Just days after a Wall Street Journal report suggested that chip giant Qualcomm floated a takeover of struggling chipmaker Intel, a new report says Apollo Global Management has proposed a multibillion-dollar investment to support Intel's turnaround efforts.

Bloomberg reported, citing sources familiar with the matter, that Apollo recently proposed an equity-like investment of up to $5 billion to Intel's management. The people said Intel execs were mulling over the proposal. There were no definites, as the investment could change or fall apart.

On Monday morning, Evercore's Roger Altman told CNBC that he couldn't comment on Intel, which suggests his involvement on the advisory side of the deal (or representing another client). In other words, Evercore is representing a potential buyer.

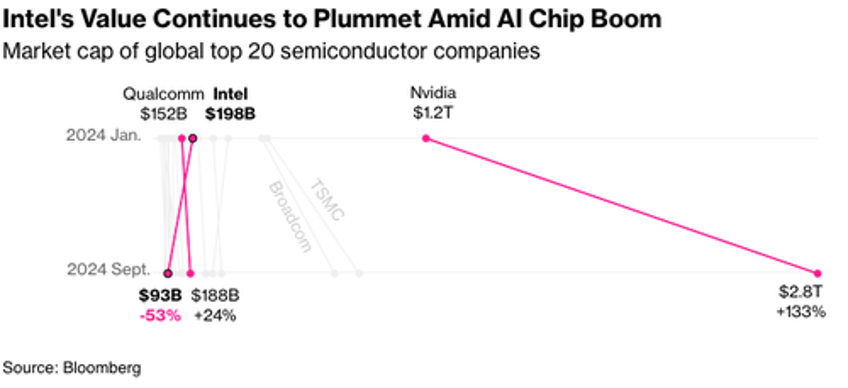

Intel's fall from grace has been nothing short of spectacular. If you can believe it, the chipmaker was once the world's most valuable chip company. As of Friday's close, its shares had fallen 56.5% so far this year. Shares of Intel are up nearly 4% in premarket trading in New York on the Apollo news.

Left behind in the AI boom...

Intel CEO Pat Gelsinger made a series of announcements last week to accelerate the turnaround strategy, including a multibillion-dollar deal with Amazon Web Services.

The wagons are certainly circling around struggling Intel.

"And when he had opened the fourth seal, I heard the voice of the fourth beast say, Come and see. And I looked, and behold a pale horse: and his name that sat on him was Death, and Hell followed with him." Revelation 6:7 https://t.co/MxEE6P2YJq

— zerohedge (@zerohedge) September 20, 2024

And maybe Gelsinger's prayers are being answered.