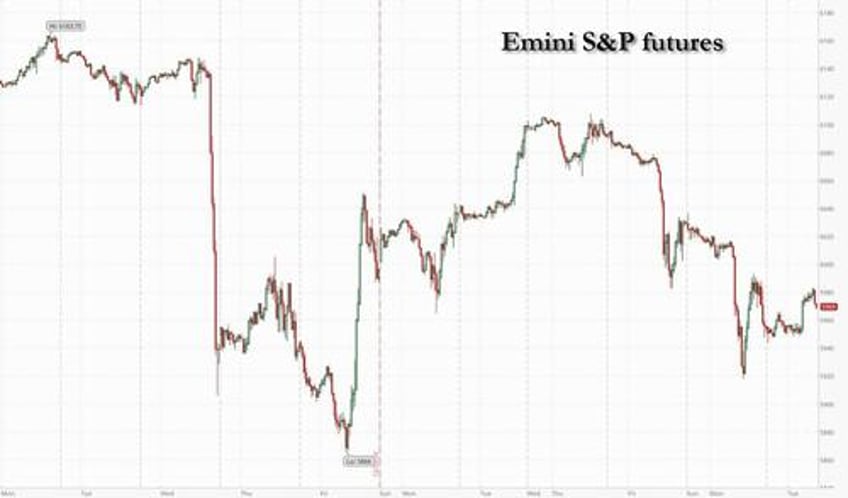

With the Santa rally dead and buried after the S&P saw two back-to-back 1% drops for the first time since August and sending the S&P sliding back under 6,000, US equity futures finally rose on the last day of 2024, setting stocks on course to snap three days of losses and build on this year’s powerful Wall Street rally. As of 8:00am, S&P futures rose 0.3% and Nasdaq futs were 0.4% higher, with all Mag7 stocks higher. European trading was muted, with several markets shut on New Year’s Eve and shortened sessions in London and Paris. 10Y yields extended their drop, sliding 1bp to 4.52% while the Bloomberg dollar index gained, capping the best year for the US currency since 2015. Bloomberg rebounded and oil dropped. The last day of the year has a sparse macro calendar and includes the Case-Shiller and the December Dallas Fed service activity index.

In premarket trading, the Mag7 were higher across the board (Apple 0.4%, Nvidia 0.7%, Microsoft 0.5%, Alphabet 0.5%, Meta Platforms 0.5%, Tesla 1.1%) as pension selling finally faded. Here are some other notable premarket movers:

- Acadia Pharmaceuticals shares gain 8.9% in the premarket session after an announcement that the company will replace Independent Bank Group Inc. in the S&P SmallCap 600 before the opening of trading on Jan. 3.

- Dave shares are down 7.6% ahead of the bell after the Federal Trade Commission said it referred its federal court case against the cash advance firm to the Justice Department, which has filed an amended complaint in the case.

- EHang Holdings ADRs climb 7.6% ahead of the bell after the urban air mobility (UAM) technology platform company gave preliminary revenue for the fourth quarter that topped its forecast.

- Sangamo Therapeutics plummet 52% in premarket trading, after Pfizer ended its collaboration and license agreement with the firm to develop a new gene therapy for hemophilia A. Pfizer’s decision comes as a surprise to analysts, who flag the risk of near-term liquidity issues at Sangamo.

- Verastem shares rise 37% in premarket trading on Tuesday after the biopharmaceutical company said FDA accepted to review its New Drug Application (NDA) for the treatment of adult patients with recurrent low-grade serous ovarian cancer.

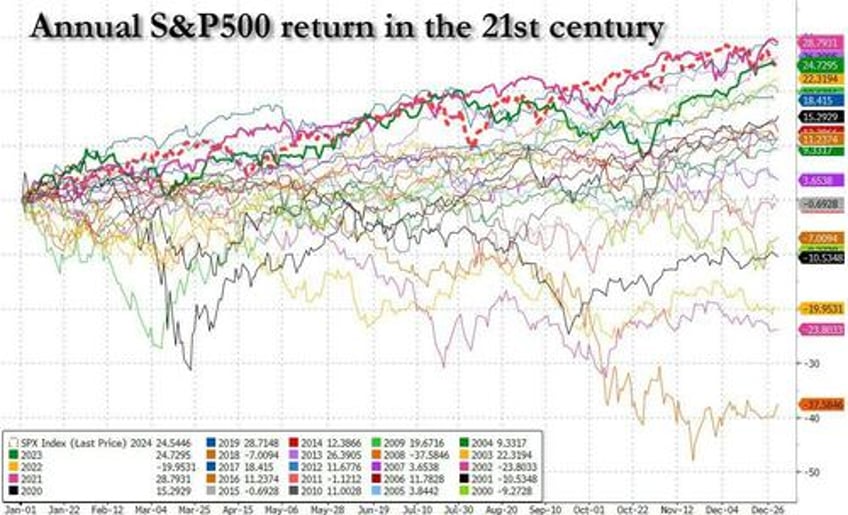

With stocks set to end 2024 on a positive note, investors have much to ponder according to Bloomberg: some are concerned about the stamina of this year’s 24% S&P 500 rally, driven by the so-called Magnificent Seven cohort of tech giants. And there’s a range of uncertainties to confront in 2025, from Trump’s protectionist policies to the outlook for central bank policy and the health of the European and Chinese economies. Still, up until the Fed's surprising hawkish pivot- which came once it was clear that Trump and not Kamala would be in the White House - the S&P was on pace for its best year this century. Even with the latest drawdown, stocks are still poised for a stellar 25% return this year, making it three years in the last four that the S&P has risen by more than 20%.

"Investors are in wait-and-see mode,” Noel Dixon, senior macro strategist at State Street Corp., told Bloomberg Television. "We don’t know what the retaliatory effects are going to be and how the Fed is ultimately going to react to those tariffs."

European stock rose, sending the Stoxx 600 up 0.4% to session high; the CAC 40 and FTSE 100 rose 0.4% while other major markets including Italy and Germany are closed. Energy shares are the best performers as they track oil prices higher while miners also outperform. Here are the biggest European movers:

- Galp Energia shares drop as much as 5.9% to a one-month low, after latest drilling results at the Portuguese firm’s Mopane-2A well in Namibia yielded gas condensate. The discovery suggests more exploration could be needed to justify Galp’s first development, RBC says.

- Wizz Air shares rose after the airline operator said it expects to return to growth by taking the new Airbus A321NEO deliveries and growing seat capacity by about 20% in FY26, according to a statement.

In Asia, trading was thin because several regional markets including South Korea’s were shut for a public holiday. Japanese markets are closed through Jan. 6. Stocks fell in Australia and mainland China, with those in Hong Kong flat. Chinese equities shrugged off data that pointed to an improvement in both services and manufacturing activity. Investors also showed little reaction to President Xi Jinping’s remark that China’s 2024 economic growth is expected to be around 5%, a target set by policymakers earlier in the year. Meanwhile, in the latest sign of simmering tensions between Beijing and Washington, the US Treasury Department said it was hacked by a Chinese state-sponsored actor through a third-party software service provider.

“Don’t think 2024 GDP growth still matters for markets actually as most have already moved towards faith that the government wants to meet the 5% target,” said Xin-Yao Ng, investment director at abrdn. “Perhaps it’s more to do with manufacturing PMI being below consensus, and within that some components like persistently soft input and output prices continue to suggest deflationary pressure.”

In FX, the Bloomberg Dollar Spot Index was steady, on course for its best year since 2015 in a rally fueled by Trump’s reelection in November and the Federal Reserve’s less dovish policy pivot.

In rates, Treasuries climbed, with US 10-year yields falling 1 bps to 4.52%. Gilts outperform their US peers, with UK 10-year borrowing costs down 3 bps. An index of Treasuries looks set to eke out a small gain for the year, with yields edging lower on Tuesday.

In commodities, gold ticked higher, set for one of its biggest annual gains this century after advancing 27%. Oil reversed an earlier gain after factory activity expanded for a third month in China, the latest evidence of economic recovery in the world’s top crude importer. European natural gas prices rose in anticipation of a halt in Russian flows via Ukraine on New Year’s Day, as a transit agreement between the two nations expires. Gas for February rose as much as 2.2% on Tuesday.

US economic data calendar includes October FHFA House Price Index and S&P CoreLogic home prices at 9am, December Dallas Fed services activity at 10:30am. Fed speaker slate is blank until Jan. 3.

Market Snapshot

- S&P 500 futures up 0.2% to 5,972.75

- MXAP down 0.1% to 181.96

- MXAPJ down 0.5% to 569.61

- Nikkei down 1.0% to 39,894.54

- Topix down 0.6% to 2,784.92

- Hang Seng Index little changed at 20,059.95

- Shanghai Composite down 1.6% to 3,351.76

- Sensex down 0.2% to 78,111.50

- Australia S&P/ASX 200 down 0.9% to 8,159.14

- Kospi down 0.2% to 2,399.49

- STOXX Europe 600 up 0.1% to 505.53

- German 10Y yield little changed at 2.37%

- Euro little changed at $1.0417

- Brent Futures up 0.5% to $74.38/bbl

- Gold spot up 0.3% to $2,615.35

- US Dollar Index down 0.19% to 107.92

Top Overnight News

- China’s NBS PMIs for December are solid, with manufacturing approximately inline (50.1, down from 50.3 in Nov and slightly below the consensus forecast of 50.2) while non-manufacturing jumps to 52.2 (up from 50 in Nov and solidly above the Street’s 50.2 forecast). RTRS

- China’s government pushes for the EV industry to utilize larger amounts of domestic chips as it aims to reduce its reliance on US supply chains (about 15% of EV silicon comes from within China, and Beijing wants to move that number higher). WSJ

- China disputed US Treasury claims that it was breached by Chinese-backed hackers in a “major cybersecurity incident.” The intrusion, through third-party provider BeyondTrust, allowed access to certain workstations and unclassified documents. BBG

- South Korea’s inflation overshoots the consensus on a headline basis in Dec (+1.9%, up from +1.5% in Nov and above the consensus forecast of +1.7%) while core cools to +1.8% (down 10bp from +1.9% in Nov and slightly below the Street’s +1.9%). WSJ

- A South Korean court issued an arrest warrant for impeached President Yoon Suk Yeol over insurrection allegations. His lawyer plans to file for an injunction. BBG

- EV sales are expected to tumble in 2025 as Trump ends the current $7500 tax credit (the US EV industry sold ~1.3M units in 2024, but that number may only be 1M in 2025). Barron's

- Active equity funds suffered record outflows of ~$450B this year while more than $1T was pushed into ETFs as investors continue to shift to passive strategies. FT