN HEADLINES

- EU leaders agree on the top EU jobs with von der Leyen given a second term as European Commission President, while Portugal's Antonio Costa is to be the new chairman of EU summits and Estonia's Kaja Kallas is to be EU's top diplomat. It was separately reported that French President Macron named Thierry Breton as the French EU commissioner.

NOTABLE US HEADLINES

- ECB Consumer Expectations Survey (May): 12-month inflation 2.8% (prev. 2.9%); 3-year ahead 2.3% (prev. 2.4%). Economic growth expectations for the next 12 months remained unchanged at -0.8%.

GEOPOLITICS

MIDDLE EAST

- "US Pentagon is moving military assets near Israel and Lebanon to be ready to evacuate Americans", via Walla's Elster citing NBC.

- US is to release part of suspended bomb shipment to Israel with the US and Israel discussing the release of a 500-pound bomb shipment to Israel, while the Biden administration is also reviewing another part of the shipment which includes 1,800 and 2,000-pound bombs, according to Axios.

- US official said the Pentagon is moving US military assets close to Israel and Lebanon as it prepares to evacuate Americans in Israel and Lebanon if the fighting intensifies, according to NBC.

OTHER

- US Deputy Secretary of State Campbell raised serious concerns regarding China’s destabilising actions in the South Sea in a call with China's Executive Vice Foreign Minister Ma Zhaoxu.

CRYPTO

- Bitcoin is incrementally softer and holds just above USD 61k.

APAC TRADE

- APAC stocks were mostly higher heading to month-, quarter-, and half-year end following the positive bias stateside but with gains capped as participants digest a slew of data and await the Fed's preferred inflation gauge.

- ASX 200 was led higher by tech strength but with upside limited by weakness in miners and materials.

- Nikkei 225 benefitted from recent currency weakness, while there was also a slew of data releases including mostly firmer-than-expected Tokyo inflation and a return to growth in Industrial Production.

- Hang Seng and Shanghai Comp. were positive in tandem with the gains in regional peers with catalysts light although there were comments from President Xi who reaffirmed the China opening up message.

NOTABLE ASIA-PAC HEADLINES

- Chinese President Xi said China will never leave the road of peaceful development and they will continue to expand the system which will become increasingly market-oriented. Xi added that China continues to expand opening up and its door will never close, while it is willing to discuss FTAs with additional developing countries.

- Japan's Finance Ministry announced they are to replace its top currency diplomat Kanda with Atsushi Mimura and replace Vice Minister of Finance Chatani with Hirotsugu Shinkawa although the changes were said to be part of a normal personnel rotation, according to Nikkei and Bloomberg.

- Japanese Finance Minister Suzuki said he won't comment on forex levels and it is important for currencies to move in a stable manner reflecting fundamentals. Suzuki reiterated he is closely watching FX moves with a high sense of urgency and is deeply concerned about excessive, one-sided moves on forex and repeated that rapid FX moves are undesirable.

- Geely Auto (0175 HK) Q1 2024 (CNY): revenue 52.315bln vs. prev. 33.506bln, profit attributable 1.561bln vs. prev. 714mln; Q1 sales volumes +49% Y/Y.

- PBoC says it is to step up the implementation of monetary policies already in place; will keep liquidity reasonably ample. Will guide a reasonable growth of credit.Will keep CNY basically stable. Will keep prices at a reasonable level. Will resolutely prevent overshooting risks. To firmly correct pro-cyclical behavior and prevent the formation and reinforcement of one-sided expectations. Deepen supply-side reform. Remarks which saw USD/CNH drop from 7.2985 to a test of 7.2900, a figure which held. Since, the move has pared marginally back to around 7.2930.

DATA RECAP

- Tokyo CPI YY (Jun) 2.3% vs. Exp. 2.3% (Prev. 2.2%)

- Tokyo CPI Ex. Fresh Food YY (Jun) 2.1% vs. Exp. 2.0% (Prev. 1.9%)

- Tokyo CPI Ex. Fresh Food & Energy YY (Jun) 1.8% vs. Exp. 1.7% (Prev. 1.7%)

- Japanese Industrial Production Prelim MM (May) 2.8% vs. Exp. 2.0% (Prev. -0.9%)

- Japanese Industrial Production Prelim YY (May) 0.3% vs. Exp. 0.0% (Prev. -1.8%)

- Japanese Unemployment Rate* (May) 2.6% vs. Exp. 2.6% (Prev. 2.6%)