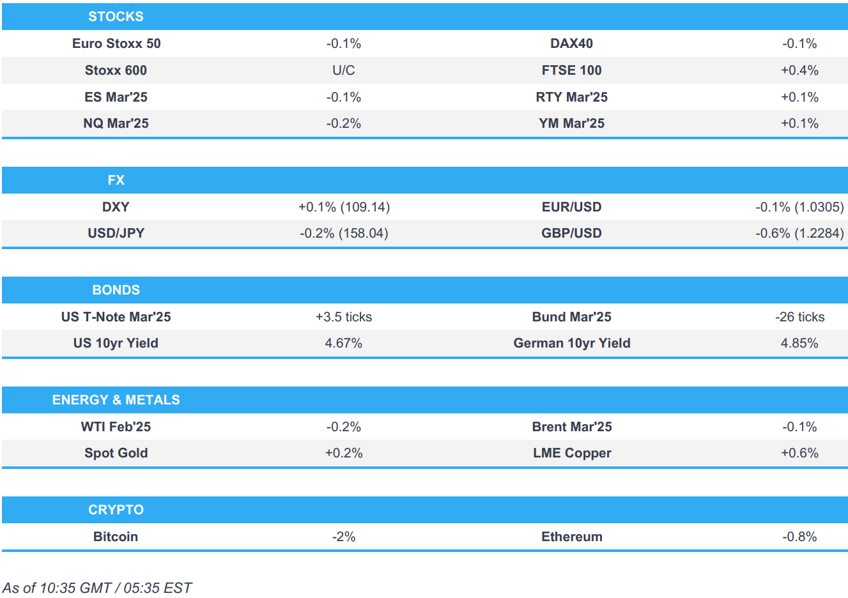

- European bourses are mixed whilst US is away amid the National Day of Mourning in honour of President Jimmy Carter.

- Pound under pressure as Cable hangs by a thread; DXY broadly firmer vs peers (ex-JPY).

- Gilts gap lower and hit 89.00 but have since pared into an imminent parliamentary question, hefty European supply well received.

- Subdued trade in energy but base metals tilt higher.

- Looking ahead, Fed's Harker, Collins, Barkin, Schmid, Bowman and BoE's Breeden.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses began the European morning with a strong negative bias, but sentiment has since improved to display a more mixed picture.

- European sectors are mixed vs initially opening with a negative tilt. Basic Resources is by far the clear outperformer today, benefiting from broad-based strength in underlying metals prices (following Chinese inflation data overnight). Retail bottoms the index and is the clear underperformer today, after a few trading updates from UK retailers, which highlighted future cost pressures as a result of the Autumn Budget.

- US equity futures reside in negative territory, with modest underperformance in the NQ; as a reminder, cash markets are shut on account of the National Day of Mourning in honour of President Jimmy Carter.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is broadly firmer vs. peers (ex-JPY). Harker, Collins, Barkin, Schmid, Bowman. As it stands, with January widely expected to see an unchanged rate from the FOMC, the March meeting has around 11bps of loosening. Note, today sees no trade for the US stock market and on account of mourning for former President Jimmy Carter - volumes will be lighter than normal.

- EUR is marginally softer vs. the USD. Updates from the Eurozone have seen a better-than-expected outturn for German Industrial Output. However, this appeared to be more of a bounce back from recent softness rather than the start of a noteworthy recovery in German. EUR/USD has just about managed to reclaim the 1.03 level after printing a WTD low yesterday at 1.0273.

- JPY is the only of the majors that is firmer vs. the USD. JPY has been lent a helping hand by firmer-than-expected labour cash earnings which supports the case for the BoJ to resume rate hikes. Elsewhere, the BoJ' Nagoya Branch Manager attempted to jawbone JPY, stating that excess FX volatility is undesirable, important for it to move stably. USD/JPY has been as high as 158.39 but is yet to approach yesterday's multi-month peak at 158.55.

- GBP is once again at the foot of the G10 leaderboard as the ongoing spike in UK yields shows no signs of abating. Accordingly, Cable cracked 1.23 to the downside for the first time since November 2023 (1.2240 is the current low), whilst EUR/GBP briefly took out 0.84 to the upside for the first time since 4th November 2024.

- Antipodeans are both near the foot of the G10 leaderboard vs. the USD as risk sentiment remains soggy and Chinese price data remained lacklustre overnight. AUD/USD was unfazed by mixed data in which the trade balance printed a larger-than-expected surplus, imports and exports improved, although Retail Sales disappointed.

- PBoC set USD/CNY mid-point at 7.1886 vs exp. 7.3159 (prev. 7.1887).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- No respite at the open with Gilts gapping lower by 78 ticks and then extending to an 89.00 low, which of course marked yet another contract trough. Since, Gilts have pared much of this downside and have at times been back within reach of the 90.00 mark, though still markedly in the red, as such yields are off highs with the 10yr around 4.85%.

- Ahead, an urgent question has been granted in parliament today to discuss the “growing pressure of borrowing costs on public finances”; the question will be heard around 10:30GMT and while Chancellor Reeves should theoretically be there to respond, it remains to be seen if that will be the case.

- USTs are just about in the green, a light data docket on account of the Federal Holiday for former President Carter though we still get December’s Challenger Layoffs. Currently at the mid-point of a 108-05 to 108-11+ band. Ahead, a slew of Fed speakers dotted throughout the day.

- Bunds are pressured having moved in tandem with Gilts in the early morning, and since rebounded off 131.34 lows. EGBs generally, and particularly OATs, heavy into supply with Spain and more pertinently France in the market. The Spanish auction was somewhat mixed with nearly the full amount sold though some of the lines saw weak demand. Following the Spanish results a bout of modest pressure was seen in EGBs, but a decent French outing helped to lift Bunds off worst levels.

- Spain sells EUR 6.22bln vs exp. EUR 5.5-6.5bln 2.40% 2028, 3.10% 2031, 2.90% 2046 Bono & EUR 0.515bln vs. Exp. 0.25-0.75bln 2.05% 2039 I/L.

- France sells EUR 12.997bln vs exp. EUR 11-13bln 3.0% 2034, 1.25% 2036, 2.50% 2043, and 3.25% 2055 OAT Auctions

- PIMCO says it "still likes UK Gilts", says much of the rise in yields has been US-led, changes to spending cuts or tax increases rise if gilt yields continue to climb and slowing growth persists.

- Click for a detailed summary

COMMODITIES

- A subdued session for the crude complex thus far as the dollar holds an upward bias, with broader sentiment also flimsy following this week's hot US data, UK bond market turmoil, and tariffs threats ahead of US President Trump's inauguration. Brent Mar sits in a USD 75.68-76.36/bbl parameter.

- Precious metals hold an upward bias across the board, albeit modestly, with some demand seen given the cautious risk tone across markets, and with little action seen on the FOMC minutes yesterday. Spot gold resides in a current USD 2,655.63-2,666.98/oz range vs yesterday's USD 2,645.37-2,670.15/oz, with the 50 DMA seen at USD 2,650/oz.

- Copper futures remain underpinned following yesterday's advances and after Chinese CPI data printed in line with expectations overnight. Gains were maintained throughout the European morning thus far despite the resilient dollar and cautious risk tone. 3M LME copper remains north of USD 9,000/t in a current USD 9,029.50-9,103.00/t parameter.

- Citi sees US Henry Hub prices likely to be supported by an extended cold wave in the short-term with upside potential for Q2-Q4 2025 and said prices are likely to rise further to mid-USD 4/mmbtu range in Q2-Q4 2025.

- Norway's 2025 Natural Gas output seen at 120.4 BCM (prev. guided 120.6 BCM); crude oil output seen at 10.2MCM (prev. guided 108.7 MCM).

- India is to reportedly sign a prelim mining pact with Mongolia soon, according to Reuters sources.

- Iraq sets Feb Basrah medium crude OSP to Asia at USD + 0.05/bbl (prev. USD -0.60/bbl) to Oman/Dubai average; Feb Basrah medium Crude OSP to Europe at USD -4.0/bbl vs dated brent (prev. USD -5.5/bbl), according to SOMO. Feb Basrah medium crude OSP to North and South America at USD -1.05/bbl vs ASCI.

- Russia's Kremlin says there are still countries in Europe which are interested in "more competitive" Russian gas.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK BRC Shop Price Index YY (Dec) -1.0% vs Exp. -0.4% (Prev. -0.6%)

- German Trade Balance, EUR, SA (Nov) 19.7B vs. Exp. 14.8B (Prev. 13.4B); Exports MM 2.1% vs. Exp. 2.0% (Prev. -2.8%); Imports MM -3.3% vs. Exp. 0.7% (Prev. -0.1%)

NOTABLE EUROPEAN HEADLINES

- Reports that an 'urgent question' on the UK market turmoil has been granted, via Sun's Cole.

- BoE Monthly Decision Maker Panel data - December 2024. Expectations for CPI inflation a year ahead rose from 2.7% to 2.8% in the three months to December. The three-year ahead CPI inflation expectations was 2.7% in the three months to December, 0.1 percentage points higher than the three months to November.

- UK Chancellor Reeves will favour fresh cuts to public spending over tax hikes if soaring UK borrowing costs wipe out her fiscal headroom, while Reeves later stated that meeting the government's fiscal rules is non-negotiable and the government will have an iron grip on public finances, according to Sky News.

- ECB's Cipollone said monetary policy should let Euro zone economy run at potential, according to Corriere.

- German engineering orders -6% Y/Y in November (Domestic orders -4%, Foreign -7%), according to VDMA; Sept-Nov orders -7% Y/Y (Domestic orders -5%, Foreign orders -8%).

NOTABLE US HEADLINES

- US President-Elect Trump, during a closed door meeting, backed US House Speaker Johnson's preferred strategy on budget reconciliation - a package covering tax & spending cuts, immigration & energy policy, according to Punchbowl.

- US President Biden declared California wildfires to be a major disaster and he cancelled his upcoming trip to Italy due to the California wildfires, while it was also reported that a mandatory evacuation order was imposed on Hollywood after a new fire erupted, according to AFP.

- US President-elect Trump says after meeting with Republicans in Congress that whether it is one or two bills to pass his agenda, something will be done, while he added that China is running the Panama Canal and "that's not going to happen either".

- US dockworkers and port employers reached an agreement to avert a strike, according to Bloomberg.

GEOPOLITICS

- US official says President Biden is set to announce new sanctions targeting Russian economy this week. Likely to also sanction more Chinese entities for supporting Russia. US official says long-range ATACMS missiles, F-16 fighter jets and Abrams tanks have not been a game changer for Ukraine against Russia. US is studying North Korean military operations in Ukraine to "understand lessons for Asia"

- US and Arab mediators have made some progress in Gaza peace talks, no deal yet, according to Reuters sources. Breakthrough when it comes to narrowing old existing gaps, but there is still no deal yet, says a Palestinian official

- Houthi media reported US-British bombing of targets in Sanaa, Amran and Hodeidah with six raids, while the Pentagon later confirmed that Central Command carried out strikes against two Houthi facilities and said that strikes were carried out in Yemen as part of efforts to weaken Houthi capabilities.

- Russia's Kremlin says there have been no contact between US President-elect Trump and Russia President Putin yet

CRYPTO

- Bitcoin continues to slip and edges below USD 94k; Ethereum holds around USD 3.3k.

- US President-elect Trump's transition team has interviewed at least a half dozen candidates to fill the role of chairman of the CFTC which will likely be the lead regulator of the USD 3.5tln crypto industry, according to Fox Business's Gasparino.

APAC TRADE

- APAC stocks were mostly negative following the cautious mood in global counterparts amid the recent UK bond market turmoil and Trump tariff reports.

- ASX 200 was dragged lower amid pressure in industrials, tech and the consumer sectors, while the data was mixed with a larger-than-expected Trade Surplus and an improvement in both monthly Exports and Imports, although Retail Sales disappointed.

- Nikkei 225 underperformed following firmer-than-expected labour cash earnings which supports the case for the BoJ to resume rate hikes, while participants also awaited after-market earnings releases including from index heavyweight Fast Retailing.

- Hang Seng and Shanghai Comp were ultimately subdued but with price action indecisive amid ongoing trade-related concerns, while participants digested the latest Chinese inflation data in which Consumer Prices matched forecasts but printed at a 9-month low and factory gate prices remained in deflation territory albeit at a slightly slower-than-expected pace of decline.

NOTABLE ASIA-PAC HEADLINES

- MOFCOM says it will ask EU to adjust relevant practices in foreign subsidy probes, after it determines EU probes constitute trade and investment barriers, according to the Global Times

- China 2024 passenger car sales: 23.1mln, Dec car sales: 2.66mln (vs 2.45mln sold in Nov, +16.6% Y/Y), according to China's CPCA. Tesla (TSLA) exported 10,839 China-made cars in December (5366 in Nov) (18,334 in 2023).

- China's CPCA says China car sales are estimated to grow 2% in 2025, EV sales estimated to rise 20%, and make up 57% of China's total car sales in 2025. Car export growth estimated to slow to 10% in 2025. Exports for EVs estimated to see no growth.

- US President Biden's administration plans additional curbs on exports of AI chips from Nvidia (NVDA) and AMD (AMD) in the final days of the administration, while it was also reported that the White House is rushing to finish cyber order after China hacks, according to Bloomberg.

- China's MOFCOM said regarding the investigation into unfair EU trade barriers that it concluded EU's measures constitute trade and investment barriers.

- China 2024 passenger car sales: 23.1mln, Dec car sales: 2.66mln (vs 2.45mln sold in Nov, +16.6% Y/Y), according to China's CPCA.

- Fast Retailing (9983 JT) Q1 (JPY): Operating Profit 157.56bln (exp. 157.81bln, prev. 146.69bln), Net 131.9bln (prev. 107.8bln Y/Y), Revenue 895.19bln (prev. 810.83bln); Co. affirms FY25 net, Operating Profit and Revenue guidance.

- BoJ Osaka Branch Manager says compared to the prior year, more large firms in the region are expressing willingness to hike wages earlier than before; significant number of firms are keen to hike pay, so expect solid wage hikes in 2025 wage talks. Rising import costs/commodity prices have moderated, concern over sharp inflation risk has not increased much.

- BoJ's Nagoya Branch Manager says some firms, incl. smaller ones, are considering increasing wages this year at/above last year's pace.

DATA RECAP

- Chinese CPI MM (Dec) 0.0% vs. Exp. 0.0% (Prev. -0.6%); YY 0.1% vs. Exp. 0.1% (Prev. 0.2%)

- Chinese PPI YY (Dec) -2.3% vs. Exp. -2.4% (Prev. -2.5%)

- Japanese Overall Lab Cash Earnings (Nov) 3.0% vs. Exp. 2.7% (Prev. 2.6%, Rev. 2.2%)

- Australian Trade Balance (AUD)(Nov) 7079M vs. Exp. 5750M (Prev. 5953M)

- Australian Goods/Services Exports (Nov) 4.8% (Prev. 3.6%)

- Australian Goods/Services Imports (Nov) 1.7% (Prev. 0.1%)

- Australian Retail Sales MM Final (Nov) 0.8% vs. Exp. 1.0% (Prev. 0.6%)