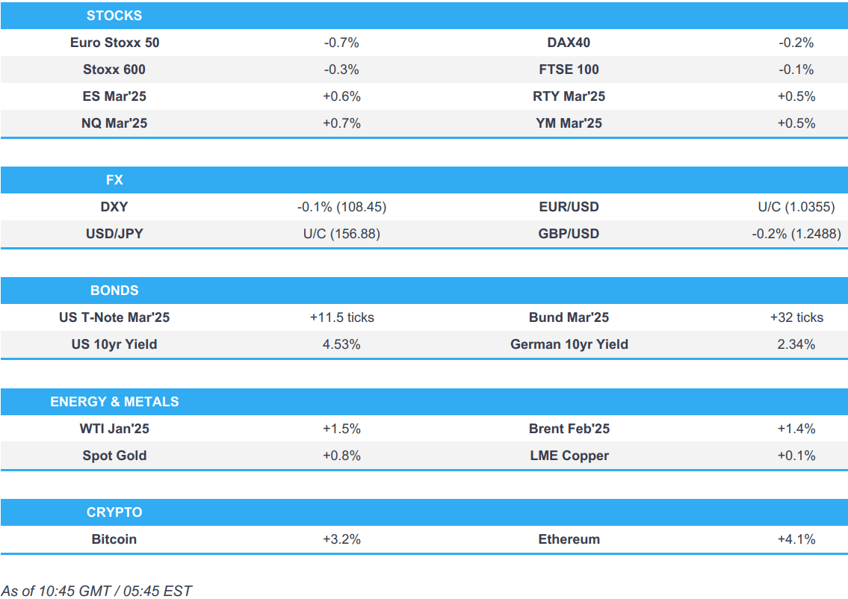

- European bourses give back early morning strength; US futures gain with modest outperformance in the NQ.

- USD began the session on a weaker footing but is now flat.

- USTs firmer after China Manufacturing PMI and ahead of their own metrics

- Crude on a firmer footing while base metals are capped by sub-par Chinese PMIs.

- Looking ahead, US Jobless Claims, Manufacturing PMI, Refunding Announcement.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses began the European session on a firmer footing, in contrast to a mostly negative APAC session; China considerably underperformed after the region’s poor Manufacturing PMI figures. Soon after the cash open, equities then gradually dipped lower with Europe now displaying a mostly negative picture, but without a clear catalyst. EZ Manufacturing PMI were revised a bit lower, but ultimately sparked little move in the complex.

- European sectors initially opened with a positive bias, but now display a mixed picture. Energy is the clear outperformer today, for two reasons; firstly, crude oil prices are a touch higher today, helping to prop up the likes of Shell and BP. Secondly, gas companies such as Saipem, and Eni both benefit from the strength in gas prices after Gazprom halted natgas supplies via Ukraine. Banks are found at the foot of the pile today, joined closely by Consumer Products; the latter weighed on by Luxury names, which is being hit following the poor Chinese Manufacturing PMI metrics overnight.

- US equity futures are on a firmer footing, despite a mostly negative Europe session thus far; the NQ marginally outperforms.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- The USD has kicked 2025 off on a modestly weaker footing vs. most peers with newsflow relatively light around the US ahead of tomorrow's House speaker vote; in recent trade, the Dollar has pared earlier losses to trade flat on the session. DXY remains on a 108 handle and was granted some mild reprieve following a pullback in European stocks. DXY currently sits towards the top end of the 31st December range of 107.86-108.58.

- EUR a touch firmer vs. the USD with fresh macro drivers from the Eurozone on the light side aside from a minor downward revision to December's EZ manufacturing data and recent comments from ECB President Lagarde who noted that the Bank aims to hit its inflation target this year.

- JPY is flat vs. the USD after USD/JPY slipped below 157 in early European trade with no clear driver behind the move and Japanese markets closed overnight. For now, the pair is contained within the 31st December range of 156.01-157.54 with potential interim resistance coming via the 21DMA at 157.16.

- GBP lagging vs. the USD in quiet trade with not much in the way of fresh fundamentals for the UK aside from a downward revision to the UK December PMI print. Cable has delved as low as 1.2487 with the next target coming via the December 2024 low at 1.2474 and the May 2024 low at 1.2446.

- Antipodeans are both firmer vs. the USD and top of the G10 leaderboard with no follow-through from disappointing Chinese manufacturing PMI data overnight. AUD/USD is currently caged within the Dec 31st range of 0.6189-0.6231; the lower bound of which was the 2024 low. NZD/USD is also within the 31st December range at 0.5587-0.5646.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are in the green as the region awaits its own data prints which include weekly jobless claims before the Final Manufacturing PMI for December and then the US Treasury will announce sizes for next week's 3yr, 10yr reopening, and 30yr reopening sales; no changes to the auction sizes are anticipated. Currently at the top-end of a 108-18+ to 109-03 band, though it remains shy of 109-06 from the end of 2024. Benchmarks are perhaps deriving impetus from the soft China data (more below) and the relatively tepid European tone.

- A slightly softer start to the session for EGBs, though the benchmarks have been picking up in recent trade with the risk tone tepid. Bunds to a 133.76 high. Earlier, saw some modest two-way action seen around the morning’s Final Manufacturing PMIs which saw the EZ revised down slightly, Germany and France unrevised and Italy revised higher.

- Gilts are in-fitting with EGBs; the region's own Manufacturing PMI figures were revised a touch lower but sparked no real reaction. Similarly to Bunds, Gilts initially in the red but are lifting into the green and at the upper-end of 92.18-43 parameters, resistance at 92.64 from the last trading day of 2024.

- Click for a detailed summary

COMMODITIES

- WTI and Brent hold an upward bias, despite the lack of fresh fundamentals, but with gains coming alongside strength in natgas after the Ukraine/Gazprom transit deal expired without renewal (details in the bullet below). Brent Mar sits at the upper end of a USD 74.72-75.71/bbl parameter thus far.

- Dutch TTF prices gapped higher this morning with the front-month hitting EUR 51/MWh before wiping out gains to sub-EUR 49/MWh (vs EUR 48.889/MWh prior close on Dec 31st). Russian gas via Ukraine stopped after a 2019 transit agreement expired on January 1st, 2025, with Ukraine refusing to renew the contract due to ongoing hostilities with Russia.

- Precious metals in general hold an upward bias as the Dollar kicks the year off on the backfoot. Newsflow for the complex has been light. Spot gold resides in a USD 2,622-2,639.90/oz range thus far as it reapproaches levels closed to its 50 DMA (2,659.07/oz).

- Overall, a mixed and tentative mood in the base metals complex with prices failing to garner much traction from the softer Dollar amid the overhang of downbeat Chinese PMI data. 3M LME copper currently resides in a USD 8,782.50-8,878.50/t range.

- Weekly API energy inventory data reportedly showed headline crude stocks drawing down by -1.4mln bbls (exp. -2.8mln), gasoline stocks built by +2.2mln bbls (exp. +0.3mln), while distillate inventories built by 5.7mln bbls (exp. -0.1mln); the more widely followed DoE weekly energy inventory report will be published later today.

- Gazprom has halted natural gas supplies through Ukraine following the expiration of five-year transit agreements on January 1st. Gazprom said that Ukraine's refusal to extend the agreements left it without the technical and legal means to continue the gas transit. Click for a brief Newsquawk analysis.

- UAE's ADNOC sets Feb Murban crude OSP at USD 73.28/bbl vs prev. USD 72.81/bbl.

- Oman sets 2025 budget on an avg. oil price of USD 60/bbl, according to State news.

- China is to raise retail fuel prices from January 3rd, according to NDRC; to raise gas and diesel prices by CNY 70/t respectively from Jan 2nd 2025

- Click for a detailed summary

NOTABLE DATA RECAP

- UK Nationwide house price MM (Dec) 0.7% vs. Exp. 0.1% (Prev. 1.2%); YY (Dec) 4.7% vs. Exp. 3.8% (Prev. 3.7%); Nationwide's Chief Economist says, “Upcoming changes to stamp duty are likely to generate volatility, as buyers bring forward their purchases to avoid the additional tax. This will lead to a jump in transactions in the first three months of 2025 (especially in March) and a corresponding period of weakness in the following three to six months, as occurred in the wake of previous stamp duty changes. This will make it more difficult to discern the underlying strength of the market. (Nationwide)

- UK S&P Global Manufacturing PMI (Dec) 47.0 vs. Exp. 47.3 (Prev. 47.3)

- Spanish HCOB Manufacturing PMI (Dec) 53.3 vs. Exp. 53.5 (Prev. 53.1)

- Italian HCOB Manufacturing PMI (Dec) 46.2 vs. Exp. 44.8 (Prev. 44.5)

- French HCOB Manufacturing PMI (Dec) 41.9 vs. Exp. 41.9 (Prev. 41.9)

- German HCOB Manufacturing PMI (Dec) 42.5 vs. Exp. 42.5 (Prev. 42.5)

- EU HCOB Manufacturing Final PMI (Dec) 45.1 vs. Exp. 45.2 (Prev. 45.2)

- EU Money-M3 Annual Growth (Nov) 3.8% vs. Exp. 3.5% (Prev. 3.4%); Loans to Non-Fin (Nov) 1.0% (Prev. 1.2%); Loans to Households (Nov) 0.9% (Prev. 0.8%)

- Swedish PMI Manufacturing Sector (Dec) 52.4 (Prev. 53.8)

NOTABLE EUROPEAN HEADLINES

- Comments on 31st Dec: European Central Bank President Christine Lagarde expressed optimism that the ECB will reach its 2% inflation target in 2025. She noted significant progress in 2024 and confirmed that efforts would continue to stabilise inflation sustainably at the target level.

- Riksbank Minutes: Deputy Governor Jansson believes the 2025 cut needs to come quite early in the year, in January or possibly at the meeting after that in March. Click for full details.

NOTABLE US HEADLINES

- US dockworkers and port employers are poised to restart negotiations on January 7th, according to Bloomberg

- Apple is offering discounts of up to CNY 500 on its iPhone models in China from January 4-7th. The promotion, aimed at defending its market share against local competitors like Huawei, applies to several models, including the iPhone 16 Pro and iPhone 16 Pro Max, Reuters reports. Separately, UBS lowered its iPhone unit and revenue estimates for December, citing weak iPhone sell-through. It's analysts revised its revenue forecast to USD 120.8bln and EPS to USD 2.25, both below consensus. Apple Services' revenue forecast was slightly raised, however, and UBS maintains a Neutral rating on Apple, with a USD 236 price target.

GEOPOLITICS

- US President-elect Trump is reportedly preparing to increase activity against the Houthis, according to journalist Stein. "Trump and his people are interested in increasing their activity against the Houthis. Among other things, the administration is expected to turn to the Gulf states to upgrade the regional coalition.". "It is possible that if Trump agrees to give the capabilities to defend themselves against the Houthis to the UAE and other Gulf states, such as Saudi Arabia, they will agree to join actively."

CRYPTO

- Bitcoin is back on a firmer footing and sits above USD 96k.

APAC TRADE

- ASX 200 +0.5%

- CSI 300 -3.1%; Hang Seng -2.2%

- Nikkei 225 closed overnight.

NOTABLE ASIA-PAC HEADLINES

- China's MOFCOM says it added 28 US entities on list of export controls; firms on the list include Lockheed Martin (LMT), Raytheon Missiles & Defence (RTX), and General Dynamics (GD). Bans exporting dual-use items to firms to safeguard China's national security. Adds 10 US firms to unreliable entity list for involvement in arms sales to Taiwan.

DATA RECAP

- CHINA PMI: China's manufacturing PMI slowed to 50.5 in December from 51.5 in November, missing expectations. Capital Economics said that while the Caixin manufacturing PMI suggests that factory activity softened in December, wider economic momentum still looks to have improved thanks to faster growth in services and construction, and adds that increased fiscal support should continue to lift growth in the near-term given that deficit spending is likely to be front-loaded at the start of 2025. Ahead, Bloomberg writes that investors are anticipating further economic stimulus, especially amid concerns over potential tariffs from President-elect Trump's return to the White House.