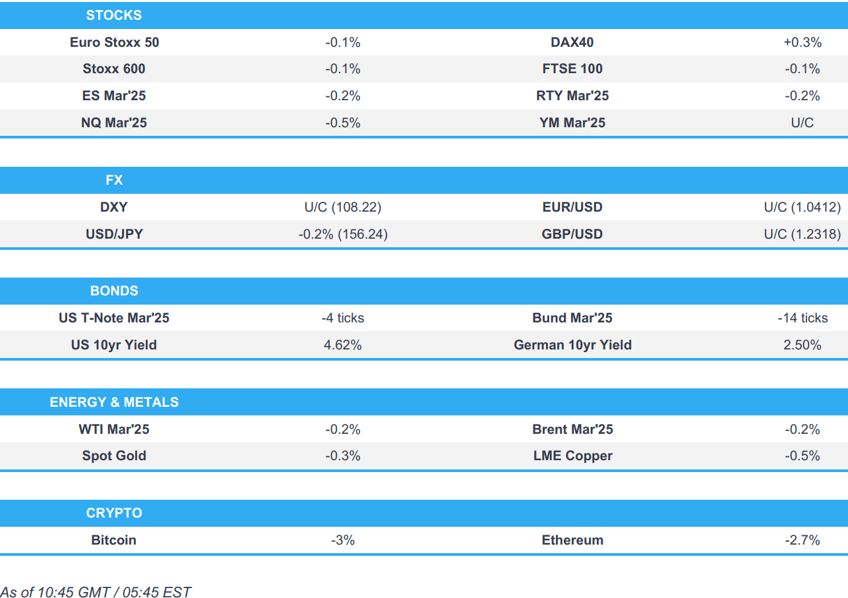

- European bourses are mixed, tech-heavy NQ slightly underperforms after SK Hynix highlights demand concerns.

- USD flat with price action contained in quiet trade; markets await US President Trump at Davos.

- Bonds hold a bearish bias into Trump though benchmarks bounced briefly on strong UK & French supply, but returned to session lows.

- Crude a little firmer, Base metals continue to be subdued by Trump tariff threats.

- Looking ahead, US Initial Jobless Claims, Australian PMI, Japanese CPI, Canadian Retail Sales, CBRT Policy Announcement, Supply from the US, Speakers including SNB Chair Schlegel & US President Trump.

- Earnings from GE Aerospace, American Airlines Group Inc., Freeport-McMoRan Copper & Gold, Huntington Bancshares Incorporated, Texas Capital Bancshares, Elevance Health, Alaska Air Group, Union Pacific Corp., Texas Instruments Incorporated, Intuitive Surgical, CSX Corp.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses (Stoxx 600 -0.1%) began the session mixed, continuing the indecisive mood seen in APAC trade overnight. Price action has generally moved sideways throughout the morning, given the lack of EZ-specific updates.

- European sectors are mixed, and aside from the day’s clear underperformer (Tech), the breadth of the market is fairly narrow. Tech underperforms following SK Hynix results; the co. reported strong Q4 figures, but highlighted concerns regarding demand declines in commodity memory chips. Banks top the pile, joined closely by Utilities and Telecoms.

- US equity futures are broadly on the backfoot, with slight underperformance in the tech-heavy NQ (-0.5%), following the weakness in Europe as the sector digests poor SK Hynix results.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is flat with price action in the FX space contained amid quiet newsflow. Today's data highlight comes via weekly claims data (covers the NFP survey week). DXY currently sits in a narrow 108.16-43 range. Focus will also be on US President Trump, who is set to appear in Davos at 16:00 GMT / 11:00 EST.

- EUR is flat vs the Dollar with EZ-macro drivers light other than an ongoing drip feed of rhetoric from various ECB speakers who have added little to the debate on the GC given that a 25bps cut next week is so nailed on. EUR/USD is back below its 50DMA at 1.0437 but maintaining a footing above the 1.04 mark after delving as low as 1.0391 in early trade.

- JPY is flat vs. the USD as mostly better-than-expected Japanese trade data did little to spur a reaction in the currency. Greater attention lies on Friday's BoJ policy announcement and Governor Ueda press conference. Policymakers are set to pull the trigger on a 25bps hike with such an outcome priced at around 95% following a slew of recent source reports suggesting that this is the case. USD/JPY is currently contained on a 156 handle within a 156.21-75 range.

- GBP is trivially softer vs. the USD and EUR with fresh macro drivers for the UK on the light side asides from messaging out of the UK government which is attempting to kickstart its growth agenda. Greater attention lies on tomorrow's PMI metrics. Cable is currently pivoting around the 1.23 mark.

- Antipodeans are both marginally softer vs. the USD and towards the bottom of the G10 leaderboard with downside coinciding with a downward drift in European equities.

- EUR/NOK was choppy after the Norges Bank kept its Key Policy Rate at 4.50% (as expected) and reiterated that the “the policy rate will likely be reduced in March”; the pair slipped to lows of 11.7269 from pre-announcement levels of around 11.74. CapEco thinks the path of inflation will allow the Bank to move "a bit more quickly", cutting by 25bps once per quarter until the policy rate reaches 3% in the middle of 2026.

- PBoC set USD/CNY mid-point at 7.1708 vs exp. 7.2826 (prev. 7.1696).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are modestly lower, in-fitting with peers; Potentially another relatively quiet session in terms of non-supply fixed drivers, with impetus potentially from weekly claims and then a virtual appearance by US President Trump in Davos at 16:00 GMT / 11:00 EST. USTs are modestly lower but also find themselves in a narrow 108-11+ to 108-19+ band. A brief bounce in EGB's following strong French/UK auctions were not seen in USTs, hence still reside at lows.

- Bunds hold a slight bearish bias, arising despite the pressure seen in equities. Downside which is relatively minimal in nature and as such is potentially not worth reading into significantly with no clear or overt driver behind it in recent trade and as it continues the bearish-trend WTD as we continue to await a significant tariff update from Trump who is scheduled at 16:00GMT. Bunds bounced off a 131.70 trough following a strong French/UK auction, but the pressure returned soon after to make a fresh session low at 131.57.

- OATs underperformed into their supply which likely saw a record amount offered for and bid on the exclusively shorter-dated tap. An outing which was very strong across the board and as such OATs have picked up by around 20 ticks from the 122.48 session low following the bidding deadline passing. However, the benchmark remains in the red.

- Gilts are also in the red. UK specifics light aside from some incremental updates around potential closer trade ties with the EU, though nothing concrete/significant has emerged on this yet. A strong UK 2028 auction, saw the b/c top 3x, and helped to boost Gilts by around 10 ticks from the bottom-end of a 91.74-92.05 band - though in-fitting with peers, pressure returned to take Gilts back to a fresh low of 91.67.

- UK sells GBP 4.25bln 4.375% 2028 Gilt Auction: b/c 3.2x (prev. 3.12x), average yield 4.384% (prev. 4.499%) & tail 0.2bps (prev. 1.0bps).

- France sells EUR 13bln vs exp. EUR 11-13bln 2.50% 2027, 5.50% 2029, 2.75% 2030 OAT auction.

- Click for a detailed summary

COMMODITIES

- Crude futures trade with a modest upward tilt in the absence of major newsflow during the European morning and after settling marginally lower yesterday following a choppy session. Brent Mar in a USD 78.60-79.31/bbl parameter.

- Precious metals are mostly softer as the dollar remains resilient but with broader newsflow light in the European morning thus far. Spot gold traded rangebound overnight and took a breather after recently advancing to its highest level in almost three months, currently in a USD 2,740.86-2,756.59/oz range.

- Base metals are lower across the board amid the tentative risk mood and with Trump's Chinese tariffs threats remaining a grey cloud over demand in the complex.

- Private inventory data (bbls): Crude +1.0mln (exp. -1.2mln), Distillate +1.9mln (exp. -0.0mln), Gasoline +3.2mln (exp. +2.3mln), Cushing +0.5mln.

- MMG (1208 HK) says Las Bambas copper production expected between 360k-400k tonnes in 2025; delivered copper production 15% higher in 2024; Zinc copper production in 2024 is 8% higher than 2023.

- EU reportedly plans to extend gas storage refill targets (main target of 90% full storage by Nov) ahead of winter for another year (set to expire Dec 2025), according to EU diplomats cited by Reuters.

- Click for a detailed summary

NOTABLE DATA RECAP

- French Business Climate Manufacturing (Jan) 95.0 (Prev. 97.0)

NOTABLE EUROPEAN HEADLINES

- ECB's Escriva says the ECB still has restrictive policy; need to be moving towards a neutral stance

- French Finance Minister Lombard says the 2024 deficit is seen coming in close to 6% of GDP.

- EU's Sefcovic says a pan-European customs area is something the bloc would consider as part of a "reset" discussion with the UK; BBC's understanding is that the gov't has begun consultations on joining the Pan-Euro-Mediterranean Convention.

- Norges Bank holds rates at 4.50% as expected; Reiterates “The policy rate will likely be reduced in March”. Click for details.

- The EU is to push AI, advanced research and clean tech in a bid to compete with the US, according to Bloomberg

NOTABLE US HEADLINES

- US President Trump set to tap health industry lobbyist Don Dempsey for top white house budget job, according to the FT. The FT say this appointment would deal a blow to Robert F. Kennedy Jr's hopes of overhauling the sector.

- BofA total card spending (week to 18th) +5.6% Y/Y (vs +2.2% average in Dec).

- US President Trump said he doesn't care if Congress does one bill or two bills for reconciliation, while he stated regarding FEMA that he would rather see states take care of their own problems during a pre-recorded interview on Fox News.

- US President Trump announced Andrew F. Puzder will serve as the next US Ambassador to the EU.

- US Senate Committee will hold a confirmation hearing on January 29th for President Trump's Secretary of Commerce nominee Howard Lutnick.

- Saudi Crown Prince MBS spoke with US President Trump on the phone and said the kingdom seeks to increase its investments and trade with the US by at least USD 600bln in the next four years, while the Saudi Crown Prince said the expected reforms under Trump's administration could create "unprecedented economic prosperity".

- Russia's Kremlin on US President Trump threat of sanctions and tariffs on Russia, says "we do not see any particularly new elements here"; "we remain ready for equal and mutually respectful dialogue".

- UK's CMA to investigate Apple (AAPL) and Google's (GOOGL) mobile ecosystem; investigation will determine if Apple and Google have strategic market status in their mobile ecosystems, including op. system, app stores and mobile browsers.

GEOPOLITICS

MIDDLE EAST

- "Heavy Israeli tank fire on city centre Rafah Southern Gaza Strip", according to Al Jazeera.

- US Secretary of State Rubio spoke to Israeli PM Netanyahu and conveyed that he looks forward to addressing threats posed by Iran.

- White House designated Yemen's Houthi movement as a foreign terrorist organisation and said the policy of the US is to cooperate with regional partners to eliminate Houthis' capabilities and operations.

RUSSIA-UKRAINE

- "A senior European source told me this week yes, Russia has significantly escalated sabotage and it poses a real threat. But there’s a danger of adding 2 + 2 and getting five, concluding that Russia is deliberately behind everything", via to WSJ's Norman.

- Military administration in Zaporizhia reported 4 explosions in the city of Zaporizhia in southeastern Ukraine due to Russian missile shelling, according to Al Jazeera.

OTHER NEWS

- US Secretary of State Rubio spoke to Venezuela's Edmundo González Urrutia and María Corina Machado on Wednesday, while he reaffirmed US support for the restoration of democracy in Venezuela and the immediate release of all political prisoners. Rubio also spoke with South Korean Foreign Minister Cho held a phone call and stated that the US-South Korea alliance is the linchpin of regional peace and security. Furthermore, he spoke to the Philippines Secretary of Foreign Affairs about China's dangerous and destabilising actions in the South China Sea.

CRYPTO

- Bitcoin is weaker today and has slipped below USD 102k; Ethereum also edges lower and back to USD 3.1k handle.

APAC TRADE

- APAC stocks traded somewhat mixed albeit with a mostly positive bias after the gains on Wall St where the S&P 500 printed a fresh record high and the Nasdaq led amid strength in tech and communications, while outperformance was seen in mainland China after Beijing announced efforts to support the stock market in a capital markets briefing.

- ASX 200 was pressured by underperformance in miners following several quarterly production updates, with tech and telecoms the only sectors that showed some resilience.

- Nikkei 225 climbed above the 40,000 level following recent yen weakness and mostly better-than-expected trade data.

- Hang Seng and Shanghai Comp were both initially underpinned with brokerage stocks lifted after the capital markets briefing in Beijing where officials from the CSRC, financial regulator and PBoC announced efforts to boost stocks with China to direct medium and long-term funds towards market investment, while there will be at least hundreds of billions of yuan of new long-term capital for A-shares every year from state-owned insurance companies. However, the Hong Kong benchmark eventually gave back the gains.

NOTABLE ASIA-PAC HEADLINES

- BoJ is poised to vote for a rate hike at tomorrow's meeting, according to Nikkei sources. The BOJ has so far viewed the economic and market conditions following Trump's inauguration as being relatively calm. The bank considered forgoing any hike if the inauguration resulted in a rollercoaster market ride, but several officials believe that "the situation is such that the bank can raise interest rates as expected."

- A record number of US companies are considering moving some of their operations out of China or are in the process of doing so, according to a study cited by the FT.

- ByteDance earmarks over CNY 150bln in Capex for 2025 mostly targeting AI; NVIDIA (NVDA) and Huawei expected to benefit from ByteDance spending, according to Reuters sources

- China's Vice Premier says China stands ready to increase understanding and mutual trust with the Netherlands.

- Nissan (7201 JT) is reportedly to procure EV batteries from SK's (034730 KS) SK ON for the US market, via Nikkei; agreed to supply 20GWh worth of batteries.

- China's MOFCOM, on US President Trump's tariff threats, says tariffs are not good for China, US, and the world; China willing to work with US to promote stable, healthy development of economic and trade ties.

- China CSRC chief said China will direct medium and long-term funds towards market investment and there will be at least hundreds of billions of yuan of new long-term capital for A-shares every year from state-owned insurance companies, while a pilot scheme of insurers buying stocks is to be implemented in H1 2025 with scales of at least CNY 100bln. Furthermore, public funds are to increase A-share holdings by at least 10% annually over the next 3 years and China will guide fund companies to buy their own equity funds using some of their profits.

- China's financial regulator vice head said they will encourage major state insurers to use 30% of their newly generated premium incomes for stock investment, while a PBoC official said they will expand the scope and increase the scale of liquidity tools to fund share purchases at the proper time.

DATA RECAP

- Japanese Trade Balance Total Yen (Dec) 130.9B vs. Exp. -53.0B (Prev. -110.3B)

- Japanese Exports YY (Dec) 2.8% vs. Exp. 2.3% (Prev. 3.8%); Imports YY (Dec) 1.8% vs. Exp. 2.6% (Prev. -3.8%)

- South Korean GDP QQ (Q4 A) 0.1% vs. Exp. 0.2% (Prev. 0.1%); YY (Q4 A) 1.2% vs. Exp. 1.4% (Prev. 1.5%)