According to S&P Global's PMI survey, the US manufacturing sector moved deeper into contraction territory at the end of the third quarter of the year (dropping from 48.0 to 47.0 - the third straight monthly contraction in the soft data survey.

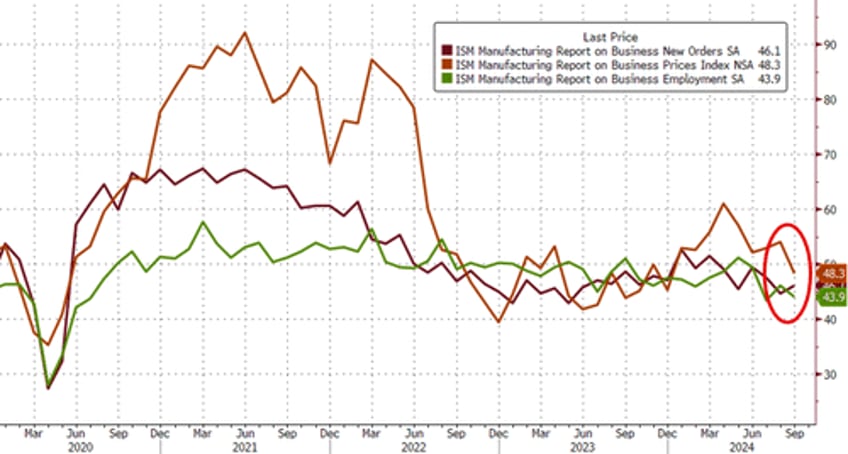

ISM's version of the Manufacturing PMI survey also showed contraction (47.2 - worse than expected) for the sixth straight month...

Source: Bloomberg

New Orders remain in contraction for the sixth straight month, Employment tumbled back near post-COVID-lockdown lows, but Prices Paid softened significantly...

Source: Bloomberg

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence:

“The September PMI survey brings a whole slew of disappointing economic indicators regarding the health of the US economy. Factories reported the largest monthly drop in production for 15 months in response to a slump in new orders, in turn driving further reductions in employment and input buying as producers scaled back operating capacity.

“However, companies are sensing that at least part of the drop in demand is likely to be temporary, as spending, investment and inventory building have been paused in many cases amid the uncertainty caused by the Presidential Election. The prospect of lower interest rates has meanwhile raised confidence in the longerterm outlook, with firms anticipating that demand will be rekindled by lower borrowing costs if the political environment improves. Hence, despite the deterioration in the current business situation, business expectations about the year ahead have in fact improved.

“While the current weak demand environment has helped keep cost pressures low in the manufacturing sector, the potential for geopolitical events to drive energy prices higher alongside possible spikes in shipping prices poses upside risks to the inflation picture.”

So, to summarize - slower growth/contraction and rising output prices - that kind of stagflationary signal is not exactly screaming "50bps rate cut!!"