Even though US cash markets are closed today for the President's Day holiday, US equity futures are open and are trading about 0.2% higher amid muted volumes.

The action, as noted earlier, is in Europe where bonds fell and shares of defense companies rallied on the likelihood of greater military spending, which could force governments to step up borrowing in the coming years.

Bloomberg reported that European officials are working on a major new package to ramp up defense spending and some EU leaders are planning to meet on Monday in Paris to start drawing up their response. The moves come as the US pushes for a quick end to the war in Ukraine and after Vice President JD Vance attacked longstanding European allies at a security conference Friday.

“The goalposts are shifting, and the EU is realizing they can rely less and less on the US for protecting their borders. In lockstep, we’re going to have to see European countries spend more on defense,” said Aneeka Gupta, head of macro research at Wisdomtree UK Ltd. “That does warrant a bit more caution on bonds.”

The developments have cemented the view that debt sales will need to increase as European nations shoulder the cost of a lasting peace deal between Ukraine and Russia. Upgrading defense and protecting Ukraine may cost Europe’s major powers an additional $3.1 trillion over 10 years, according to Bloomberg Economics estimates.

In response to what some view as a massive new debt burden, which of course to others is just fiscal stimulus, Europe’s Stoxx 600 index rose 0.4%...

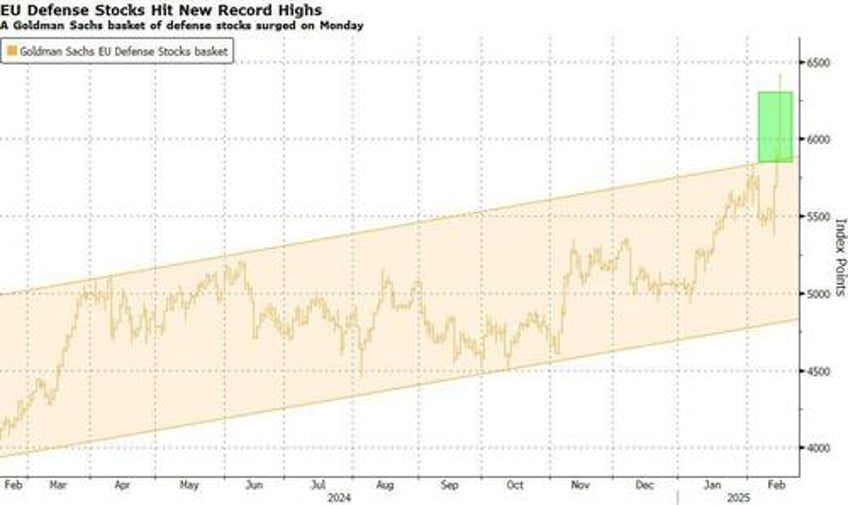

... led by strong gains in defense names with Rheinmetall hitting a fresh record high, as officials in the region work on a major new package to ramp up defense spending and support Ukraine, pushing Goldman's index of European defense shares topped a record high (Saab +11%, Hensoldt +13%, RENK +13%, Leonardo +5.7%, BAE Systems +7%).

European stocks were also lifted by improved sentiment over China, a key export market, where a meeting between President Xi Jinping and business figures including e-commerce icon Jack Ma raised hopes that authorities’ years-long crackdown on the private sector is ending.

Here are some of the biggest movers on Monday:

- Assura shares soar as much as 18% on Monday, the most since January 2010, after the UK primary health-care property group’s board rejected a £1.56 billion ($2 billion) takeover bid by funds managed by KKR & Co. and the Universities Superannuation Scheme Ltd.

- Ferrexpo shares rally 18% in London after Peel Hunt raised the recommendation on the miner to buy from hold, citing chances of the company that operates mines and plants in Ukraine returning to full capacity.

- Bavarian Nordic shares rise as much as 6.1%, the most since Jan. 9, after the Danish vaccines maker said the US Food and Drug Administration approved its chikungunya shot called Vimkunya.

- CCC shares drop as much 8.9% after announcing plans to issue as many as 10 million new shares to buy out minority investors in its e-commerce arm Modivo.

- Formycon shares fall as much as 45%, their steepest drop on record, as RBC (outperform) sees a balance sheet impairment due to pricing for biologically similar medicines in the US.

- Bakkafrost falls as much as 8.8%, the most since August 2023, after the Oslo-listed salmon farmer’s 4Q operating Ebit came in below consensus expectations.

- Galp shares fall as much as 3.2% after Portuguese oil co. reported adjusted net income for the fourth quarter that missed the average analyst estimate.

- IP Group shares drop as much as 8.2%, the most in almost three months, after the investor in science and technology firms said its portfolio company Istesso’s mid-stage study of leramistat in rheumatoid arthritis didn’t meet the primary endpoint of improvements in ACR20 versus the placebo.

- Tomra falls as much as 5.4%, the most since November, after Kepler Cheuvreux cut its recommendation of the Norwegian recycling-technology firm to reduce from hold following last Friday’s estimate-beating 4Q.

Earlier in the session, Asian stocks rose, supported by gains in Taiwanese and Japanese heavyweights, even as a rally in China cooled. The MSCI Asia Pacific Index advanced 0.5%, on track for a fourth day of gains. TSMC offered the biggest boost to the benchmark, while Sony led an advance in Japanese shares after raising its guidance. Chinese stocks gave up some of their earlier gains as investors took profit following a recent rally. Optimism remains strong, with a meeting between President Xi Jinping and prominent entrepreneurs including Alibaba co-founder Jack Ma signaling endorsement for the private sector. Tencent stood out, climbing to the highest since 2021 after incorporating DeepSeek to its WeChat social media platform.

In rates, German, French and Italian bonds all slipped, with 10-year bund yields — the benchmark borrowing rate for the euro area — reaching the highest in more than two weeks. US bond yields are closed,

In FX markets, Japan’s yen strengthened against all its Group-of-10 peers after the economy grew faster than expected, bolstering expectations of interest-rate hikes from the Bank of Japan. Bloomberg’s dollar index traded steady after two days of losses.

DB's Jim Reid concludes the overnight wrap

As weekends go this year, this one seemed a fairly quiet one, especially after the last three where a combination of Deep Seek and tariffs have kept us on our toes ahead of the Monday open. However, there were still some fascinating European political developments after JD Vance's confrontational speech towards Europe on Friday at the annual Munich Security Conference, and news the day before that the Trump administration would start bilateral talks with Russia, as soon as this week, aimed at ending the war in Ukraine. The responses ranged from bemusement to anger but it seems to have had an impact. European leaders will convene for an emergency meeting today in Paris to discuss the latest Ukraine developments and the future of European defence in light of recent fast moving developments, especially those emanating from the Trump administration. So in terms of European geopolitics it's been a huge last few days with potentially large ramifications ahead, and maybe we'll look back on them as a big catalyst to higher European defence spending.

Indeed our German chief Economist Robin Winkler wrote a blog on Friday suggesting that these very recent developments could potentially transform Europe's security architecture and could prove to be an important catalyst for German defence and fiscal policy after the election on Sunday. It has led his team to adjust their base case for what is likely to be agreed in the coming weeks by the three centrist parties, regardless of which of them end up in government. There is seemingly more urgency now to increase defence spending and this is something European leaders seem to be coalescing around to some degree. Mark Wall has followed up his recent defence series with “Defending Europe: 10 key points” earlier this morning.

So its a big week for Europe and we'll preview the German election in a bit more detail below. Before that, today should be quiet as the US is off for Presidents' Day. It's not a huge week for data but there's plenty of Fed speak to go alongside the FOMC minutes on Wednesday. In US data terms, the highlights are housing starts and permits (Wednesday), the Phili Fed (tomorrow), jobless claims (Thursday) - which corresponds to payrolls survey week, and existing home sales and the final University of Michigan consumer sentiment reading on Friday. On this last one, the long-term inflation expectation series printed at the second highest level since 1996 in the preliminary release. So one to watch. However, the survey is extraordinarily partisan at the moment so the market is struggling to work out whether it should ignore the wild disparity between Democrat and Republican voters' views on prices.

Elsewhere, Friday brings the global flash PMIs and before that we'll get rate decisions from Australia (tomorrow) and NZ (Wednesday). Our economists expect a 25bps and 50bps cut respectively. We also see inflation from Canada (tomorrow), UK (Wednesday), and Tokyo (Friday), with UK labour market data (tomorrow).

With regards to earnings, 384 of the S&P and 201 of the Stoxx 600 have now reported with 41 and 124 reporting this week. So US earnings season is slowing down with one final macro hoorah next week (26th) with Nvidia. See the full day-by-day week ahead guide at the end as usual.

With regards to the German election on Sunday, the fiscal policy of Europe going forward is potentially at stake here. In terms of the current polls, the Conservatives (led by Friedrich Merz) are still leading by a wide margin at around 30%. The far-right AfD is polling at 21%, and the SPD are third with 15% of total votes, followed by the Greens with 14%. Given its successful social media campaign, the Left is currently enjoying the strongest polling momentum, currently in fifth with 6%. Both the newly founded hard-left party BSW and the FDP are currently polling between 4 and 4.5% and would thus not reach the 5% hurdle for entering parliament but it's clearly all very finely balanced. At the moment we think a two-party coalition is the most likely scenario but the probability of a tripartite coalition has been rising, especially if two of the three smaller parties hit the 5% threshold required to join parliament. The key for markets is whether the three centrist parties attain the required two-thirds majority for amending the constitutional debt brake at some point if agreement can be made to do so. This likely depends on the three smaller parties’ ability to cross the 5% threshold to parliament. If none or one does then the majority will likely be secured. If two do, then it most likely won't be. So a big moment ahead.

Asian equity markets are mostly quiet to start the week with the KOSPI (+0.62%) leading the gains with the Nikkei (+0.12%) slightly higher. Chinese risk is slipping after a stronger start with the Hang Seng (-0.91%), and the Shanghai Composite (-0.20%) lower. S&P 500 (+0.20%) and NASDAQ 100 (+0.35%) futures are edging higher with the cash equivalents closer later due to the holiday.

Early morning data showed that Japan’s Q4 GDP expanded at an annualised rate of +2.8%, significantly exceeding Bloomberg estimates of +1.1% while marking the third straight quarter of expansion on improved business spending. On a q/q basis, it grew +0.7%, more than the +0.3% rise expected. Following the data, the Japanese yen (+0.41%) is strengthening for the third straight session, trading at 151.70 against the dollar. Meanwhile, yields on 10yr JGBs (+2.1bps) have hit their highest since April 2010 trading at 1.37%. 5yr JGB yields have risen to 1.04%, the highest since October 2008. So some big landmarks crossed.

Looking back at last week now, risk assets managed to post a fresh advance, despite having to navigate an array of different events. That included the news of reciprocal tariffs from the US, an upside surprise in the January CPI print, potential negotiations over Ukraine, and then a weak retail sales release on the Friday. The latter saw a headline decline of -0.9% in January (vs. -0.2% expected). But amidst all that, the S&P 500 moved up +1.47% last week (-0.01% Friday) to within 0.1% of its all-time high. And over in Europe, the STOXX 600 advanced for an 8th consecutive week, posting a +1.78% advance despite a -0.24% retreat on Friday from Thursday’s record high.

The equity rally extended to other risk assets, with US IG and HY credit spreads down -4bps on the week, while European HY spreads tightened to the narrowest level since September 2021 (-12bps to 283bps). Meanwhile, most commodities moved higher over the week, with Bloomberg’s Commodity Spot Index up by +2.14% (+0.09% Friday) to a two-year high. So that exacerbated some of the concern about inflation, leaving the 2yr US inflation swap up +3.8bps last week to 2.77%, though they retreated -4.4bps on Friday after the weak US retail sales print. This also led gold (-1.56% Friday but +0.75% on the week) to post its biggest daily decline of the year so far.

This backdrop saw sovereign bonds put in a divergent performance on either side of the Atlantic. In the US, the balance of weaker data helped push the 10yr Treasury yield down -1.9bps (-5.3bps Friday) to 4.48%. That came as investors dialled up their expectations for Fed rate cuts, as the upside in the CPI was outweighed by the softer activity data and the weakness in the PPI components that feed into the Fed’s preferred measure of PCE. So investors are now pricing in 40bps of cuts by the December meeting, up from 36bps the previous week. By contrast, yields on 10yr bunds were up +6.1bps (+1.4bps Friday) to 2.43%. And over in Japan, the 10yr yield was up +6.0bps (+0.9bps Friday) to 1.36%, its highest level since 2011.