Well, once again the majority - make that the vast majority - of "economisseds" were dead wrong, and as we noted earlier, 105 of 114 economists predicted a 25bps cut... and were wrong. But don't blame them: it really is the Fed's fault - again - because while odds of a 50bps rate cut were only 10% as the Fed entered its "blackout period", these surged after an unprecedented media leak campaign in the past week pushed 50bps odds to 70% (and yes, we can now confirm that Powell used Nick "Nikileaks" Timiraos not once but twice in the past few days to ease the blow of the 50bps cut), which brought us to today, when the Fed shocked with a 50bps rate cut, and slashed its expectations for the 2025 rate cut...

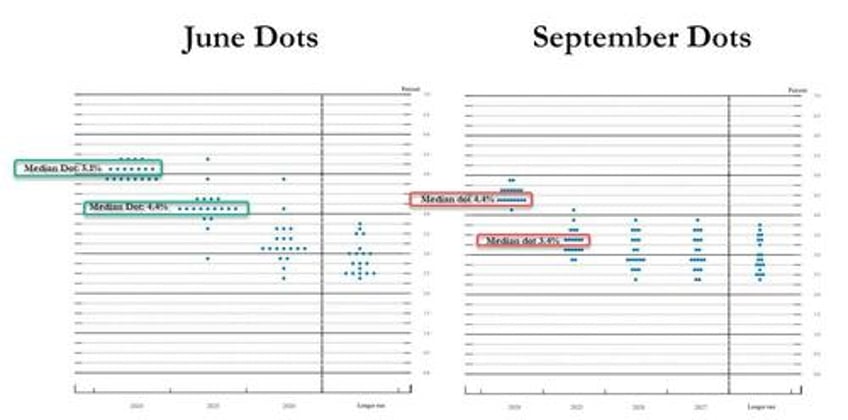

... even though the conditions from June until September were barely changed:

- 2025 GDP forecast unchanged

- 2025 unemployment rate up just a fraction, from 4.2% to 4.4%

- 2025 core PCE dip tiny from 2.3% to 2.2%

And somehow that justified the FOMC predicting an additional 3 rates cuts from June to September and a whopping 4 additional rate cuts in 2025!!!

Just don't call it political.

In any case, here is a snapshot of some of the kneejerk Wall Street reactions to today's Fed rate cut, which as the Fed itself now admits, was far behind the curve as the economy was clearly in far worse shape than the Fed dared admit.

Diane Swonk, KPMG Chief Economist

“This was a huge victory for Jay Powell”

Anna Wong, Bloomberg Economics:

“The first question in Powell’s presser was what information caused the FOMC to opt for the larger cut, and Powell mentioned the Beige Book. We’ve long thought Powell gives strong consideration to the anecdotal information in the Beige Book -- and the latest version was extremely downbeat. The Beige Book also was the key piece of information that led to Powell’s’ dovish pivot last December.”

More from Bloomberg Economics:

“The FOMC concluded one of its most suspenseful meetings ever by cutting rates 50 basis points, while cautioning markets that this type of jumbo cut won’t be the norm. The updated dot plot suggests a gradual path of rate cuts going forward, suggesting the Fed sees the 50-bp move as a preemptive one that will be enough to stabilize the labor market. The median participant still sees real GDP growing at a solid pace of 2% this year.

“In our view, the 50-bp cut was the right move with the labor market clearly weakening. If the economy is indeed heading toward a soft landing, the unemployment rate will likely stabilize at 4.4% as the Fed foresees. We think this move has increased the chance of that outcome.”

Ira Jersey, Bloomberg Intelligence:

"The 2024 median dot shows another 50 bps of cuts by year-end, but there’s a large minority thinking only one further cut might be needed. Market pricing hasn’t shifted toward the risk of fewer cuts this year. Chair Powell’s comments on this score may cause this pricing to move if he’s not as dovish as the median dots suggest.”

“The long-end dots are interesting, and over time the steepening of the curve may come in. The long end’s modest selloff reflects the market’s view that inflation might increase as the Fed cuts so aggressively.

“We’re not convinced this will turn into a trend, and see bull steepening continuing further. The 2025 dots moving lower by 75 bps wasn’t a shock at this point: The question is, will the market believe 2.75-3% terminal floor, or price for more?”

Kathy Bostjancic, Nationwide Chief Economist

"There’s more work to be done -- and quickly. We foresee the Fed needing to continue to rapidly lower interest rates to underwrite a soft-landing – which is our baseline forecast.”

Nancy Tengler, CEO at Laffer Tengler Investments

“Stocks love a good Fed put. I think the Fed may have jumped the gun at 50 bps. The economy is slowing but still strong. Productivity robust and unit labor costs moderate. Unemployment may indeed rise but we are not seeing layoffs—JOLTs still a very large number, well above pre-pandemic levels. My criticism of the Fed has been a myopic focus on backward looking data. This feels like that. A single weak employment report and here we are.”

Eric Orenstein, senior director at Fitch Ratings

“The Fed’s 50bp rate cut likely adds downward momentum for mortgage rates, which have already come down materially since May as treasuries have rallied. While not enough for a full scale refi boom, an average 30-year rate approaching 6% does open up a meaningful slice of the market for refinancing. Mortgage originators stand to benefit, and will likely find the toughest times already behind them.”

Dean Baker, Center for Economic & Policy Research

“It is good that the Fed has now recognized the weakening of the labor market and responded with an aggressive cut. Given there is almost no risk of rekindling inflation, the greater boost to the labor market is largely costless. Also, it will help to spur the housing market where millions of people have put off selling homes because of high mortgage rates.”

Seema Shah, chief global strategist at Principal Asset Management:

“Despite the skepticism around economic need for an aggressive 50 bps cut, markets can and should only celebrate today’s move -- and will continue to celebrate over coming months. We have a Fed that will go to historic lengths to avoid a hard landing. Recession, what recession?”

Maxine Waters, House Democrat and Court Jester:

“I am pleased that the Fed has not only remained independent, but shown the importance of remaining independent as it followed the data and not politics.”

Last - and least - here is Elizabeth Warren, Indian shaman of the Cherokee tribe

“This cut in interest rates is yet another acknowledgement that Powell waited too long to reduce rates. The Fed has finally changed course to follow its dual mandate on prices and jobs. Lower rates mean relief for consumers and aspiring homeowners. More rates cuts are needed.”

d