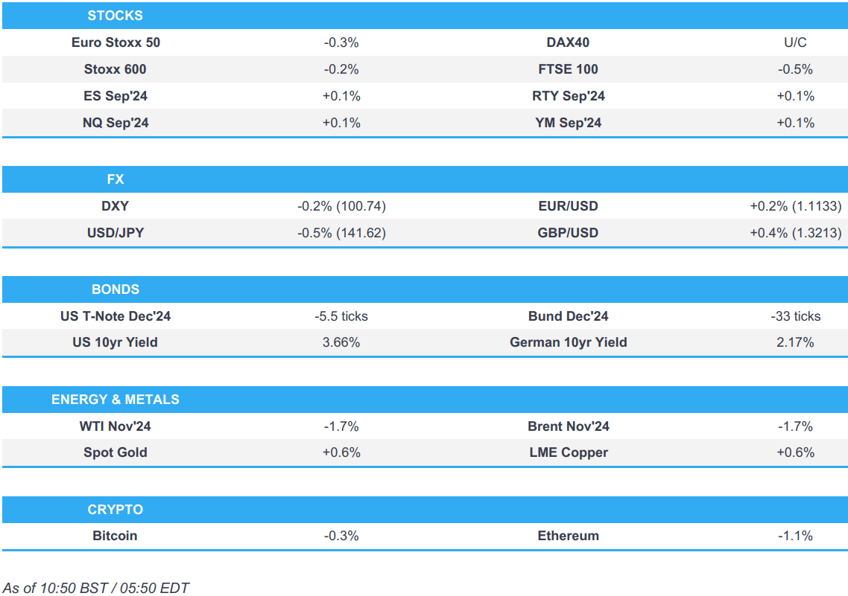

- European bourses are slightly lower whilst US futures see very modest gains ahead of the FOMC announcement

- Dollar is slightly softer, Kiwi outperforms, with JPY also stronger

- Bonds are at lows, Gilts underperform following the region’s UK inflation report which saw Services & Core Y/Y print above expectations

- Crude resides near lows and took another leg lower amid reports that Russia could hold off oil export cuts, XAU/base metals gain

- Looking ahead, US Building Permits, FOMC Policy Announcement & Press Conference, BCB Policy Announcement, BoC Minutes, Earnings from General Mills.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (-0.3%) began the session mixed/modestly lower, and slowly dipped lower as the morning progressed.

- European sectors hold a strong negative tilt; Optimised Personal Care tops the pile, propped up by gains in Reckitt, amid asset-sale related reports. Healthcare is found at the foot of the pile, hampered by losses in Novo Nordisk (-2.1%) after it was reported that Ozempic is “very likely” to be part of the next US price cut negotiations.

- US Equity Futures (ES +0.1%, NQ +0.1%, RTY +0.1%) are indicative of a very modestly firmer open, with traders mindful of today’s FOMC Policy Announcement, where the Fed is expected to deliver its first rate cut in 4 years.

- Alphabet's Google (GOOGL) wins court challenge against EUR 1.49bln EU antitrust fine

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is softer with all focus today on the FOMC rate decision. Heading into the release, markets assign a circa 60% chance of a 50bps reduction and a 40% chance of a 25bps move. DXY is currently within yesterday's 100.56-101.02 range. The YTD low sits at 100.51.

- EUR is a touch firmer vs. the USD with fresh EZ drivers lacking as policymakers continue to downplay the chances of a rate cut next month; currently trading around 1.1130.

- GBP is firmer vs. the USD and EUR in the wake of the latest UK inflation data which printed in-line on a headline Y/Y basis but slightly firmer for core and services. Cable is now back on a 1.32 handle but below yesterday's 1.3230 peak.

- JPY is firmer vs. the USD on a day which will contrast the respective policy paths of the Fed and BoJ. An extension of the downside could see the pair revisit the sub-140 levels.

- AUD/USD has extended its rally seen since the start of the week which has taken it from a 0.6697 base to a 0.6779 peak. NZD/USD is also on the rise with the pair gaining a firmer footing on a 0.62 handle.

- PBoC set USD/CNY mid-point at 7.0870 vs exp. 7.0828 (prev. 7.1030).

- BoC Deputy Governor Rogers said that the Bank wishes to see more progress on core inflation measures, adding that "there is still work to do", according to Bloomberg.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are lower and towards the bottom end of today's 115-06+ to 115-13+ parameters. All eyes are on the Fed. The odds of a 50bps cut are currently just above the 60% mark with just under a 40% chance of a 25bps move.

- Gilts are underperforming. Despite an in-line headline print and mitigating factors from base effects and the prior survey period, slightly hotter-than-expected core and services Y/Y UK inflation points have sparked a modest hawkish reaction in Gilts.

- Bunds are pressured, in-fitting with peers. Specifics are somewhat light for EGBs with markets generally awaiting the FOMC. Bunds at the low-end of a 134.49-134.86 band, similarly to Gilts there is now limited support until the 134.00 mark. EZ HICP (Final) passed without reaction.

- German Debt Agency says issue of green federal security scheduled for November 5th has been cancelled.

- UK sells GBP 2.75bln 0.875% 2033 Green Gilt: b/c 3.55x (prev. 3.52x), average yield 3.731% (prev. 4.072%) and tail 0.9bps (prev. 0.7bps).

- Germany sells EUR 0.814bln vs exp. EUR 1bln 1.80% 2053 Bund and EUR 0.82bln vs exp. EUR 1bln 2.50% 2054 Bund.

- Click for a detailed summary

COMMODITIES

- Softer trade across the crude complex after the weekly Private Inventory data showed a surprise build in headline crude and larger-than-expected builds in other components of the release, which helped to pare some of the geopolitcal induced headlines seen in the prior session. The complex then took another leg lower amid Reuters reports which suggested Russia could hold off oil export cuts in October due to domestic refineries maintenance. Brent'Nov trades towards the bottom end of today's USD 72.42-73.77/bbl intraday parameter.

- Flat/slightly firmer trade in precious metals as traders bide time ahead of the FOMC announcement whereby the main question around the Fed’s decision is the magnitude of the rate cut to kick off its easing cycle, with a 25 or 50 basis point cut under consideration.

- Base metals are on a firmer footing following early weakness as the DXY eased off best levels and after sentiment around Chinese markets recovered on their first day back from the long weekend, with Mainland China offered the first chance to react to its sub-par activity data from the weekend.

- US Private Energy Inventories (bbls): Crude +2.0mln (exp. -0.5mln), Distillate +2.3mln (exp. +0.6mln), Gasoline +2.3mln (exp. +0.2mln), Cushing -1.4mln.

- PBF's 166k BPD Torrance California refinery reports unplanned flaring due to malfunction.

- Russia's Kremlin, on Norway and elevated levels of caesium-137, says there is no alerts from Russian services about the high levels of such isotopes in the atmosphere.

- Russia could hold off oil export cuts in October due to domestic refineries maintenance, according to traders cited by Reuters; sources expect a small rise of exports by around several hundred thousands. Primorsk and Ust-Luga for September has been revised higher by 0.2mln tons to 6.2mln tons, sources state.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK CPI YY (Aug) 2.2% vs. Exp. 2.2% (Prev. 2.2%); Core YY 3.6% vs. Exp. 3.5% (Prev. 3.3%); Services YY 5.60% vs. Exp. 5.50% (Prev. 5.20%)

- UK CPI MM (Aug) 0.3% vs. Exp. 0.3% (Prev. -0.2%); Core MM 0.4% vs. Exp. 0.4% (Prev. 0.1%); Services MM 0.4% vs. Exp. 0.50% (Prev. 0.50%)

- EU HICP Final YY (Aug) 2.2% vs. Exp. 2.2% (Prev. 2.2%)

- South African Core Inflation YY (Aug) 4.1% vs. Exp. 4.2% (Prev. 4.3%); CPI YY (Aug) 4.4% vs. Exp. 4.5% (Prev. 4.6%); CPI MM (Aug) 0.1% vs. Exp. 0.2% (Prev. 0.4%)

NOTABLE EUROPEAN HEADLINES

- Irish Central Bank lowered its 2024 HICP forecast to 1.6% from 1.7% and 2025 HICP forecast to 1.9% from 2.0%, while it cut its 2024 GDP forecast to -0.9% from 1.9% and raised 2025 GDP forecast to 4.6% from 4.4%. Furthermore, it stated that economic growth risks are tilted to the downside and risks to the inflation outlook are broadly balanced.

- The Times' BoE Shadow MPC said the Bank should leave rates unchanged whilst increasing the rate at which it reduces its balance sheet from GBP 100bln per year to GBP 120bln.

- ECB's Villeroy says the ECB is likely to continue cutting rates. Regarding France: the plan to cut the deficit would need a balance of around 75% from savings and 25% from higher taxes; for some big firms, could envisage extra effort being made in relation to their taxes.

- Maersk (MAERSKB DC) says due to significant terminal congestions in the Mediterranean and Asia ports, are experiencing substantial delays in vessel schedules. These congestions have resulted in extended waiting times at various ports, impacting ability to maintain a regular schedules.

- UK ONS says house prices increased by 2.2% to GBP 290,000 in 12 months to July 2024.

- Spain's Economy Ministry revises down 2023 debt-to-GDP ratio by three percentage points, to 105%

NOTABLE US HEADLINES

- Former Atlanta Fed President Lockhart said he sees a normal 25bps rate cut by the Fed but wouldn't be surprised by 50bps.

- China's Foreign Ministry says it is taking countermeasures against some US firms regarding their weapons sales to Taiwan; measures incl. freezing property within China owned by the firms.

GEOPOLITICS

MIDDLE EAST

- At least 2,750 were injured and 9 died in the pager detonation incident across Lebanon, while the Lebanese Information Minister said the government condemned the pagers detonation as '"Israeli aggression". Furthermore, Hezbollah promised to retaliate after blaming Israel for detonating pagers on Tuesday and Hezbollah Chief Nasrallah was reportedly not harmed in the pager blasts, according to a Senior Hezbollah source cited by Reuters.

- Israeli press cited sources that warned Hezbollah will pay a heavy price if it chooses escalation, according to Al Jazeera. It was also reported that senior Israeli military officials are preparing for a third Hezbollah War which is expected to begin almost immediately, according to Israel's Channel 14. Furthermore, the security and military weight will shift from the Gaza Strip to the northern front, according to Al Jazeera citing Israel's Channel 14.

- US officials cited by NYT stated that Hezbollah's communication devices are Taiwanese and were hacked before they reached Lebanon, while they added that Israel hid explosives inside a batch of Taiwanese pagers imported into Lebanon.

- Taiwan's Gold Apollo founder said the pagers in the Lebanon explosions were not made by the company and had their brand but production had been outsourced and were made by a company in Europe. Gold Apollo later stated that a company called BAC made the pagers used in the Lebanon blasts.

- "IDF Radio: Raising the alert level in air defense systems and air forces in anticipation of an attack by Hezbollah", according to Al Jazeera.

- "Israeli media: The commander of the Northern Command presented the Chief of Staff and the political level with a series of plans to launch a ground operation in Lebanon", according to Cairo News.

OTHER

- Russia's Tver regional governor ordered a partial evacuation of Toropets town after a Ukrainian drone attack sparked a fire.

- North Korea fired suspected ballistic missiles which fell shortly after and appeared to have landed outside of Japan's Exclusive Economic Zone.

- Taiwan's Defence Ministry said a Chinese aircraft carrier group sailed through waters to the northeast of Taiwan on Wednesday and then sailed to the southeast of Japan's Yonaguni island, while NHK reported that a Chinese navy aircraft carrier temporarily entered Japan's contiguous waters in a first such entry.

CRYPTO

- Bitcoin is incrementally softer and trades just below USD 60k.

APAC TRADE

- APAC stocks were mostly rangebound with participants lacking conviction heading into the crucial Fed policy decision.

- ASX 200 was contained amid light macro newsflow and a quiet overnight calendar heading into this week's central bank updates.

- Nikkei 225 initially rallied on currency weakness but then reversed course and briefly wiped out its gains after mixed data and as the JPY nursed some of its losses.

- Some BoJ policymakers are reportedly worried that they may not be able to increase interest rates much further as a stronger JPY would result in cheaper imports, slow inflation and impact corporate earnings, via WSJ citing sources.

- Shanghai Comp initially struggled for direction on return from the holiday closures before retreating below the 2,700 level. Hong Kong participants were absent from the market, while the weak activity data from over the weekend had little impact and the PBoC delayed its MLF operations once again.

NOTABLE ASIA-PAC HEADLINES

- PBoC said it will conduct a Medium-term Lending Facility loan rollover on September 25th.

- US is urging Vietnam to avoid Chinese cable-laying firm HMN Technologies and other Chinese companies in its plans to build new undersea cables, while Washington shared intelligence with Hanoi about possible cable sabotage.

- China's Ministry of Culture and Tourism says there was a 6.3% increase in domestic trips during this year's mid autumn festival holiday since 2019, reaching 107mln trips.

- Japan's Government says the economy is in moderate recovery; they keep economic assessment unchanged in September from August.

- Chinese FX regulator says global financial environment expected to improve as developed economies start rate cutting cycle. China's FX market becomes more resilient, it will continue to play a positive role in stabilising market expectations and trading. Foreign institutes continued to increase China bond holdings in August. Foreign willingness to allocate Yuan assets remains stable.

DATA RECAP

- Japanese Machinery Orders MM (Jul) -0.1% vs. Exp. 0.5% (Prev. 2.1%); YY 8.7% vs. Exp. 4.2% (Prev. -1.7%)

- Japanese Trade Balance Total (JPY)(Aug) -695.3B vs. Exp. -1380.0B (Prev. -621.8B, Rev. -628.7B)

- Japanese Exports YY (Aug) 5.6% vs. Exp. 10.0% (Prev. 10.3%, Rev. 10.2%); Imports 2.3% vs. Exp. 13.4% (Prev. 16.6%)