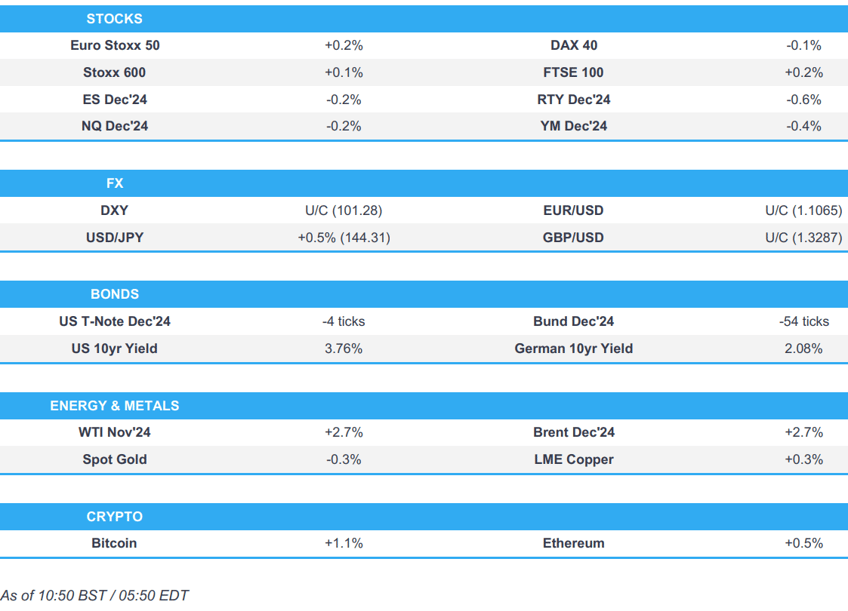

- European bourses are generally on a firmer footing whilst US futures are modestly lower with slight underperformance in the RTY

- Dollar is flat unable to continue the prior day’s geopolitical-indued gains, JPY underperforms with USD/JPY around 144.25

- USTs are flat and Bunds give back some of its recent strength, Gilts follow peers and took another leg lower following an auction

- Crude continues to benefit from the geopolitical risk premium, XAU slips off best levels whilst base metals gain

- Looking ahead, ADP National Employment, NBP Policy Announcement; OPEC+ JMMC Meeting, Speakers including ECB’s Elderson, Schnabel, Fed’s Hammack, Musalem, Bowman & Barkin. Earnings from Conagra & Levis.

More Newsquawk in 3 steps:

More Newsquawk in 3 steps:1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (+0.1%) opened on a tentative footing, however, sentiment gradually improved as the morning progressed, with indices now generally in positive territory to varying degrees. In recent trade, bourses have edged slightly off best levels.

- European sectors are mixed; Energy tops the pile, propped up by the geopolitical-induced strength in oil prices; a factor which has weighed on Travel & Leisure names. Consumer Products is also towards the top of the pile, assisted by gains in Luxury amid continued optimism surrounding China on its return from Holiday.

- US Equity Futures (ES -0.2%, NQ -0.2%, RTY -0.6%) are modestly lower across the board, continuing the weakness seen in the prior session with slight underperformance in the RTY.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- The rally in the USD has paused for breath with DXY unable to advance above yesterday's 101.39 peak. Wednesday's price action was driven by geopolitics and if the situation in the Middle-East escalates, this could have some bearing on today's price action; looking at US-specifically, ADP National Employment will be in full focus ahead of the NFP on Friday.

- EUR/USD has moved back onto a 1.10 handle in the wake of Tuesday's USD rally. For EUR-specifically, ECB's Kazaks put his weight behind a likely rate cut this month. The Single-Currency is currently flat and trades within a 1.1055-82 range.

- After starting the week above the 1.34 mark, Cable now sits on a 1.32 handle with heavy losses yesterday triggered by the haven bid into the USD. For now, GBP/USD is holding above Tuesday's 1.3237 low and the 21DMA at 1.3233.

- JPY is struggling vs. the USD following yesterday's indecisive session which drew a safe haven bid into both the USD and JPY. USD/JPY is currently tucked within Tuesday's 142.97-144.53 range.

- Antipodeans are both slightly firmer vs. the USD in an attempt to claw back yesterday's losses. AUD/USD has returned to a 0.68 handle after topping out on Monday at a fresh YTD peak at 0.6942.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are essentially flat/incrementally lower and holding at a 114-18+ base, having faded from Tuesday’s geopolitically-driven 115-00 peak. Today's docket is packed with ADP National Employment alongside Fed speak from Barkin, Bowman, Hammack & Musalem.

- Bunds are in the red, with yields firmer across the board in Europe after the marked dovish action seen on Tuesday in the European morning and then extended in the afternoon/evening on geopols. As it stands, Bunds at a low of 135.37, fading from the 136.00 mark and above yesterday’s 136.20 peak. OATs underperform marginally, with the OAT-Bund 10yr yield spread just shy of the 80bps mark. President Macron is due to speak from 14:15BST onwards.

- Gilts are directionally in-fitting with peers which are pulling back from a combination of dovish ECB pricing and geopolitical premia. At a 98.36 trough following the Gilt auction, owning to the softer b/c and wider yield tail vs the prior outing.

- UK sells GBP 4bln 4.125% 2029 Gilt: b/c 2.93x (prev. 3.29x), average yield 3.880% (prev. 3.811%) & tail 1.2bps (prev. 0.9bps).

- Germany sells EUR 3.704bln vs exp. EUR 4.5bln 2.60% 2034 Bund: b/c 2.0x (prev. 2.1x), average yield 2.08% (prev. 2.11%), retention 17.69% (prev. 18.04%)

- Click for a detailed summary

COMMODITIES

- Crude is firmer intraday, and holding onto the gains seen yesterday and overnight amid the geopolitical risk premium woven into prices after Iran attacked Israel. Brent Dec resides in a USD 74.24-75.55/bbl parameter.

- Mixed trade across precious metals with upside seen in spot silver and spot palladium whilst spot gold remains subdued since early European trade following recent geopolitically-induced gains. XAU currently resides in a USD 2,644.58-2,662.88/oz range.

- Base metals are mostly firmer in European trade despite the cautious risk tone, but with some potential continued tailwinds from the Chinese stimulus efforts. 3M LME copper reclaimed USD 10k/t to the upside.

- Saudi Energy Minister reportedly warns of USD 50/bbl oil as OPEC+ members flout production curbs, according to WSJ sources; interpreted as a threat Saudi is willing to launch a price war to keep market share if other countries do not abide. Saudi reportedly singled out Iraq which overproduced by 400k BPD in August.

- US Private inventory data (bbls): Crude -1.5mln (exp. -1.3mln), Distillate -2.7mln (exp. -1.5mln), Gasoline +0.9mln (exp. -0.1mln) Cushing +0.7mln.

- Click for a detailed summary

NOTABLE DATA RECAP

- French Budget Balance (Aug) EUR -171.91B (Prev. -156.91B)

- Italian Unemployment Rate (Aug) 6.2% vs. Exp. 6.6% (Prev. 6.5%, Rev. 6.4%)

- EU Unemployment Rate (Aug) 6.4% vs. Exp. 6.4% (Prev. 6.4%)

NOTABLE EUROPEAN HEADLINES

- Citi expects the ECB to cut by 25bps in October and December and through the beginning of 2025, to reach a deposit rate of 1.50% by September 2025.

- UBS expects the ECB to cut at the October, December, January, March, April & June meetings for a total of 150bps.

- ECB's de Guindos says "Broadly speaking, the problems we are discussing today derive from the incompleteness of the Economic and Monetary Union" adds "risks to growth remain tilted to the downside".

- ECB's Lane slide deck "Expectations and Monetary Policy"

- German engineering orders +7% Y/Y in August (Domestic -7%; Orders +13%); Jun-Aug -3% Y/Y (Domestic -6%, Foreign Orders -1%), according to VDMA.

NOTABLE US HEADLINES

- US Democratic VP candidate Walz said in the VP debate that they will continue to support Israel in defending itself and that former President Trump created the largest trade deficit between the US and China, while Walz admitted to misstating the timing of his visit to China in 1989.

- US Republican VP candidate Vance said in the VP debate that Harris's economic policies do not meet the interests of American workers and stated that Trump's economic policy focuses on the return of industry to the US.

GEOPOLITICS

MIDDLE EAST - EUROPEAN SESSION

- Israeli PM Netanyahu "is expected to hold a limited security consultation in the afternoon with several senior ministers and defense chiefs to continue discussing the response to the Iranian attack", according to Axios' Ravid citing sources.

- Israeli military says regular infantry and armoured units are joining the ground operation in Lebanon.

- Yemeni Houthis says they targeted military posts deep inside Israel with "Quds 5" rockets, according to a statement; will not hesitate in broadening operations against Israel. Continuous US and UK support to Israel will put their interests under fire.

- Lebanon's Hezbollah says it targeted areas north of Haifa City in Israel, with a large missile salvo.

- "Atomic Energy Organization of Iran: Nuclear facilities have been secured against any attacks", according to Cairo News.

- "After Israel security cabinet meet: Israel is expected to respond 'harsh' against Iran, with the possibility of targeting strategic sites in Iran"; according Kann's Stein.

- "Lebanese media: Israeli army advances towards a Lebanese army checkpoint in Al-Adaisseh, southern Lebanon", according to Sky News Arabia

MIDDLE EAST - APAC SESSION

- Iranian state television reported that Tehran confirmed it fired 200 missiles in its attack on Israel, according to Sky News Arabia.

- Iran's armed forces said if Israel responds to the Iranian attack it will be met with vast destruction of its infrastructure and if Israel's backers directly intervene against Tehran, their interests and bases in the region will face Iran's strong attack.

- Iran's Foreign Minister commented on X that Iran exercised self-defence under Article 51 of the UN Charter and Iran's action is concluded unless the Israeli regime decides to invite further retaliation, while he said Israel's enablers now have a heightened responsibility to rein in the warmongers in Tel Aviv. Iran's Foreign Minister also commented that there is a possibility that the confrontation with Israel will continue in the coming days and forces are on standby, as well as noted that Iran told the US not to get involved following the missile attack on Israel and warned that any new action by Israel or its supporters will face a more severe response.

- Israel’s Home Front Command lifted restrictions on Israelis after the end of Iranian missile attacks and said it will defend the citizens of Israel and respond to Iranian missiles at the right time and place, according to Sky News Arabia. Israel's Home Front Command also said it eased restrictions on large gatherings in much of Israel including Tel Aviv and Jerusalem areas.

- Israeli PM Netanyahu said Iran made a big mistake tonight and they will pay for it, while he added that the Iranian missile attack on Israel failed.

- Israel's UN envoy said Israel will act and Iran will soon feel the consequences of their actions with the response to be painful.

- Israeli officials cited by Axios said Israel will launch a strong response within days to the major Iranian attack which could target oil production facilities inside Iran, according to Reuters and Al Jazeera.

- Israeli military said it conducted strikes on Hezbollah targets in Beirut and it issued warnings to residents of the Chiyah neighbourhood and Hadath al-Gharb in the southern suburbs of Beirut, while a correspondent reported eight Israeli raids on southern suburbs of Beirut in about two hours.

- Hezbollah said it struck Israeli artillery in Beit Hille with rockets, according to Al Jazeera. Hezbollah separately announced that it confronted an Israeli force infiltrating the Lebanese town of Adaisseh and forced it to retreat, while the Israeli army also reported heavy fighting with Hezbollah operatives in southern Lebanon.

CRYPTO

- Bitcoin is slightly firmer, finding its footing following on from the weakness seen in the prior session after Iran's attack on Israel.

APAC TRADE

- APAC stocks traded mixed with some cautiousness seen amid heightened tensions in the Middle East after Iran conducted a missile attack on Israel.

- ASX 200 was rangebound as gains in the commodity-related industries offset the losses in the tech and consumer sectors.

- Nikkei 225 slumped at the open and retreated beneath the 38,000 level after the prior day's currency strength.

- Hang Seng resumed its China stimulus-spurred rally on return from the holiday with notable strength in tech and property.

NOTABLE ASIA-PAC HEADLINES

- Japan's new Economy Minister Akazawa said a complete exit from deflation is the top priority and he wants the BoJ to share their view that an exit from deflation is the top priority, while he commented that the BoJ should be careful about raising rates as it takes time to fully exit deflation. Akazawa also stated that it is not necessarily correct that PM Ishiba is positive about further rate hikes and that Ishiba's comment on the need for monetary policy normalisation has various conditions attached.

- BoJ Governor Ueda says "Japan's economy is recovering moderately albeit with some weak signs"; "trend inflation, likely below 2%, is likely to accelerate"; says markets remain unstable. "Uncertainty surrounding Japan's economy prices remain high", "We must be vigilant to impact of markets, FX moves, an their effect on Japan's economy", "We must scrutinise market moves with a high sense of urgency for the time being".

- Japan's Finance Minister Kato says Japan is seeing signs of recovery; "We will strengthen this trend, aiming for higher growth via higher wages and investment". "Hope that BoJ will take the appropriate policy to achieve 2% inflation target, while taking into account financial situations". "Expect thorough communication with market when asked about BoJ monetary policy".

DATA RECAP

- South Korean CPI MM (Sep) 0.1% vs. Exp. 0.3% (Prev. 0.4%); YY (Sep) 1.6% vs. Exp. 1.9% (Prev. 2.0%)