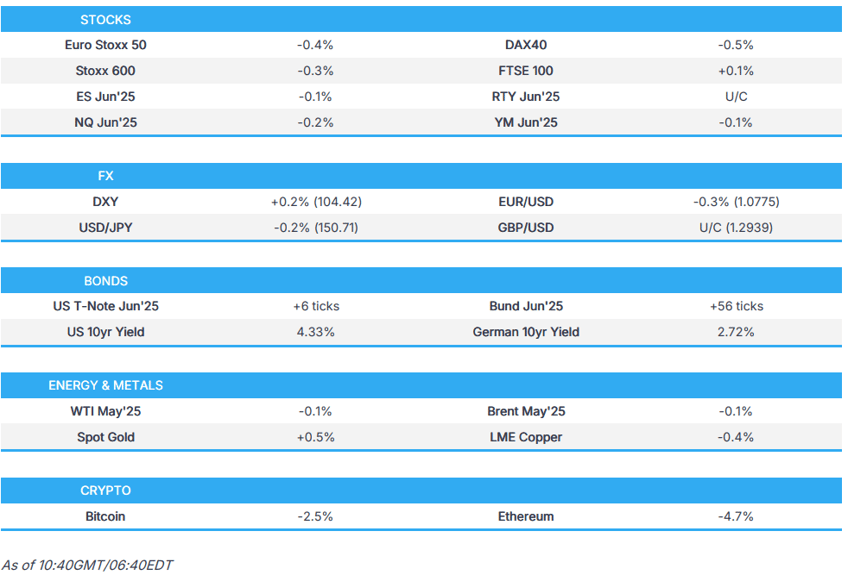

- European bourses and US futures approach PCE in the red following the overnight tone and further risk aversion from earthquakes in Myanmar

- Canadian PM to speak with Trump today; EU has mentioned Apple, Meta and PayPal as part of any potential tariff response

- DXY attempts to claw back Thursday's pressure and is firmer vs peers ex-JPY, which is the best performer after Tokyo CPI

- A firmer start for fixed benchmark ahead of US PCE and any tariff/trade developments, no move to the morning's prelim. HICP figures

- Crude choppy, precious metals underpinned by the tone while base metals are lower

- Geopolitics in focus amid updates on Panama, Ukraine minerals deal and further damage to the Sudzha station

- Looking ahead, highlights include US PCE (Feb) & Consumption, Speakers including Fed’s Bostic, Barr & ECB’s de Guindos.

- Click for the Newsquawk Week Ahead.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

TARIFFS/TRADE

- Canadian PM Carney is to speak with US President Trump on Friday.

- EU reportedly looks to hit big tech in a crackdown on US services exports, according to FT.

- EU is set to limit Apple (AAPL) and Meta (META) fines to avoid angering US President Trump, according to FT.

- Head of EU's Parliamentary Trade Committee says the EU could charge fees on PayPal (PYPL) in the dispute with the US over tariffs.

EUROPEAN TRADE

EQUITIES

- European bourses started Friday trade on a cautious note, Euro Stoxx 50 -0.6%, after APAC stocks were pressured on tariff and growth concerns overnight, and ahead of next week’s "Liberation Day", and with markets also bracing for US PCE inflation data later today.

- Note, the risk tone took a hit generally on the morning's earthquakes in Myanmar.

- Sectors are mainly in the red, Banks lag with German names lagging while softer yields assist Real Estate names.

- Stateside, futures are on the backfoot directionally in-fitting with the above but with magnitudes more limited into PCE and awaiting any tariff/trade updates, ES -0.2%.

- EU plans minimal fines on AAPL (-0.6%), META (-0.3%); CRM (-0.3%) raises dividend; CRWV IPO prices beneath guidance range; LULU (-13%) drops on weak outlook.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is attempting to claw back some of yesterday's lost ground with the USD currently firmer vs. all peers ex-JPY into PCE. Index remains within yesterday's 104.07-65 range.

- JPY is the current best performer after firmer-than-expected Tokyo CPI data, which is seen as a leading indicator for national price trends and effectively supports the case for further BoJ policy normalisation. USD/JPY has pulled back from the overnight peak @ 151.21 and made its way back onto a 150 handle. The next downside target comes via Thursday's low @ 150.05.

- EUR is under modest pressure and has faded gradually from the 1.08 mark against the USD. No reaction to the morning's data points or ECB speak. Thursday's base at 1.0732 and then the 200-DMA at 1.0729.

- GBP flat despite a blip higher on the morning's better-than-expected Retail Sales and upward revisions to dated GDP metrics. While this lifted Cable to a 1.2968 peak it proved fleeting.

- Antipodeans softer given the risk tone though action is limited given the lack of specific drivers for the region.

- PBoC set USD/CNY mid-point at 7.1752 vs exp. 7.2591 (Prev. 7.1763).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- A firmer start to the session for the benchmarks given the tepid risk tone overnight and risk aversion entering the market on the sizable earthquakes in Myanmar.

- USTs hit a 110-24 peak but since pulled back modestly but remains comfortably clear of the overnight 110-15 base. The session ahead is focussed on US PCE.

- Bunds bid, USTs hit a 110-24 peak but since pulled back modestly but remains comfortably clear of the overnight 110-15 base. The session ahead is focussed on US PCE. Prelim. French and Spanish inflation this morning cooler than forecast, but spurred no move; ECB SCE maintained the inflation view.

- Gilts gapped higher by 25 ticks as the Gilt open roughly coincided with the high point in USTs and Bunds as the complex generally continued to climb on the broad risk tone. Since, the benchmark has eased slightly from highs but remains above the 91.00 mark. No hawkish follow through from the Retail and GDP data this morning.

- Click for a detailed summary

COMMODITIES

- Crude futures choppy with initial downside on broader risk aversion. Since, the benchmarks briefly moved into the green but only by around USD 0.10/bbl with the move fleeting and the benchmarks now essentially unchanged. WTI May at the top of a USD 69.53-70.05/bbl band, Brent May in-fitting in USD 73.63-74.15/bbl parameters.

- Precious metals mostly firmer despite the firmer USD, benefitting from the risk tone as discussed into key events. Spot gold is currently off highs in a USD 3,054.42-3,086.21/oz intraday range.

- Base metals are mostly lower, tracking sentiment, 3M LME copper resides in a USD 9,741.70-9,855.15/t range at the time of writing. Dalian iron ore prices also dipped overnight but still notched a weekly gain as hot metal output continued to increase in March - used as a gauge for iron ore demand.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK Retail Sales MM (Feb) 1.0% vs. Exp. -0.4% (Prev. 1.7%, Rev. 1.4%); Ex-Fuel MM (Feb) 1.0% vs. Exp. -0.5% (Prev. 2.1%, Rev. 1.6%)

- UK Retail Sales YY (Feb) 2.2% vs. Exp. 0.5% (Prev. 1.0%, Rev. 0.6%); Ex-Fuel YY (Feb) 2.2% vs. Exp. 0.4% (Prev. 1.2%, Rev. 0.8%)

- UK GDP YY (Q4) 1.5% vs. Exp. 1.4% (Prev. 1.4%); ONS adds that UK GDP has been revised up by 0.1pp for each quarter between Q4-2023 and Q2-2024

- French CPI (EU Norm) Prelim MM (Mar) 0.2% vs. Exp. 0.40% (Prev. 0.10%); YY (Mar) 0.9% vs. Exp. 1.1% (Prev. 0.9%)

- French CPI Prelim MM NSA (Mar) 0.2% vs. Exp. 0.30% (Prev. 0.00%); YY NSA (Mar) 0.8% vs. Exp. 0.90% (Prev. 0.80%)

- Spanish HICP Flash MM (Mar) 0.7% vs. Exp. 0.90% (Prev. 0.40%); YY (Mar) 2.2% vs. Exp. 2.6% (Prev. 2.9%)

- Spanish CPI MM Flash NSA (Mar) 0.1% vs. Exp. 0.35% (Prev. 0.40%); YY Flash NSA (Mar) 2.3% vs. Exp. 2.40% (Prev. 3.00%)

- German Unemployment Chg. SA (Mar) 26.0k vs. Exp. 10.0k (Prev. 5.0k); Unemployment Total SA (Mar) 2.922M (Prev. 2.886M)

- EU Consumer Confid. Final (Mar) -14.5 vs. Exp. -14.5 (Prev. -14.5); Selling Price Expec (Mar) 11.4 (Prev. 9.8, Rev. 10.2); Cons Infl Expec * (Mar) 24.4 (Prev. 21.1, Rev. 21.4)

NOTABLE EUROPEAN HEADLINES

- Magnitude 6.9 (initially reported 7.72/7.4) earthquake occurs in Myanmar, via GFZ; reports of buildings shaking in Bangkok & Hanoi. Thereafter, magnitude 6.37 earthquake occurs in Myanmar, via GFZ; shocks reported in the Yunnan Province of southwest China and in Bangkok.

- ECB's de Guindos says disinflation process is continuing, goal is for it to be reached in the coming months; caution is even more important at times of uncertainty. Trade war would mostly impact economic growth.

- ECB Consumer Expectations Survey (Feb): See inflation in next 12 months at 2.6% (prev. 2.6%); 3y ahead sees 2.4% (prev. 2.4%). Consumers’ nominal income growth expectations over the next 12 months increased to 1.0% in February from 0.9% in January.

NOTABLE US HEADLINES

- Fed's Collins (2025 voter) said she is cautiously and realistically optimistic about the economy and stated the economy started 2025 in a good place. Collins said inflation had come down but was still elevated at the start of the year, and the outlook now is much cloudier for inflation and growth. She noted it is inevitable that tariffs will increase inflation in the near term and it remains a question how long tariff-driven inflation will last. Furthermore, she said inflation risks are on the upside and she strongly supported the Fed's decision to hold rates steady, while she expects the Fed will likely hold rates steady for longer given the outlook and stated that watching inflation expectations and sentiment data is important right now.

- Fed's Barkin (2027 voter) said the current moderately restrictive stance is a good place to be and if conditions shift, the Fed can adjust. Barkin said given recent high inflation, tariffs could have more of an impact on prices, but still not known where rates will settle or how affected countries' businesses and consumers will respond. Barkin also commented that the direction of federal policy changes may be known, but the extent and how they net out in the economy remains uncertain, while he added federal policy changes create instability in the near term and the Fed is waiting for uncertainty to clear before acting.

- Elon Musk commented that their goal is to reduce the deficit by USD 1tln and will achieve most of that objective within a 130-day tenure, while he added that legitimate recipients of Social Security benefits will receive more, not less money, according to Fox News.

GEOPOLITICS

MIDDLE EAST

- Israeli military said it intercepted one launch from Lebanese territory and another one was detected.

- Israeli Defense Minister said if there is no peace in Kiryat Shmona and the Galilee communities, there will be no peace in Beirut, according to Asharq News. It was separately reported that Israel's Defence Minister holds Lebanon responsible for firing on Galilee and said Israel will respond forcefully against any threats.

- Iran's ambassador in Baghdad said US President Trump's message to Tehran included a request to dissolve or merge the Popular Mobilization Forces, which is unacceptable to us, while the ambassador added they refuse to negotiate on their ballistic missiles and the decision to dissolve the PMU is an Iraqi decision which he thinks is impossible, according to Sky News Arabia.

- "Lebanese media: Israeli warplanes fly over Beirut", according to Sky News Arabia; thereafter, the Israeli Military says it will release an urgent statement to Beirut residents soon.

RUSSIA-UKRAINE

- Russia and US teams may meet regarding Ukraine in Riyadh in mid-April, according to TASS.

- Russian President Putin suggested the possibility of placing Ukraine under temporary administration to allow for elections and signature of accords, according to Russian news agencies. Putin said Russia stands for resolving Ukraine conflict through peaceful means and wants to work with Europe on resolving Ukraine conflict, but the EU is acting inconsistently. It was separately reported that Putin said Russia welcomes a peaceful resolution to the Ukraine conflict "but not at our expense", according to CGTN Europe.

- White House said governance in Ukraine is determined by its constitution and the people of Ukraine.

- Russian Defence Ministry says Ukraine continued attacks on Russian energy infrastructure, according to Ria; attacked the Sudzha gas metering station on Friday and almost destroyed it; thereafter, Ukraine said Russia conducted the attack.

- Ukrainian Deputy PM confirms Ukraine has received new US draft of the minerals deal.

OTHER

- CK Hutchison Holdings (0001 HK) will not go ahead with the expected signing of a deal next week to sell its two strategic ports at the Panama Canal, according to SCMP.

- US Secretary of State Rubio warned if Venezuela attacked Guyana or Exxon (XOM), "it would be a very bad day" for them. It was also reported that the Guyanese President agreed with the US to further integrate energy production after a meeting with US Secretary of State Rubio.

- US Defense Secretary Hegseth said during a visit to the Philippines that he and US President Trump want to express the ironclad commitment they have to the mutual defence treaty and are very committed to the Philippines-US alliance, friendship and cooperation they have. Hegseth added that friends need to stand shoulder to shoulder to deter conflict and ensure that there's freedom of navigation in the South China Sea, and noted that deterrence is necessary around the world, but specifically in this region considering the threats from the Communist Chinese. Hegseth later announced they are doubling down on the US-Philippines partnership and agreed on the next steps to re-establish deterrence in the Indo-Pacific with the US to deploy advanced capabilities to the Philippines.

CRYPTO

- US Senator Warren and other Democrats have sent a letter to Fed's Bowman warning that US regulators could seen face an "extraordinary conflict of interest" overseeing a crypto entity controlled by President Trump, via WSJ.

APAC TRADE

- APAC stocks were mostly pressured amid the ongoing themes of tariffs and growth concerns heading closer to next week's 'Liberation Day' and with markets also bracing for the latest US PCE Price Index.

- ASX 200 traded rangebound and was just about kept afloat by strength in consumer staples and the commodity-related sectors with gold miners rejoicing after the precious notched another fresh record high.

- Nikkei 225 underperformed and dipped beneath the 37,000 level as automakers continued to suffer from Trump's recent auto tariff proclamation and with firmer-than-expected Tokyo CPI data supporting the case for the BoJ to continue with future policy adjustments.

- Hang Seng and Shanghai Comp failed to sustain the early resilience and slipped into negative territory amid a deluge of earnings and tariff uncertainty, while it was also reported that China rejected US President Trump's offer of tariff waivers in exchange for a TikTok deal.

NOTABLE ASIA-PAC HEADLINES

- Chinese President Xi said, at a meeting with foreign CEOs, that foreign firms' investment plays an important role and China was, is and will certainly be an ideal, safe and promising investment destination for foreign business people. Xi added they will ensure that foreign-funded enterprises have fair access to factors of production in accordance with the law and maintaining a stable, healthy, and sustainable development of China-US relations is in the fundamental interests of the two peoples. Xi also stated that blocking someone else's path will only block your own path in the end and blowing out other people's lights will not make your own lights brighter. Furthermore, he said economic and trade frictions should be properly resolved through equal dialogue and consultation, and noted that China will handle China-US relations in accordance with the principles of mutual respect, peaceful coexistence and win-win cooperation.

- China is to promote high-quality development of the aluminium sector and will actively respond to trade frictions, according to a plan by ten government departments cited by Global Times.

- Japanese PM Ishiba said the impact of US auto tariffs on the Japanese economy could be very big.

- Bank of Japan March Meeting Summary of Opinions noted one member said inflation is somewhat overshooting expectations and a member said wage hikes in spring wage talks are somewhat exceeding last year's figures, with nominal wages rising at a pace in line with the achievement of the BoJ's price goal. There was the opinion that they don't have enough data to gauge the impact of the January policy change and recent long-term rate moves on the economy, while it was reiterated that the BoJ will continue to hike rates if economy and prices move in line with forecast, but should not have a preset idea on specific policy management. A member stated that for the time being, the BoJ must scrutinise US policy impact on the global economy and markets, as well as the effect of BoJ's past rate hike on Japan's economy, then move to the next rate hike, while a member said they must adjust the degree of monetary support nimbly to avoid a buildup of financial excess. Furthermore, there was an opinion that when they next hike rates, they must consider shifting the monetary policy stance to neutral from accommodative, and at the next meeting, they must scrutinise inflation expectations, the chance of upside price risk materialising, and progress in wage hikes when setting monetary policy.

DATA RECAP

- Tokyo CPY YY (Mar) 2.9% vs Exp. 2.8% (Prev. 2.9%)

- Tokyo CPY Ex. Fresh Food YY (Mar) 2.4% vs Exp. 2.2% (Prev. 2.2%)

- Tokyo CPY Ex. Fresh Food & Energy YY (Mar) 2.2% vs Exp. 2.0% (Prev. 1.9%)