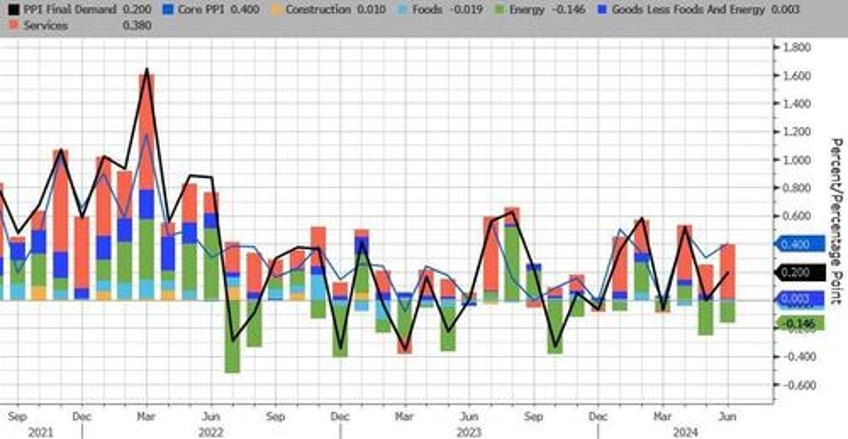

After yesterday's soft CPI, this morning's PPI seems somewhat 'less than' but as we noted earlier, in fact it is key to the ongoing disinflationary trend (and in fact suggests all may not be trending smoothly).

After May's MoM deflationary impulse (thanks to a plunge in energy costs), June was expected to see a modest 0.1% rise (and we have seen energy prices starting to rise again). Sure enough, headline PPI printed HOT at +0.2% MoM (and May was revised higher), pushing the YoY print up to 2.6% (well above the 2.3% expected)...

Source: Bloomberg

That is the highest PPI since March 2023.

Core PPI rose by 0.4% MoM (double the 0.2% exp), sending the YoY price rise up by 3.0% (also the hottest since March 2023)...

Source: Bloomberg

The jump in PPI was driven by a resurgence in Services costs as Energy remains deflatioanry (for now)...

Source: Bloomberg

This is not what the doves wanted to see...