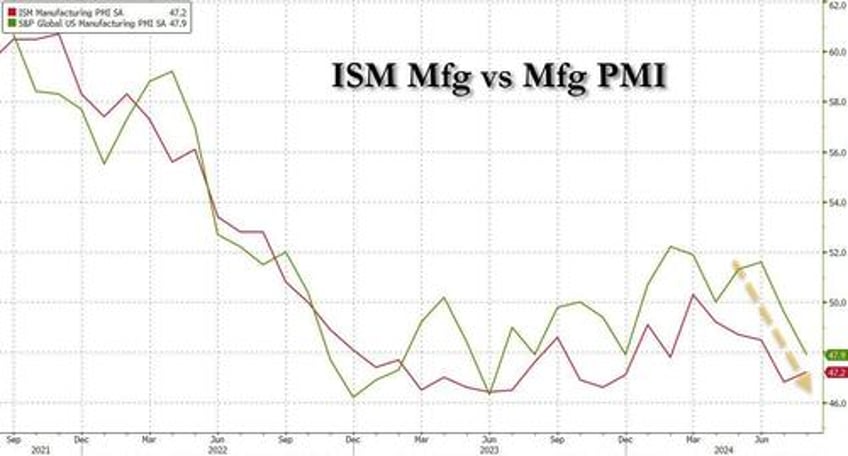

Ahead of Friday's payrolls report, there were rising expectations that the economic rebound observed in the past two weeks - and following the dismal July jobs report - would persists. Alas, those hopes were promptly crushed moments ago when shortly after a dismal US Manufacturing PMI report, which printed in its final iteration at 47.9, below the prelim print of 48.0 and below the 48.1 estimate, the more closely watched Manufacturing ISM report came in even uglier, printing at the 5th consecutive contractionary level of 47.2, which while a modest rebound from the 2024 low of 46.8 hit last month, missed estimates of a 47.5 print. And while the two surveys have frequently diverged in the past, there is clear agreement between the two since the early summer: the US manufacturing sector is imploding, and the economic contraction is accelerating.

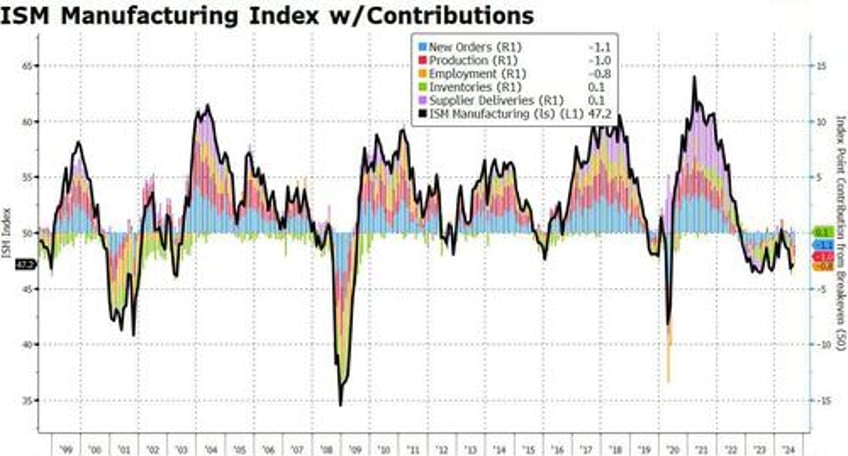

The contraction was broad based, with the index posting declines in the all important New Orders, Production, and Employment.

While the Employment subindex did post a modest rebound - while still stuck deep in contraction - which suggests that Friday's jobs report will come stronger than expected, the bad news is that new orders declined at their fastest rate since June 2023.

And while most output subindexes remain deep in contraction territory, one continues to rise: the one that should not be doing that: we are talking of course about prices paid which rose again, from 52.9 to 54.0, beating estimates of 54.0, and resuming its ascent since the start of 2023. In fact, compared to an 8-month lagging CPI print, one can be assured that we have seen the lowest CPI prints for this cycle.

Adding insult to injury, the closely watched ISM New Orders/ Inventory ratio suddenly plunged back to recession levels, signaling that the manufacturing pipeline is now hopelessly clogged and mass layoffs are about to begin.

While traditionally a 50 print in the ISM is the cutoff for contraction, the highly politicized ISM report was quick to claim that a "manufacturing PMI above 42.5 percent, over a period of time, generally indicates an expansion of the overall economy": spoiler alert: it does not, but it is an election year, so anything goes. In any case, not even the ISM was able to put much more lipstick on this pig and explained that this "contractionary expansionary" print was hardly the stuff expansions are made off with ISM chair Tim Fiore saying that "the past relationship between the Manufacturing PMI® and the overall economy indicates that the July reading (46.8 percent) corresponds to a change of plus-1.2 percent in real gross domestic product (GDP) on an annualized basis."

Translation: we are this close to a stall speed.

The respondents, as shown below, agreed:

- “Business is relatively flat — the same volume, but smaller orders.” [Chemical Products]

- “Demand continued to soften into the second half of the year. Supply chain pipelines and inventories remain full, reducing the need for overtime. Geopolitical issues between China and Taiwan as well as the election in November remain weighing concerns.” [Transportation Equipment]

- “Even though we are used to a seasonal reduction in business over the summer, consumer behavior is changing more than normal. Sales are lighter, and customer orders are coming in under forecasts. It seems consumers are starting to pull back on spending.” [Food, Beverage & Tobacco Products]

- “Availability of parts is good, with small exceptions of missing materials here and there. Ordering is still well below typical levels as we continue to burn down inventory of raw goods, with ‘normal’ ordering trends expected to return sometime in the second half of 2024.” [Computer & Electronic Products]

- “It seems that the economy is slowing down significantly. The number of sales calls received from new suppliers is increasing significantly. Our own order backlog is also diminishing. We are hoping for an increase in customer demand, or we will possibly need to make organizational changes.” [Machinery]

- “Unfortunately, our business is experiencing the sharpest decline in order levels in a year. We were well below our budget target in June; as a result, it was the first month this year that we had negative net income.” [Fabricated Metal Products]

- “Business is slowing, and we are taking cost actions.” [Electrical Equipment, Appliances & Components]

- “Some markets that are usually unwavering are showing weakness. Weather is the common factor, but only so much.” [Nonmetallic Mineral Products]

- “Our sales forecast for July and August are slow, but we’re making every attempt to remedy that situation. Our medical end-user customers continue to meet their forecasts, which is promising.” [Textile Mills]

- “Elevated financing costs have dampened demand for residential investment. This has reduced our need for component products and inventory.” [Wood Products]

But if the ISM was bad, than the final August S&P PMI report was downright apocalyptic and as the following comments from Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, made clear:

“A further downward lurch in the PMI points to the manufacturing sector acting as an increased drag on the economy midway through the third quarter. Forward looking indicators suggest this drag could intensify in the coming months.

“Slower than expected sales are causing warehouses to fill with unsold stock, and a dearth of new orders has prompted factories to cut production for the first time since January. Producers are also reducing payroll numbers for the first time this year and buying fewer inputs amid concerns about excess capacity.

“The combination of falling orders and rising inventory sends the gloomiest forward-indication of production trends seen for one and a half years, and one of the most worrying signals witnessed since the global financial crisis.

“Although falling demand for raw materials has taken pressure off supply chains, rising wages and high shipping rates continue to be widely reported as factors pushing up input costs, which are now rising at the fastest pace since April of last year.”

Bottom line: core outputs sinking as input costs and inflation expectations are once again surging: not exactly the 'data-dependence' that dovsh Fed members are hoping to see. But at least the Fed Chair will finally see that "stag" and the "flation" he had so much trouble spotting just a few months ago...