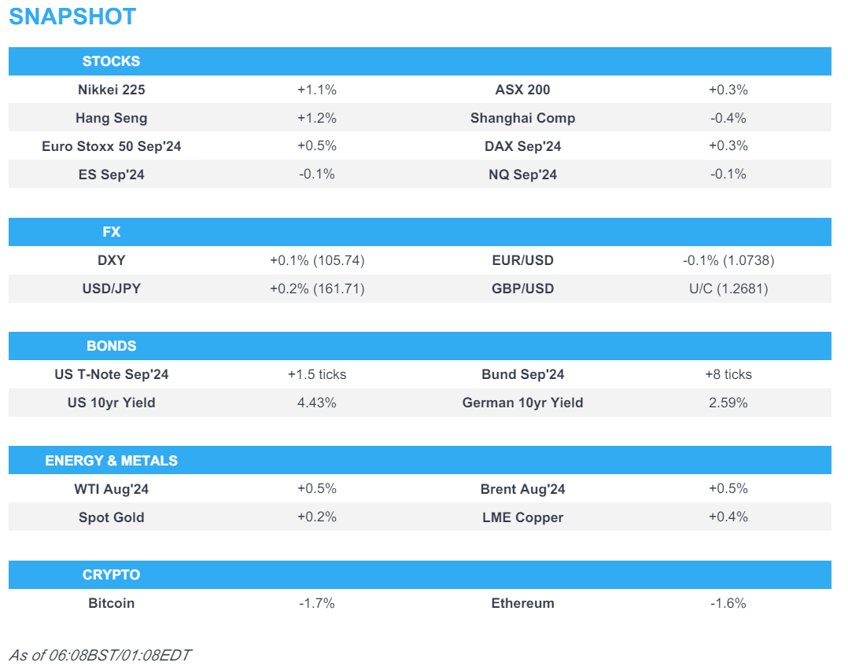

- APAC stocks mostly took impetus from the gains on Wall St where the S&P 500 and Nasdaq posted record closes.

- European equity futures indicate a firmer open with Euro Stoxx 50 future +0.5% after the cash market closed lower by 0.5% on Tuesday.

- DXY remains sub-106, EUR/USD has pivoted around the 1.0750 mark, USD/JPY is in close proximity to its multi-decade high.

- Bunds have edged mild gains, oil futures were supported by a large draw in private crude inventories.

- Looking ahead, highlights include EZ, UK & US Final PMIs, US ADP, IJC, Challenger, Factory Goods, ISM Services, FOMC Minutes, Riksbank Minutes, NBP Policy Announcement, Fed's Williams, ECB's Lane, Lagarde, de Guindos, Cipollone & Knot, Supply from Germany.

- Note, US markets will close early ahead of the Independence Day holiday.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks finished positive in which the S&P 500 and Nasdaq printed fresh record closes with sentiment helped amid slightly softer yields and dovish-leaning comments from Fed Chair Powell who said they have made quite a bit of progress on inflation and are getting back on the disinflationary path, while the data calendar was quiet although JOLTS topped estimates and pointed to a hot labour market.

- SPX +0.62% at 5,509, NDX +1.01% at 20,012, DJI +0.41% at 39,332, RUT +0.19% at 2,034.

- Click here for a detailed summary.

NOTABLE HEADLINES

- US judge postponed former President Trump's sentencing in the hush-money case to September 18th.

APAC TRADE

EQUITIES

- APAC stocks mostly took impetus from the gains on Wall St where the S&P 500 and Nasdaq posted record closes amid softer yields and dovish-leaning comments from Fed Chair Powell, although gains were capped and China lagged on weak Caixin PMI data.

- ASX 200 kept afloat amid strength in the commodity-related sectors and with some encouragement from the better-than-expected Retail Sales and Building Approvals data from Australia.

- Nikkei 225 was underpinned and further extended above the 40,000 level on the back of recent currency weakness.

- Hang Seng and Shanghai Comp. were mixed in which the former attempted to reclaim the 18,000 status, while the mainland bucked the trend after Caixin Services PMI data disappointed and amid lingering global frictions as European officials alleged that China is building and testing lethal attack drones for Russia.

- US equity futures (ES -0.1%) took a breather after Wall St's advances and with trade in the US shortened on Wednesday ahead of the Independence Day celebrations.

- European equity futures indicate a firmer open with Euro Stoxx 50 future +0.5% after the cash market closed lower by 0.5% on Tuesday.

FX

- DXY lacked direction after its recent retreat from the 106.00 level and with headwinds seen following dovish comments from Fed Chair Powell, while the attention today turns to a slew of data releases and the FOMC Minutes in a shortened trading session.

- EUR/USD traded indecisively on both sides of 1.0750 ahead of Eurozone PPI and Services PMI data, while ECB speakers were recently out in force and continued to suggest the openness for additional cuts this year.

- GBP/USD took a breather but held on to the prior day's spoils heading closer to Thursday's general election.

- USD/JPY retained a firm footing above 161.00 and near its 38-year highs amid downward revisions to Japanese Services PMI.

- Antipodeans were marginally firmer with AUD/USD briefly supported following stronger-than-expected Building Approvals and Retail Sales but with the upside limited by a weaker PBoC reference rate setting and soft Chinese Caixin Services PMI data.

- PBoC set USD/CNY mid-point at 7.1312 vs exp. 7.2633 (prev. 7.1291).

FIXED INCOME

- 10-year UST futures were little changed after yesterday's mild rebound which was helped by Powell's dovish-leaning comments.

- Bund futures edged mild gains but upside limited following recent whipsawing and ahead of a 10-year Bund auction.

- 10-year JGB futures continued the gradual recovery from the prior day's trough amid the BoJ's presence in the market for JPY 1.1tln of JGBs.

COMMODITIES

- Crude futures eked mild gains following the private sector inventory data which showed a much larger-than-expected draw in headline crude inventories although gasoline stockpiles showed a surprise build.

- US Private Inventory Data (bbls): Crude -9.2mln (exp. -0.7mln), Distillate -0.7mln (exp. -1.2mln), Gasoline +2.5mln (exp. -1.3mln), Cushing +0.4mln.

- Spot gold lacked firm direction after the recent choppy mood heading into a slew of data, FOMC Minutes, and Independence Day.

- Copper futures were kept afloat amid the mostly positive risk tone but with upside capped by the subdued mood in its largest buyer China following soft Caixin Services PMI data.

CRYPTO

- Bitcoin gradually retreated throughout the session and dipped beneath the USD 61,000 level.

NOTABLE ASIA-PAC HEADLINES

- EU reportedly targets China's Temu and Shein with proposals for an import duty, according to FT.

- South Korean President Yoon said they have prepared KRW 25tln worth of support measures for small businesses and will provide tax benefits to companies actively raising dividend payouts, while they will address structural problems causing high local food prices.

DATA RECAP

- Chinese Caixin Services PMI (Jun) 51.2 vs. Exp. 53.4 (Prev. 54.0)

- Chinese Caixin Composite PMI (Jun) 52.8 (Prev. 54.1)

- Australian Building Approvals (May) 5.5% vs. Exp. 1.6% (Prev. -0.3%, Rev. 1.9%)

- Australian Retail Sales MM Final (May) 0.6% vs. Exp. 0.2% (Prev. 0.1%)

GEOPOLITICAL

MIDDLE EAST

- Israeli army said it shelled Hezbollah positions last night in the areas of Blida, Yaron, Tair Harfa and Aitaroun in southern Lebanon, according to Al Jazeera.

- Palestinian Health Ministry said four were killed in an Israeli strike on West Bank's Nur Shams Refugee Camp, according to Reuters.

- US State Department said it has seen disturbing reports of the Israeli army's use of civilians as human shields and it called on Israel again to investigate quickly and ensure accountability for any abuses and violations, according to Al Jazeera.

OTHER

- China is building and testing lethal attack drones for Russia with Chinese and Russian companies said to be developing an attack drone similar to an Iranian model deployed in Ukraine, according to European officials familiar with the matter cited by Bloomberg.

EU/UK

NOTABLE HEADLINES

- Former UK PM Boris Johnson joined the Tory election campaign and said that current PM Sunak asked him to join the campaign, while he compared their differences as “trivial” to the threat of Labour leader Starmer, according to The Sun's Political Editor Harry Cole.

- ECB's Makhlouf said he is comfortable with expectations of another interest rate cut and cutting twice more is probably going a little bit too far, but he would not rule it out.

- German Chancellor Scholz expects to reach a deal on the 2025 budget this week and told members of his Social Democratic Party that sufficient meetings had been scheduled to ensure a draft budget could be put together by Thursday, according to Reuters sources.

To download the report, please click here If you would like to subscribe to receive the research sheets directly in your inbox, you can now do so under the Research Suite section of the portal. To subscribe simply check the box next to "Email these reports" under the desired category.